work-on-the-boards

2008 Ends Up Weak for Architectural Firms

With the industry in a downturn, many firms examining staffing levels for 2009

by Kermit Baker, PhD, Hon. AIA

Chief Economist

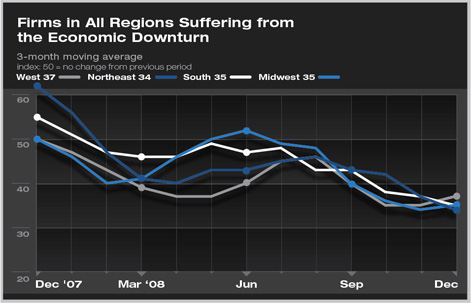

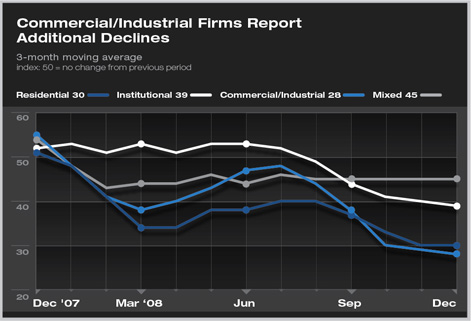

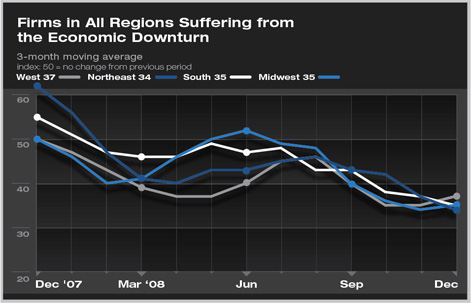

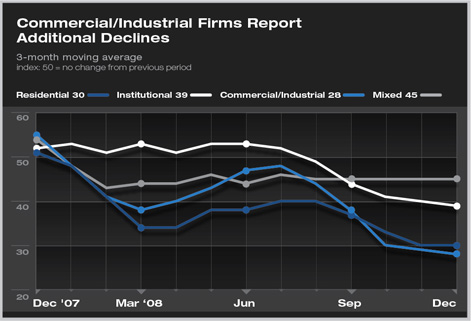

Summary: Business conditions at architecture firms ended the year on another sour note, with steep billings declines and ongoing weakness in inquiries for new projects. Business levels at commercial/industrial firms have turned down dramatically in recent months, while conditions at institutional firms are just beginning to soften. Residential firms have been mired in a downturn for several years. Summary: Business conditions at architecture firms ended the year on another sour note, with steep billings declines and ongoing weakness in inquiries for new projects. Business levels at commercial/industrial firms have turned down dramatically in recent months, while conditions at institutional firms are just beginning to soften. Residential firms have been mired in a downturn for several years.

Given the magnitude of the national economic downturn, firms in all regions are reporting very weak conditions. Most firms are expecting conditions to remain weak throughout the year, as almost a third of firms are expecting further downsizing before the end of 2009.

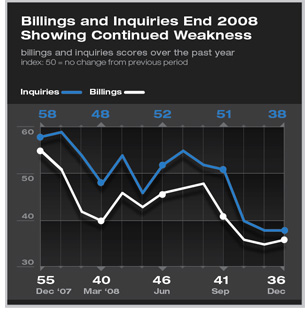

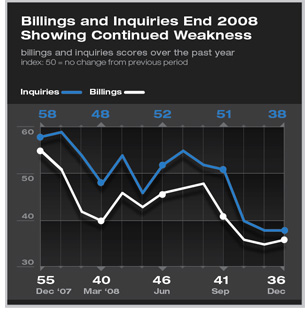

The AIA’s Architectural Billings Index was 36.4 in December, indicating that business levels dropped from November levels, but somewhat less than November levels had declined from October levels. However, after a score of 50.7 in January 2008, the ABI was below 50 every month of the year, reflecting the national billings decline experienced every month after January. Most of the declines were fairly significant, with four monthly readings below 40, including the last three of the year.

The index for inquiries for new projects was almost as pessimistic, as readings for the last three months of 2008 all were below 40. Project inquiries would be expected to begin to increase before billings began to reverse. However, none of the major project sectors is showing signs of improvement. The residential index has been soft for several years, and the commercial/industrial index turned down at the beginning of 2008, with the downturn accelerating recently. In November and December, the Commercial/Industrial ABI was below 30. Even the institutional index, which generally is quite stable, has been below 50 since July of 2008, and its December reading was below 40.

Help from the stimulus package?

The best hope for a relatively quick recovery for the construction industry is the emerging federal stimulus program, of which infrastructure investment is purported to be a priority. The initial January 15 House proposal targeted $63 billion of the $825 billion total package for highways, transit, airports, and other infrastructure projects. Additionally, architecture firms could benefit from programs to upgrade educational facilities and programs to promote energy efficiency. Finally, design firms also could benefit from the business tax incentives, including the accelerated depreciation provisions for capital expenditures.

The ultimate impact of the emerging stimulus program will need to offset tremendous negative momentum in the economy before a recovery can begin. With the Federal Reserve having lowered short-term interest rates to close to 0 percent, it has limited ability to provide further monetary stimulus to the economy. Government spending is the other major alternative, and even a stimulus program approaching $1 trillion may not be enough to turn around the economy anytime soon.

Job losses accelerated through 2008, with declines of 400,000 or more a month in September and October, and 500,000 or more in both November and December. Most major international economies are suffering from the same problems as the U.S., so there are no obvious sources of new demand for U.S goods and services.

Architecture firms are retrenching Architecture firms are retrenching

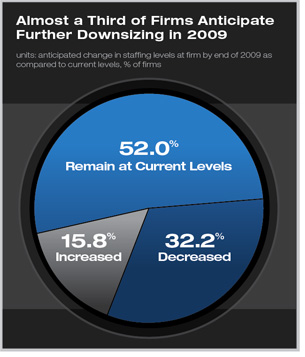

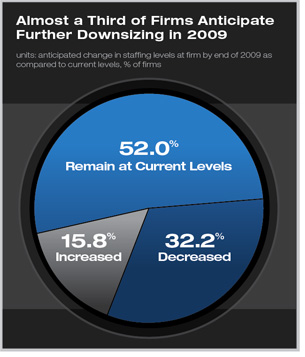

Having endured a year of declining billings, most architecture firms are aware of the magnitude of the current weakness in the industry. Almost a third of the AIA’s Work-on-the-Board’s panel anticipates that their staffing levels will be lower at the end of the year than they are now. Half as many firms (16 percent) expect to add staff this year.

Moderately experienced architecture positions (with 4-6 years of experience) as well as intern positions are the positions most likely to be added this year, as over 8 percent of firms expect to add moderately experienced architecture staff, and over 7 percent expect to add interns. However, these are also the positions most likely to be downsized by firms that are decreasing their staff. Over 20 percent of firms expect to reduce moderately experienced architecture staff, and over 17 percent expect to decrease intern positions, so on net these positions could see the greatest losses this year. |

Summary:

Summary:

Architecture firms are retrenching

Architecture firms are retrenching