work-on-the-boards

Billings, Still in the Negative Column, Inch Up a Bit

Firms anticipate little improvement for the rest of the year

by Jennifer Riskus

Manager, Economics Research

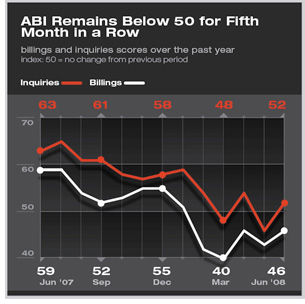

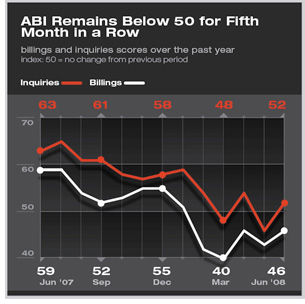

Summary: The AIA’s Architectural Billings Index (ABI) remained below 50 for the fifth month in a row in June, indicating that more survey respondents saw a decrease in billings than saw an increase. Better news is that the inquiries-for-new-business score rose back above 50. Regionally, conditions are improving in the Midwest, although they are weakening in the West. Considering building type specialties, firms with an institutional specialization continue to report billings growth. Firms with institutional specialization predict a brighter near-term outlook than other firms: Nearly two-thirds of firms with projects in the institutional sector anticipate that activity in that sector will either improve or remain the same through the end of 2008, while nearly half of all panelists expect business conditions to decline in the second half of the year, as compared to the second half of 2007. Summary: The AIA’s Architectural Billings Index (ABI) remained below 50 for the fifth month in a row in June, indicating that more survey respondents saw a decrease in billings than saw an increase. Better news is that the inquiries-for-new-business score rose back above 50. Regionally, conditions are improving in the Midwest, although they are weakening in the West. Considering building type specialties, firms with an institutional specialization continue to report billings growth. Firms with institutional specialization predict a brighter near-term outlook than other firms: Nearly two-thirds of firms with projects in the institutional sector anticipate that activity in that sector will either improve or remain the same through the end of 2008, while nearly half of all panelists expect business conditions to decline in the second half of the year, as compared to the second half of 2007.

Although the AIA Architecture Billings Index (ABI) rose by nearly 3 points in June, at 46.1 it remains below the threshold of 50, indicating that business conditions at architecture firms continue to weaken. June was the fifth month in a row with billings below 50, the longest period of sustained weakening since late 2003. The inquiries score rebounded above 50 this month, but there will need to be several months with scores above 50 before we can be confident that inquiries for new work have picked back up.

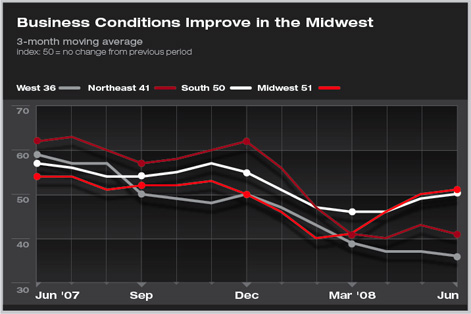

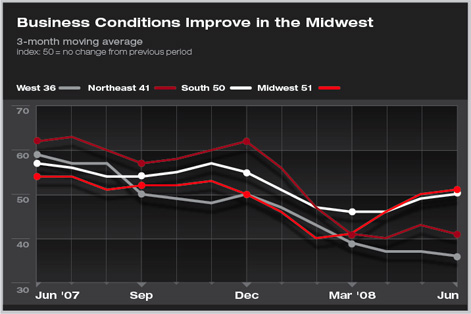

The downward trend in June persisted in all regions of the country except for the Midwest, which has reported billings growth for the last two months. Conditions in the West, on the other hand, continue to weaken: Its score has now been below 50 for 9 of the last 10 months.

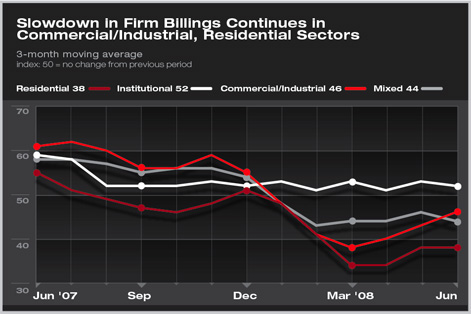

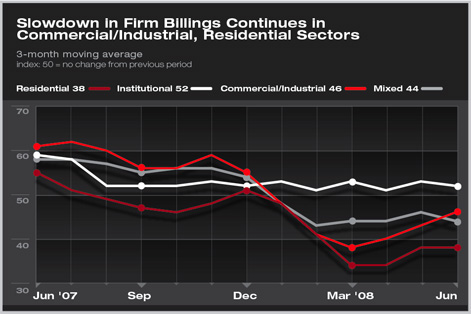

Firms with an institutional specialization continue to report billings growth; in fact, the score for this sector has never fallen below 50 during the current downturn. However, weakness persists in the residential and commercial/industrial sectors and does not show any indication of improvement in the immediate future.

Overall economy remains sluggish

The overall economy remains sluggish as payrolls fell again in June. Construction employment declined by 43,000 and has shed more than half a million jobs since its peak nearly two years ago in September 2006. The Conference Board’s Consumer Confidence Index has declined every month so far this year, and fell by nearly 8 points to a score of 50.4 in June (index: 1985=100). Overall, it is down by nearly 40 points since last December. Rising inflation is one element of concern to both consumers and producers. The Consumer Price Index was up by a seasonally adjusted 1.1 percent in June and has risen by 5 percent since June 2007, while the Producer Price Index (which measures the change in selling prices over time) rose by 1.8 percent this month.

Firms anticipating little improvement

This weakness in the economy is also clearly being felt by our survey panelists, as nearly half (45 percent) indicated that they expect firm billings to decrease by 5 percent or more during the second half of 2008, compared to the second half of 2007. More than half of firms with annual billings of less than $1 million expect lower billings this year, compared to just 36 percent of firms with annual billings of more than $5 million. However, large firms do not anticipate that billings will increase, but instead are more likely to expect that they will remain about the same this year compared to last. Firms located in the West are also more likely than those in other regions to expect billings to decline by 5 percent or more during the second half of the year (compared to the last six months of 2007).

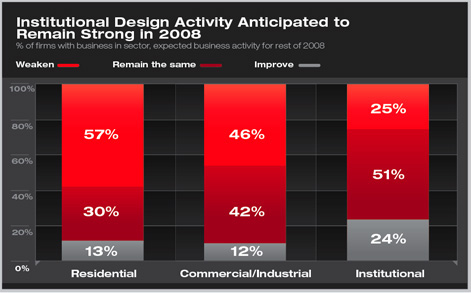

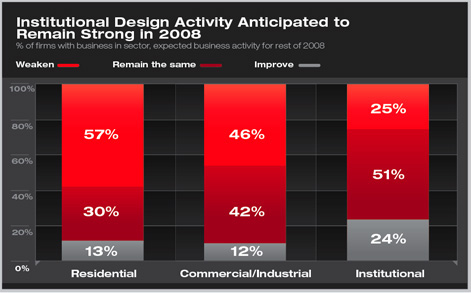

When asked to consider anticipated design activity by sector for the remainder of 2008, few respondents expected any sector to improve. More than half of firms working on residential projects believe that conditions will continue to weaken, as do nearly half of firms working on commercial/industrial projects. A large share of these firms also believes that conditions will remain about the same, which is to say, in an already weakened state. For those working on institutional projects, more than half also believe conditions will remain the same, which is good in this case since conditions continue to be relatively strong in that sector. In addition, as many respondents with institutional projects anticipate that conditiions will improve in the next six months as expect that they will weaken. |

Summary:

Summary: