|

work-on-the-boards

While Moderating, Downturn Continues at Architecture Firms

Integrated project delivery gaining toehold as delivery method, as collaborative approach of building team mentioned as major benefit

by Kermit Baker, PhD, Hon. AIA

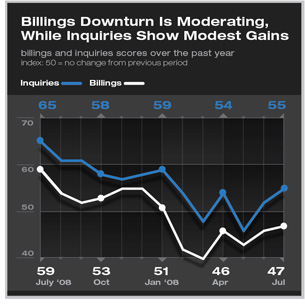

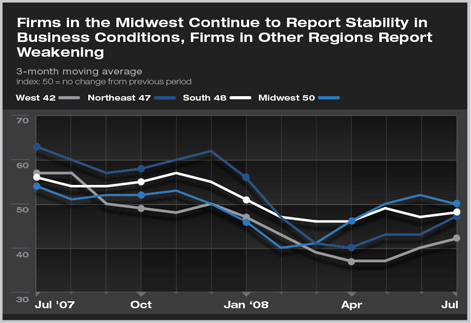

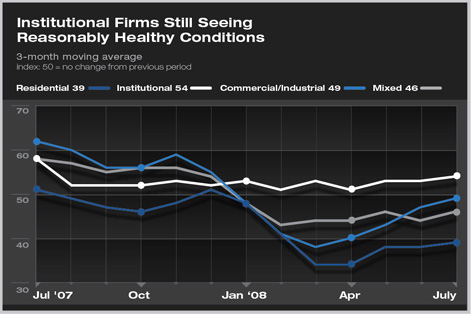

Chief Economist

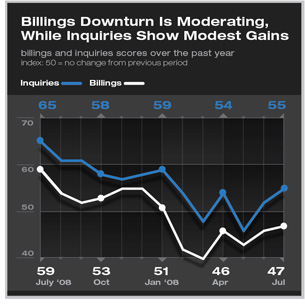

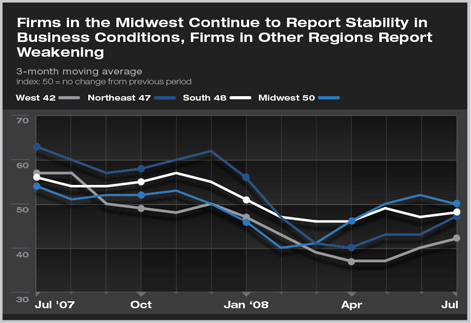

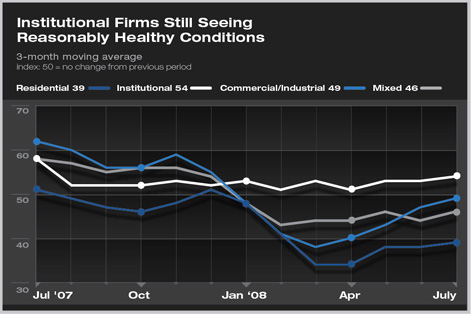

Summary: Billings at architecture firms continue to decline, but the slowdown has been moderating in recent months. With a July reading of 46.8 for the Architecture Billings Index, more firms are seeing their billings stabilize, and some are even reporting increases. Inquiries for new projects—with their second highest reading of the year—also have seen some improvement recently. Firms in the Midwest are seeing stable levels of activity in recent months, even as firms in other regions continue to face softer markets. The institutional sector (education, health-care, and government facilities) remains in expansion mode, while commercial/industrial activity shows signs of nearing a bottom in terms of design activity. Summary: Billings at architecture firms continue to decline, but the slowdown has been moderating in recent months. With a July reading of 46.8 for the Architecture Billings Index, more firms are seeing their billings stabilize, and some are even reporting increases. Inquiries for new projects—with their second highest reading of the year—also have seen some improvement recently. Firms in the Midwest are seeing stable levels of activity in recent months, even as firms in other regions continue to face softer markets. The institutional sector (education, health-care, and government facilities) remains in expansion mode, while commercial/industrial activity shows signs of nearing a bottom in terms of design activity.

The national design downturn entered its seventh month in August, with some hopeful signs that the downturn may be nearing a bottom. The AIA’s Architecture Billings Index (ABI) improved for its second straight month, rising to 46.8. Still, if the downturn earlier this decade is any example, the ABI is likely to bounce around the 50 level (where the share of firms reporting increases in billings is offset by the share reporting declines) for several months before a real upturn kicks in. The increase in inquiries for new projects, also to their second highest level of the year, is one encouraging sign of better business conditions to come.

Firms in the Midwest are the only ones to report stable business conditions. Having been at or above the 50 level for three straight months, firms in this region may be seeing signs of an impending recovery in design activity. Since the Midwest was the first region to have seen weaker conditions when this downturn began, it would not be surprising for it also to be the first to recover.

Firms concentrating in the institutional sector are seeing the strongest conditions. The billings index for these firms has still not dipped below 50 for this cycle, and currently is at its highest level of the year. Commercial/industrial firms also are reporting greater stability in business conditions. However, with the index still below 50 for these firms, activity is still declining.

Economy remains weak

The construction industry is facing difficult times, and the broader economy remains very weak. An official national economic recession has not yet been declared, but job growth trends and consumer sentiment readings are at levels historically associated with recessions. U.S. businesses lost almost 500,000 payroll positions since the beginning of the year. Fully half of these losses have come from the construction sector, so weakness in this sector has weighed down the economy. The national unemployment rate moved up to 5.7 percent in July, its highest level since early 2004.

A major concern is that an economic slowdown is coinciding with an increase in inflation. Consumer prices are currently rising at almost 5 percent per year, while producer prices are rising at a pace in excess of 9 percent. Netting out food and energy costs drops these figures significantly but still creates a dilemma for national economic policy. Typically, when the economy slows, there is less demand for products and services, thereby causing prices to fall. This time, however, other factors are causing oil prices to rise, as well as other key construction commodities. Stimulating the economy is likely to cause prices to rise even faster, while fighting inflation—through such means as increasing short-term interest rates—will likely further slow the economy.

Evolving project delivery methods

As the construction slowdown continues to put pressure on designers, contractors, and owners, the industry is searching for ways to enhance business opportunities. One strategy is integrated project delivery (IPD), a project delivery approach that integrates key members of the project team in the initial phases of a project. With this model, decisions are made collaboratively, with project responsibilities determined by what is best for a wide range of specific, agreed-upon project objectives. This approach has been facilitated by the increased use of building information modeling (BIM) in cross-platform applications, whereby entire building designs are modeled digitally and shared across the building team.

Currently, about one in eight (12 percent) of members of our Work-on-the-Boards panel report having worked on projects organized around the IPD model. Additionally, more than one in five firms (22 percent) has actively considered or is actively considering working on a project using an IPD approach. Over half of these firms are larger firms with annual billings of $5 million a year or more, so to date larger firms have been more likely to use this project delivery method.

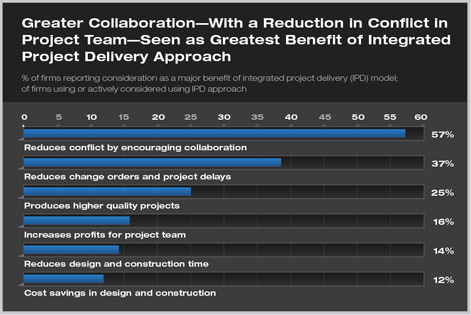

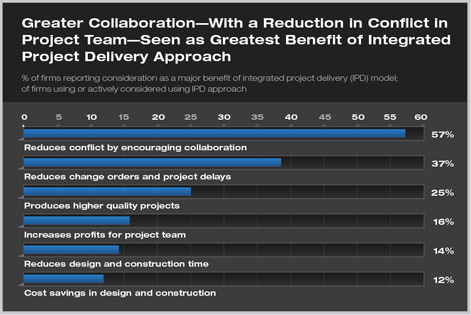

Firms that have used this method or have actively considered using it were asked what they see as key benefits. More than half (57 percent) indicated as a major benefit that the method reduces conflict by encouraging all parties to work collaboratively. Other perceived major benefits that were commonly cited were that IPD reduces change orders and other project delays (37 percent) and produces higher quality projects (25 percent).

More than a third of respondents (36 percent) felt that owners benefit the most from an IPD model, while 24 percent indicated that the contractor was the prime beneficiary. However, the most popular response (40 percent) was that all members of the building team benefited about equally. |