Pace of Decline in Billings Continues to Slow, Inquiries Are Up

Midwest and West report stabilizing conditions

by Jennifer Riskus

Economics and Markets Research Manager

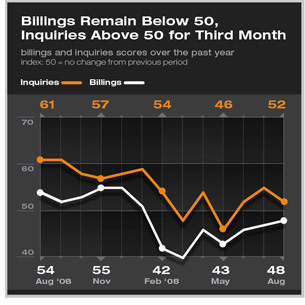

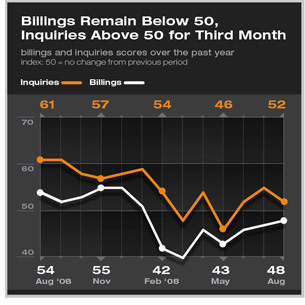

Summary: The Architecture Billings Index (ABI) score remained below 50 in August, but the score of 47.6 indicates that conditions may be moderating. Inquiries were above 50 for the third month in a row. Firms located in the Midwest and West are reporting that business conditions are stabilizing and billings continue to grow for firms with an institutional specialization. Backlogs at architecture firms currently average 5.1 months but are nearly two months longer for large firms. Summary: The Architecture Billings Index (ABI) score remained below 50 in August, but the score of 47.6 indicates that conditions may be moderating. Inquiries were above 50 for the third month in a row. Firms located in the Midwest and West are reporting that business conditions are stabilizing and billings continue to grow for firms with an institutional specialization. Backlogs at architecture firms currently average 5.1 months but are nearly two months longer for large firms.

Although billings at U.S. architecture firms declined for the seventh month in a row in August, the pace of the decline has slowed considerably since the ABI recorded its lowest score ever in March. The August ABI score of 47.6 indicates that more firms are starting to see business conditions improve, although they continue to be outweighed by firms seeing weakness. In addition, the inquiries score remained above 50 for the third month in a row, indicating some degree of optimism about upcoming work.

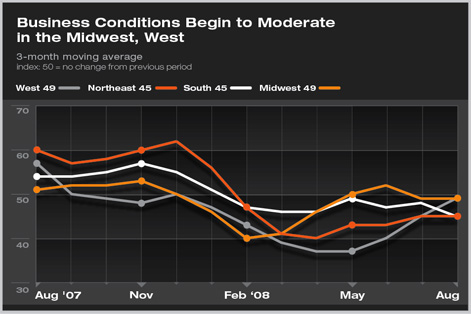

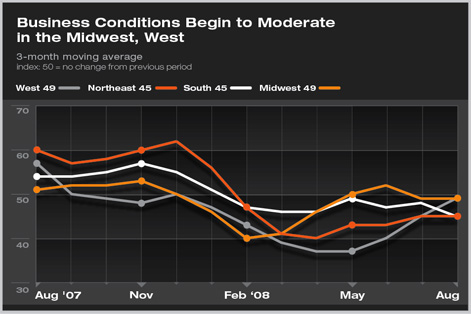

Business conditions continue to be depressed in all regions of the country in August, with firms in the Northeast reporting the slowest pace of billings growth for the second month in a row. Firms in the West have begun showing signs of an upturn in the last two months as the score approaches 50, indicating that billings at firms in that region are beginning to moderate.

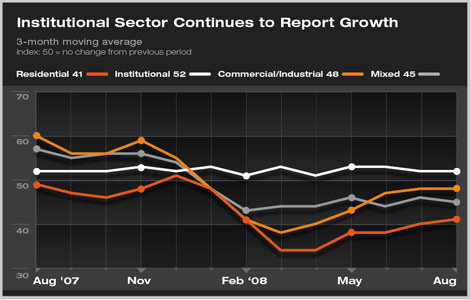

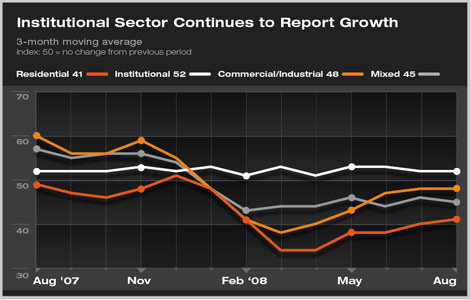

Industrial remains okay; residential, commercial/industrial sluggish

By sector, firms with an institutional specialization remain the only group to have never reported a score below 50 during the current downturn. Although billings at those firms have grown at a relatively sluggish pace, the scores have remained in the low 50s for the last year. Firms with a residential specialization continue to report weak business conditions as do firms with a commercial/industrial specialization. Both sectors have had scores below 50 for the entire year thus far.

GDP is up, payrolls are down

Although the broader economy remains weak, the real GDP grew at an annualized rate of 3.3 percent in the second quarter of 2008, compared to just 0.9 percent in the first quarter. This growth was led in part by personal consumption expenditures, likely due to the consumer spending that followed receipt of the stimulus checks in early summer, as well as government spending and nonresidential structures. Payrolls, on the other hand, continued to decline in August, shedding 84,000 jobs, slightly more than the monthly average of 76,000 for the year so far, while construction employment declined by just 14,000 jobs in August. Unemployment continued to rise, climbing by 0.4 percentage points to 6.1 percent this month.

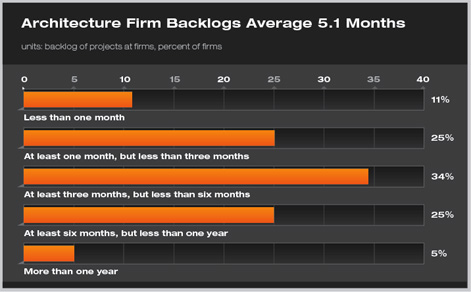

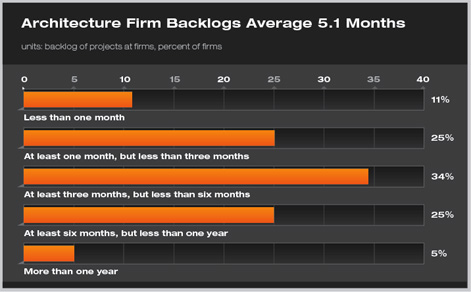

Backlogs at firms are lower

With business conditions remaining weak, more than half (55 percent) of our survey panelists report that backlogs at their firm are either modestly or substantially lower than they were at the beginning of the year. Just one fifth indicated that backlogs are higher now than they were in early 2008.

On average, our panelists report a backlog of 5.1 months, although nearly one third (30 percent) report backlogs of six months or more. Small firms, with annual gross billings of less than $250,000, report small backlogs of just 3.7 months, while the largest firms (with billings of $5 million or more) have average backlogs of 7.0 months, nearly two months more than average.

Firms with an institutional specialization also report strong, above average backlogs of 6.5 months, which makes sense as firms in that sector have remained busy during the current downturn. Weaker sectors have smaller backlogs. Residential firms have an average backlog of 4.3 months while firms with a commercial/industrial specialization report a backlog of just 4.0 months.

|

Summary:

Summary: