| work-on-the-boards Billings Hit Lowest Score in 12-Year History Weakness apparent in all regions of the country

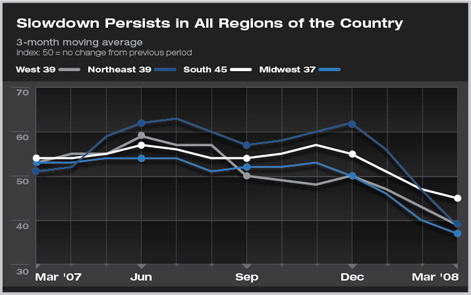

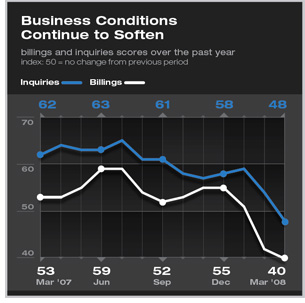

Business conditions at architecture firms continued to weaken in March, with the Architecture Billings Index recording 39.7, its lowest score since it was instituted in 1995. (Any score above 50 indicates growth.) While this score is not unexpected, given the weakness in the broader economy, it is nevertheless a sign that firm billings are continuing to soften at firms across the country. Inquiries for new work also slowed in March, falling below 50 for only the second time in the history of the index. Clients seem to be delaying projects until they see some sign of a turnaround. Weakness in all geographic regions

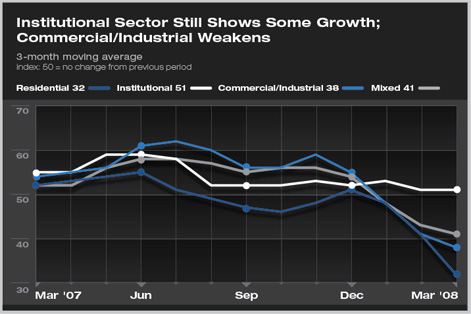

Considering business conditions by practice sector, only firms with an institutional specialization reported a score above 50 in March. The residential sector continues to slump (it is down by nearly 20 points from March 2007) while the commercial/industrial sector is also reporting a serious slowdown. Larger economy, consumer confidence on a downturn

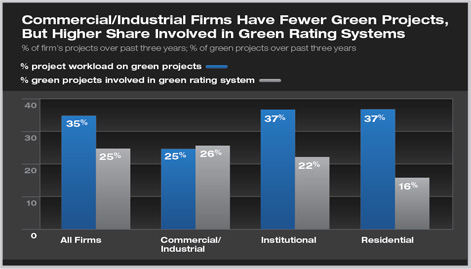

But going green is growing

As far as the green rating systems that have been used, LEED is by far the most popular (68 percent have used it over the past three years), followed by Energy Star (29 percent), local programs such as Austin Energy Green Building (16 percent), and Green Globes (4 percent). |

||

Copyright 2008 The American Institute of Architects. All rights reserved. Home Page |

||

news headlines

practice

business

design

This month, Work-on-the-Board participants are saying:

• Office/retail development has slowed, but industrial and hospitality are still very strong.

—125-person firm in the South, commercial/industrial specialization

• With a very sluggish level of inquiries and work, staffing levels will decline. It may be a buyer’s market for staff very soon.

— 14-person firm in the West, residential specialization

• Institutional work remains strong. We continue to see a number of opportunities for new work, and the year should be as good or better than last year.

—49-person firm in the Midwest, institutional specialization

• Some jobs aren’t progressing to completion. Clients are waiting to see how the economy shakes out before committing to contract documents or construction.

— 2-person firm in the Northeast, mixed specialization.

Free Webcast on April 29

How can you position your firm to remain profitable in a time when recession, tight credit, and soaring costs are eating into consumer confidence and the willingness of clients to build and financiers to lend? Join in April 29 from 1:30 to 3 p.m., ET, to find out as the AIA brings the ”Architecture Practice in an Economic Downturn: Challenges and Opportunities” free on-line seminar right to your office or component. AIA Chief Economist Kermit Baker, PhD, Hon. AIA, will be joined by Zimmer Gunsul Frasca Architects Managing Principal Robert G. Packard III, Assoc. AIA, the current chair of the AIA Large Firm Roundtable on Excellence in Design and Practice, and Karen L.W. Harris, AIA, principal, Architecture Matters, and past chair of the AIA Small Project Practitioners Knowledge Community, as AIArchitect Executive Editor Doug Gordon, Hon. AIA, facilitates the discussion. For more information or to register (required, even though the event is free—and office- or component-wide registrations are encouraged), visit the Webcast Web site.

If registration is closed due to high demand, sign up to view the taped program, free of charge, within 30 days of the broadcast.

Summary:

Summary: