work-on-the-boards survey

Institutional Sector Reports First Slowdown in Four Years

Overall, firms report client problems with financing as the most serious current problem

by Jennifer Riskus

Economics and Research Manager

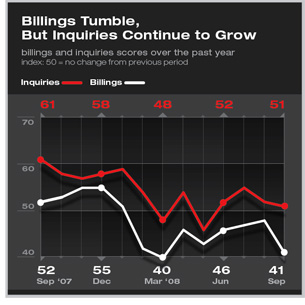

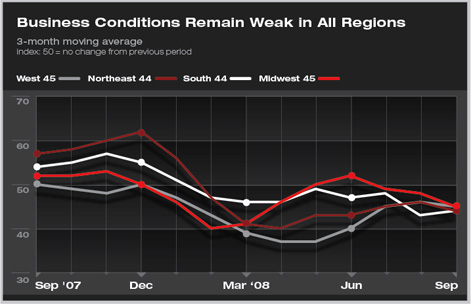

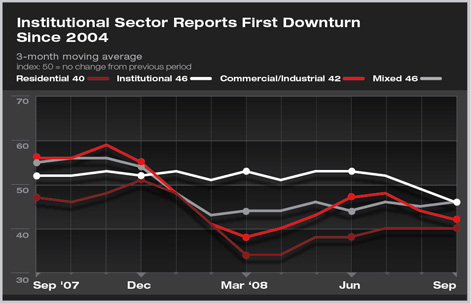

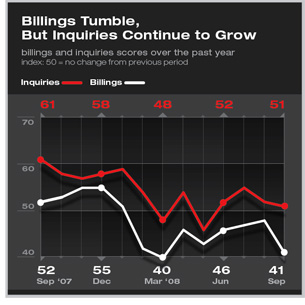

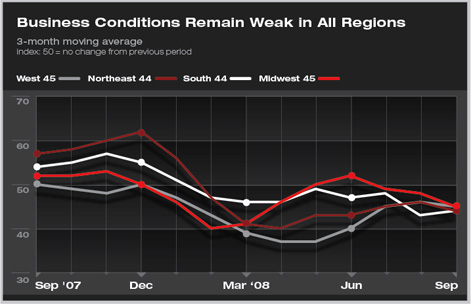

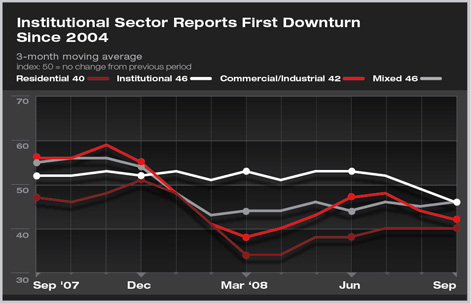

Summary: Billings at architecture firms tumbled in September on the heels of turmoil in international credit markets, generating increased economic uncertainty. However, firms still are reporting interest in new projects as indicated by September’s inquiries score remaining above 50. Overall, business conditions remain weak in all regions of the country, and firms with an institutional specialization, the one construction sector that had yet to be affected by the downturn, reported its first slowdown in nearly four years. Nearly all our survey panelists reported that their firms were directly feeling the effects of ongoing problems in financial markets, and client problems with financing was reported as the most serious current problem. Summary: Billings at architecture firms tumbled in September on the heels of turmoil in international credit markets, generating increased economic uncertainty. However, firms still are reporting interest in new projects as indicated by September’s inquiries score remaining above 50. Overall, business conditions remain weak in all regions of the country, and firms with an institutional specialization, the one construction sector that had yet to be affected by the downturn, reported its first slowdown in nearly four years. Nearly all our survey panelists reported that their firms were directly feeling the effects of ongoing problems in financial markets, and client problems with financing was reported as the most serious current problem.

Business conditions at architecture firms deteriorated in September amid the ongoing financial turmoil. The Architectural Billings Index (ABI) score fell to 41.4, the lowest reading since March, indicating that the pace of the decline in firm billings is accelerating. Any ABI score below 50 indicates a slowdown; scores above 50 indicate growth. The one bright spot this month was the inquiries score, which at 51.0 remained above 50 for the fourth month in a row. This means that clients are still looking into new projects, although now it seems likely that those inquiries will take longer to translate into actual billings.

Architecture firm billings continue to slow in all regions of the country, with scores hovering in the mid-40s. Firms in the South continue to report the weakest conditions, and business conditions in the Midwest continue to worsen after recording scores above 50 for two months in the late spring/early summer.

Business conditions at firms with an institutional specialization finally began to weaken, after remaining above 50 for the entire year. (The August score, previously reported as 52.2, was revised down to 48.9, due to the three-month moving average.) With no rebounds yet apparent in any other sectors, firms of all specializations are now struggling.

Problems reach a boil

The problems that have plagued the economy for more than a year now reached a boil in late September as banks failed and the stock market plunged, necessitating the $700 billion federal bailout. Employment continues to fall. The U.S. job market shed another 159,000 jobs in September. Although the unemployment rate remains unchanged from August, at 6.1 percent, it is 1.4 percentage points higher than a year ago. More than 2 million people have become unemployed in the last year. The one silver lining in the economy is that inflation is beginning to moderate. Oil is well below $100 a barrel and the Producer Price Index (PPI) for finished goods was down by a seasonally adjusted rate of 0.4 percent in September, following a decline of 0.9 percent in August. Before the last two months, it had risen steadily since January.

Financial market troubles hitting most firms Financial market troubles hitting most firms

The majority of our panelists (92 percent) report that the ongoing problems in financial markets have had or will have an impact on business at their firms in the near future. (Compare this to late summer 2007, when just 54 percent of our panelists reported that troubles in the credit markets had impacted or were likely to impact business at their firms.) Firms in the South have been the hardest hit so far, with 95 percent reporting an impact on business, in contrast to the Northeast, which had the smallest share of panelists reporting an impact (85 percent).

In fact, nearly two thirds of our panelists (62 percent) report that problems in financial markets have already directly affected projects at their firm. Firms with an institutional specialization were least likely to have already been affected, with just 45 percent reporting a direct impact. By far, the firms that have been directly affected indicated that the most serious problem they are facing is client problems with project financing (selected by 63 percent of respondents). An additional 20 percent of panelists reported that the most serious problem is some other issue related to the overall financial market turmoil, such as difficulty obtaining public bond issuances for construction, delayed payments, or general client uncertainty. Just 8 percent of firms reported that escalation of construction costs was the most serious problem. But for small firms, those with annual billings under $250,000, 14 percent indicated that this was their most serious problem. |

Summary:

Summary:

Financial market troubles hitting most firms

Financial market troubles hitting most firms