| work-on-the-boards Billings Take a Tumble in February Commercial/industrial specializations particularly hard hit Summary: The ABI fell dramatically this month to its lowest score in more than six years. Weakness persisted in most regions of the country, and firms with a commercial/industrial specialization were particularly hard hit. More firms reported that employee turnover decreased than increased, due in part to the ongoing economic uncertainty.

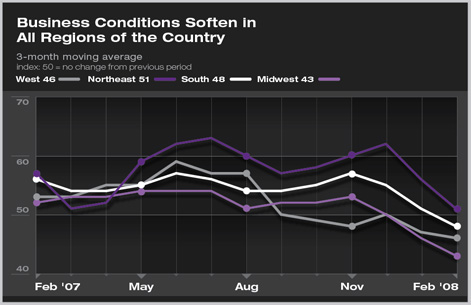

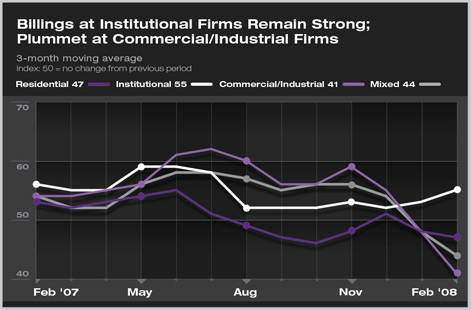

All regions of the country, with the exception of the Northeast, reported significantly weaker business conditions in February. But even the Northeast is showing signs of softening, with the score falling to 51.5 from 61.8 just two months ago. The score of 48.3 in the South is the first score below 50 in that region in nearly six years. As could be expected, firms with residential specialization continued to report weak conditions. More noticeable, however, is the dramatic slowdown at firms with commercial/industrial specializations—from 54 in January to a current score of 40.6. As we predicted earlier this year, the types of projects that these firms specialize in are being particularly hard hit by the current weakness in the economy. On the other hand, firms with an institutional specialization are seeing billings at their firm continue to strengthen as they recover from their slowdown of last summer.

Payrolls down again

Downturn slows job turnover

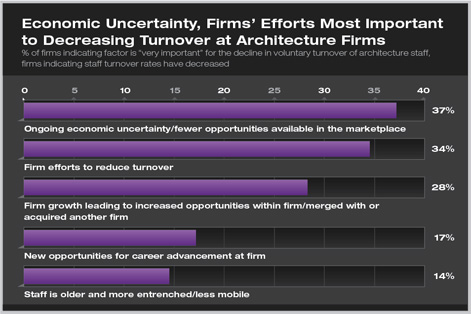

For those firms in which turnover has decreased compared to last year, the primary reason was ongoing economic uncertainty and fewer opportunities available in the marketplace. However, and perhaps because of this, firms are taking more steps to reduce turnover, including increasing compensation relative to competitors and merging with or acquiring another firm. Few firms (14 percent) indicated that decreased turnover was due to staff who are older and more entrenched. |

||

Copyright 2008 The American Institute of Architects. All rights reserved. Home Page |

||

news headlines

practice

business

design

This month, Work-on-the-Boards participants are saying:

So far, business conditions remain strong in our practice areas. Existing clients remain busy and are looking to get project timing sorted out to be on the market when the demand returns.

—325-person firm in the Northeast, mixed specialization

The overall market is definitely weakening. Our prime market, which is higher education, seems to be doing well though.

—15-person firm in the West, institutional specialization

Things have gotten so slow that I have laid off my staff and I am helping another firm for cash flow.

—2-person firm in the Midwest, residential specialization

Our firm is currently busy with several major public sector projects. However, we are not seeing significant activity in the private sector and are concerned about long-term prospects. The problems in the financial sector are impacting clients’ ability to get construction loans and proceed with projects.

— 10-person firm in the South,

mixed specialization.

Economics Podcast Coming in April

Due to the current volatile economic conditions in the design and construction industry, the AIA will create and make available to members a podcast offering advice for firms and architects on how to best navigate these difficult times. The podcast panel likely will include architect representatives from the Large Firm Roundtable, the AIA Practice Management Knowledge Community, and the Small Project Practitioners Knowledge Community, who will share insights with AIA Chief Economist Kermit Baker, PhD, Hon. AIA. Stay tuned.

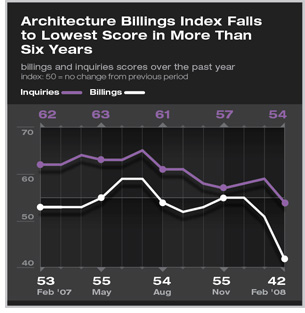

Billings at architecture firms took a dramatic downward turn in February as the ABI fell to 41.8, the lowest score since the immediate aftermath of September 11 in October 2001. The ABI has now fallen more than 13 points since December, which is the largest two-month drop ever recorded in the dozen years of the index. This drop serves as the clearest indicator yet that softer business conditions are coming. Inquiries growth continued to slow this month, as the score fell to 54.3. Although any ABI score above 50 indicates growth, this is the lowest indication of inquiries growth in more than five years.

Billings at architecture firms took a dramatic downward turn in February as the ABI fell to 41.8, the lowest score since the immediate aftermath of September 11 in October 2001. The ABI has now fallen more than 13 points since December, which is the largest two-month drop ever recorded in the dozen years of the index. This drop serves as the clearest indicator yet that softer business conditions are coming. Inquiries growth continued to slow this month, as the score fell to 54.3. Although any ABI score above 50 indicates growth, this is the lowest indication of inquiries growth in more than five years.