Business Conditions at Critical Levels at Architecture Firms

As economy continues to cycle down, majority of firms expect substantial revenue falloff in 2009

by Kermit Baker, PhD, Hon. AIA

Chief Economist

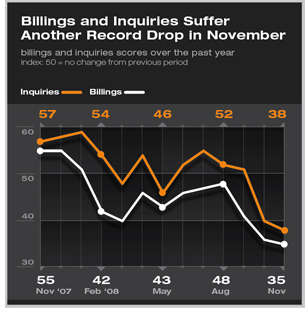

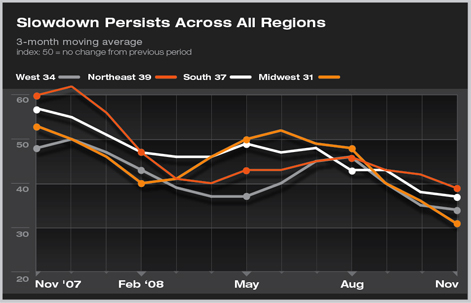

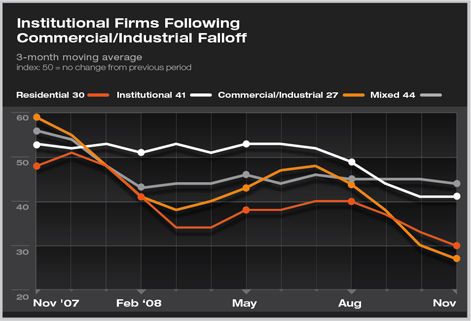

Summary: Architecture firms reported yet another record decline in November in billings for ongoing projects and inquiries for new projects. Both of these indexes declined about 1.5 points from October, indicating that the slowdown in business conditions at firms is still accelerating. All major regions of the country shared in the weakness, as did all the major construction sectors. Firms specializing in institutional buildings have reported the least decline to date, although conditions continue to deteriorate in this sector also. Summary: Architecture firms reported yet another record decline in November in billings for ongoing projects and inquiries for new projects. Both of these indexes declined about 1.5 points from October, indicating that the slowdown in business conditions at firms is still accelerating. All major regions of the country shared in the weakness, as did all the major construction sectors. Firms specializing in institutional buildings have reported the least decline to date, although conditions continue to deteriorate in this sector also.

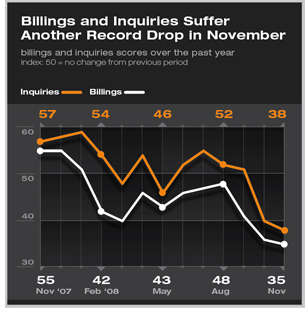

The AIA’s Architectural Billings Index continued its downward spiral in November. With a reading of 34.7, this represents a very steep drop from October levels, which already were well down from levels earlier in the year. Billings have declined each month since January of 2008. Inquiries for new projects also recorded a rare drop in November. The November reading of 38.3 points to a sharp drop from October, and marks the fourth time this year that inquiries have fallen below the 50 mark; the level that indicates a decline in activity.

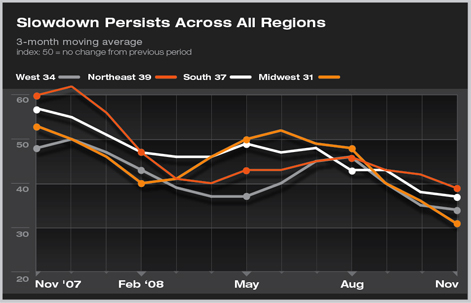

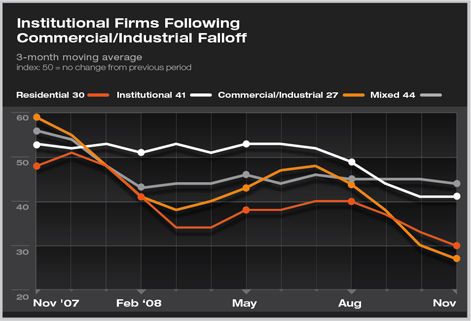

Firms in all regions are reporting comparable levels of weakness. Firms in the Midwest had indicated that conditions were improving as recently as this past June, but no region has seen growth since. By construction sector, commercial/industrial and residential firms continue to report very weak conditions. Institutional firms, which were still seeing slow growth as of this past July, now seem to be following commercial/industrial firms into a period of weaker activity.

Coping with a recessionary economic environment

The economy has been in a recession since December of 2007, according to a recent announcement by the National Bureau of Economic Research, a nonprofit firm that officially dates business expansions and recessions in our economy. Given the duration of previous recessions, being a year into this one means that we are probably closer to the end than the beginning. However, that doesn’t mean that that there will be signs of improvement anytime soon. Our economy declined by 0.5 percent in the third quarter of 2008 with the most recent revision. That’s the steepest quarterly decline for this recessionary period, and the biggest drop recorded for our economy since the third quarter of 2001. However, this figure is almost certain to be surpassed, and probably by a lot, when we get a reading in late January for the fourth quarter of the year.

The national jobs report is also getting more negative each month. In November, we lost an additional 533,000 payroll jobs, bringing the 2008 figure for losses to more than1.9 million with one more month to go. The construction sector has accounted for over 500,000 of these net losses so far this year. The national unemployment rate rose to 6.7 percent in November, and has increased almost two percentage points from its level of 4.9 percent in January.

Rising unemployment is making consumers nervous. Consumer sentiment is at its lowest level since the early 1980s, according to information from the University of Michigan’s consumer sentiment index. Manufacturing activity is also very weak, as the Institute for Supply Management’s index of manufacturing activity is at its lowest levels since the early 1980s. Some of the only good news is coming from the inflation front. With a weak international economy, oil prices are dropping rapidly, and both consumer and producer prices have slowed dramatically in recent months.

With economic weakness likely to continue, the federal government is getting more serious about an additional stimulus package. The specifics of such a program and the likelihood of passage are uncertain, but the construction industry is poised to be a beneficiary should something happen. The Obama administration has targeted infrastructure and energy upgrades at government buildings as key priorities of any stimulus program.

2009 shaping up as a weak year 2009 shaping up as a weak year

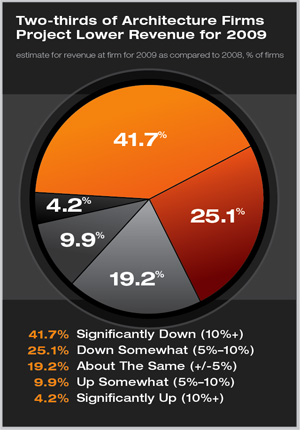

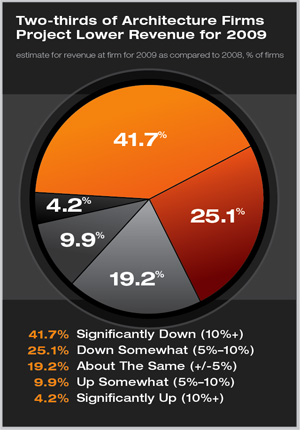

Most architecture firms do not expect the weak business conditions to end anytime soon. Only 14 percent of firms estimate that revenue will grow in 2009. Two-thirds are projecting a revenue decline next year, with over 40 percent of firms anticipating revenue to be off by 10 percent or more from generally weak levels in 2008. The remaining 19 percent expect revenue to remain relatively flat.

Institutional firms are expecting the best conditions, with almost 17 percent expecting growth and 54 percent anticipating declines. Commercial/industrial firms are somewhat more pessimistic overall, with 14 percent projecting growth and 73 percent declines, but residential firms remain the gloomiest. Only 7 percent of firms with this specialization anticipate growth; 77 percent see weaker times in 2009.

Larger firms are the most downbeat about prospects for next year. Of firms with $5 million in annual revenue, only 7 percent anticipate revenue growth while almost 73 percent are planning for a retrenchment. Smaller firms—under $250,000 in annual revenue—are more optimistic, with 17 percent expecting growth and 59 percent anticipating declines.

|

Summary:

Summary:

2009 shaping up as a weak year

2009 shaping up as a weak year