| work-on-the-boards Downturn Continues in May for Design Activity Concern over economy has produced changes in building characteristics

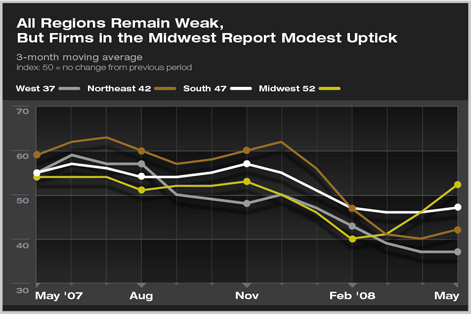

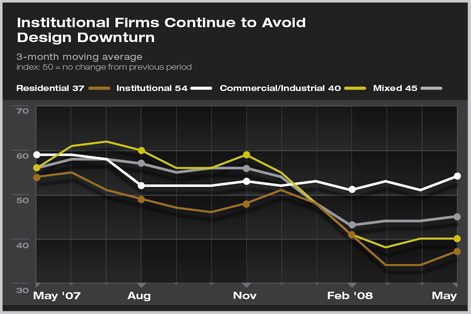

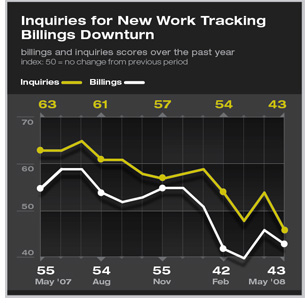

May was the fourth straight monthly decline in billings at architecture firms. Although the slowdown moderated a bit in April, it accelerated again in May, with an ABI reading of 43.4 nationally. Any score below 50 indicates a decline in aggregate billings at U.S. architecture firms. The last time billings declined for four straight months was in late 2002/early 2003, when the nonresidential industry was mired in a steep downturn. Inquiries for new work also dropped in May, with the inquiries index reading 46.5. This was the steepest drop in inquiries in the more than 12 years that the AIA has been surveying architecture firms on business conditions. With declining inquires for new projects, firms are unlikely to see an increase in new billings over the next few months. Despite overall weakness in design activity, institutional firms continue to report reasonably healthy business conditions. The billings index for institutional firms was 53.9 in May, and has not dipped below 50 during this current period of weakness. Readings at both residential and commercial/industrial firms, on the other hand, were below 40 in May, pointing to continued deceleration in business conditions at these firms. Overall economy is weak but stabilizing

The rising unemployment rate, coupled with rising gasoline prices, has cut into consumer sentiment readings. The University of Michigan’s Consumer Sentiment Index fell to 56.7 for the preliminary June reading (indexed to Q1-1966 =100), down from 59.8 in May, and 78.4 in January. The current reading is the lowest in almost three decades. However, the optimists point to the fact that we haven’t had a negative reading so far in the estimates of growth of our gross domestic product. Our economy continues to grow slowly; in three of the past five quarters the rate of growth has been below 1 percent on a seasonally adjusted and annualized basis. However, one of the reasons that the U.S. economy has been able to grow is that a low dollar has improved our trade situation. In each of the past four quarters, exports have grown faster than imports. The 2007 increase in net exports was the largest in the post-World War II era.

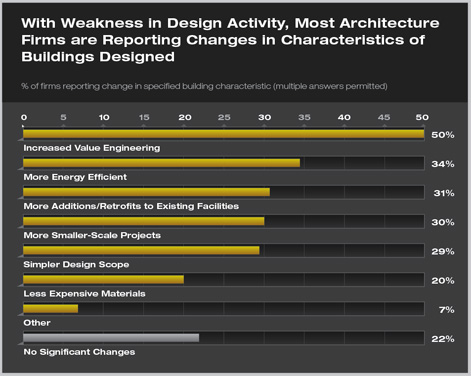

With a weak market, building designs are changing

More than a third of firms mentioned that buildings are designed as more energy efficient, while about 30 percent mentioned that current projects are more likely to be retrofits or additions to existing facilities rather than new construction. A comparable share mentioned that there are more smaller-scale projects than in previous years, as well as that current projects have a simpler design scope (and therefore smaller design budgets) than did projects in recent years. About 20 percent of firms noted that current projects are using less expensive materials. Larger firms and those concentrating on institutional facilities were more likely to report that they weren’t seeing any significant changes in their projects. |

||

Copyright 2008 The American Institute of Architects. All rights reserved. Home Page |

||

news headlines

practice

business

design

Recent Related

› Design Slowdown Continues in April

› Billings Hit Lowest Score in 12-Year History

› Billings Take a Tumble in February

› January Drop in Billings Index May Point to More Sustained Downturn

Stand Up and Be Counted: Join the Work-on-the-Boards Panel.

This month, Work-on-the-Boards participants are saying:

In our 40th year, 2008 will be our strongest year ever. Workload is strong with great projects and clients.

—48-person firm in the Midwest, institutional specialization

Health-care clients will be closely watching any “health-care reform” initiatives after the election, and this may result in a slowdown in health-care project commitments.

—22-person firm in the South, institutional specialization

Worst it’s been in 20 years. Everyone’s apprehensive and reluctant to start projects or spend a lot of money. Construction costs keep going up, even though contractors are hungry for work.

—5-person firm in the West, residential specialization

Our larger projects ($1-8 million) have been frozen for a few months now. Clients are unwilling to pay for services. They are asking for more, and willing to pay for less.

—6-person firm in the Northeast, mixed specialization.

Summary:

Summary: