| work-on-the-boards January Drop in Billings Index May Point to More Sustained Downturn Commercial/industrial and institutional firms have been reporting weaker business conditions for past several months

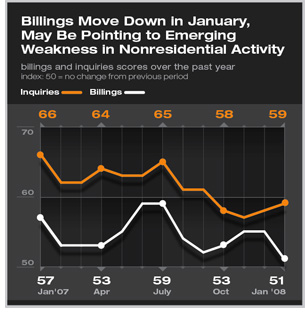

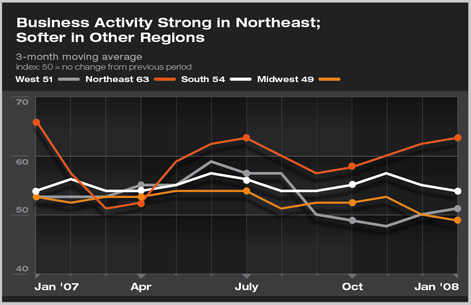

The AIA’s Architectural Billings Index (ABI) stood at 50.7 in January, where any score above 50 indicates growth in design activity, and any score below 50 indicates a decline. The January reading was the lowest in more than 18 months and, in all likelihood, points to a continued softening in the nonresidential sector. Inquiries for new work, while rebounding a bit in January, also have been softer in recent months. Firms in the Midwest and South have reported an easing in recent months, while firms in the West report stabilizing conditions after a few months of downturn. Conditions in the Northeast remain healthy, with firms in this region reporting an upturn in recent months.

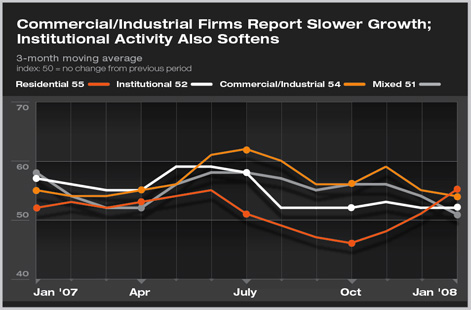

Commercial/industrial firms have reported the sharpest downturn since the ABI hit its recent high last July. However, institutional firms and those with a mixed practice have also reported fairly steep falloffs. Residential firms have seen a bit of a rebound after reporting declining conditions for most of the past two years. The national economy also has weakened

Another sign of economic weakness is the decline in payrolls in January. The net loss of 17,000 jobs for the month marked the first decline since the third quarter of 2003 as we were still emerging from the last recession. Business confidence levels also point to emerging concerns. The Conference Board’s CEO Business Confidence Survey stood at 39 in the fourth quarter of last year, where scores of 50 or better indicates a positive outlook. That score was the lowest since the fourth quarter of 2000. Further acceptance of building information modeling

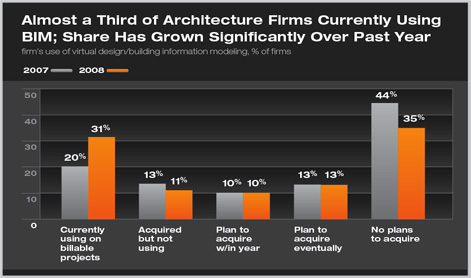

Thirty-eight percent of respondents think that BIM will become the industry standard over the next three years. Over half (51 percent) think that this will happen sometime after three years, while the remaining 11 percent feel that it never will become the industry standard. Not surprisingly, larger firms are further up the adoption curve. Over two-thirds (69 percent) of firms with annual billings of $5 million or more are currently using BIM on billable projects, while almost half (49 percent) feel that BIM will become the industry standard within three years. |

||

Copyright 2008 The American Institute of Architects. All rights reserved. Home Page |

||

news headlines

practice

business

design

Recent Related

› Billings, Inquiries End the Year on an Uptick

› Billings’ November Upturn Points to Solid Momentum in Nonresidential Construction Sector Firms Improve in July

› October Billings Show Small Rebound After Declines of Late Summer

› Billings Stall Across the Board in Credit-crunched Economy

This month, Work-on-the-Boards participants are saying:

• Some contractors are saying it is getting more competitive and that residential contractors are trying to get into commercial work, thus causing lower fees for them.

—30-person firm in the South, commercial/industrial specialization

• There is a lot of concern about recession and, due to that perception, pressure from owners for better “deals” when contracting for architectural work.

—15-person firm in the Northeast, commercial/industrial specialization

• Rules for lending are tightening; money is available but only being used on low-risk projects.

—22-person firm in the West, institutional specialization

• There is a definite slowdown in the Miami architectural market. Several firms have either laid off staff or are getting worried! Even the blueprinter is getting slow.

—1-person firm in the South, mixed specialization.