work-on-the-boards

Economic Downturn Stalling Design Activity

With both billings and inquiries heading down, firms expect a broad range of changes over the coming year

by Kermit Baker, PhD, Hon. AIA

Chief Economist

Summary: As the economy continues to spiral downward, design and construction activities increasingly are being slowed down, put on hold, or cancelled. These trends have accelerated recently with the problems in credit markets, as many projects that otherwise are viable are unable to secure financing. The result is that many architecture firms have experienced a sharp slowdown in activity, with both billings on ongoing projects and inquiries for new projects posting their sharpest monthly declines in the AIA’s 13 year history of tracking architecture business trends. Summary: As the economy continues to spiral downward, design and construction activities increasingly are being slowed down, put on hold, or cancelled. These trends have accelerated recently with the problems in credit markets, as many projects that otherwise are viable are unable to secure financing. The result is that many architecture firms have experienced a sharp slowdown in activity, with both billings on ongoing projects and inquiries for new projects posting their sharpest monthly declines in the AIA’s 13 year history of tracking architecture business trends.

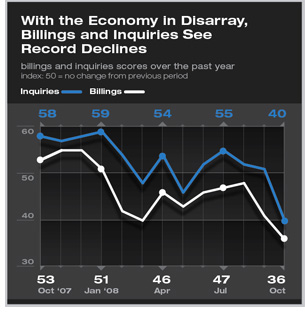

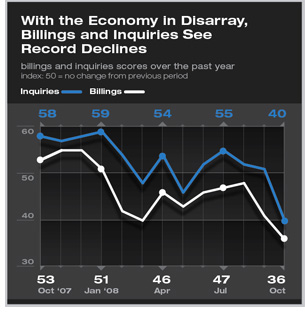

The AIA’s Architecture Billings Index (ABI) recorded its ninth straight monthly decline in October. However, the October drop to 36.2 was the steepest decline in its history, surpassing the weakness reported last February and March as the broader economy was just beginning to decelerate. This round of billings declines is largely the result of unsteady credit markets that have created financing problems for construction projects.

Although many of these projects will ultimately progress once credit markets stabilize, the pipeline for new projects is slowing to a trickle. The index for new project inquiries also dropped precipitously in October to 39.9, also marking its greatest drop in the history of this effort. Our expectations are that a recovery in firm billings will be preceded by a few months of inquiry increases, so, at present, business conditions show no signs of improving.

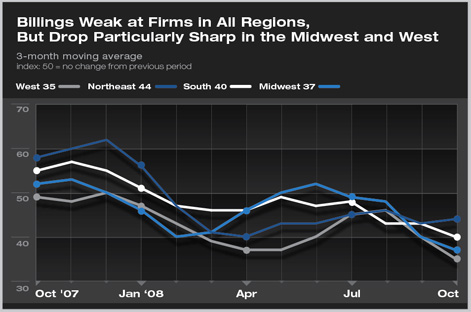

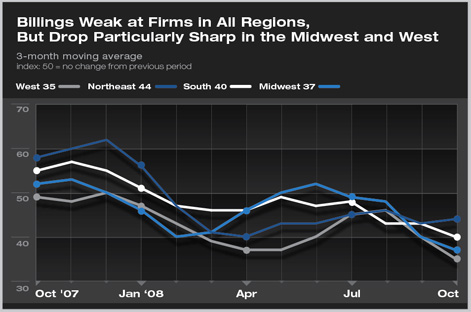

No region of the country nor type of facility has been immune from this steep drop. Firms in the Northeast and South have reported the mildest declines recently, but firms in both regions have reported steady declines through the year. Conditions at firms in the Midwest looked to be stabilizing over the summer, but the recent weakness in international markets has slowed gains in the exports of manufactured goods, which is particularly detrimental to the Midwest economy. Firms in the West also have seen a marked downturn in business conditions recently.

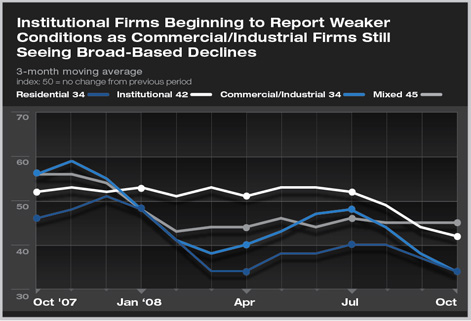

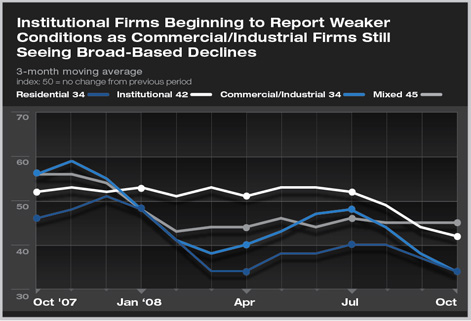

Firms specializing in the commercial and industrial sector are feeling the brunt of this downturn. Their billings have dropped more sharply recently than firms with other specializations. With mostly private businesses as clients, this group has seen the greatest impact of the problems in credit markets. However, firms with an institutional specialization are seeing problems emerging in their sector. After reporting steady growth through most of the summer, institutional firms have seen an erosion of business activity in October and November. With mounting budget problems for state and local governments and stock market losses hitting the endowments of nonprofits, the institutional market also looks to be in for a period of uncertainty.

Few bright spots in the economy

The Commerce Department recently reported a slight decline in economic growth for the third quarter of this year, a downturn that is almost certain to accelerate in the fourth quarter. Business payrolls declined by another 240,000 positions in October, bringing the losses for the year to almost 1.2 million jobs and pushing the national unemployment up to 6.5 percent, its highest level since early 1994. The construction sector has been one of the hardest hit: the 400,000 payroll decline this year accounts for fully a third of the national losses.

Consumers are feeling particularly nervous about economic conditions. With mounting job losses and falling home values and stock prices, the University of Michigan’s consumer sentiment index for October fell to its lowest level since mid-1980. The preliminary November reading essentially remained flat, pointing to continued concern by consumers over the state of the economy. As evidence of their nervousness, retail sales—which had shown no growth in August and September over year-ago levels—declined more than 3 percent in October, a major sign of weakness in the economy.

Firms respond to business downturn

Most architecture firms have directly witnessed the slowdown in the construction markets. When asked to rate the impact of the economic situation on their firm over the next year on a five-point scale, with 1 indicating it as “relatively minor,” 3 as “significant but manageable,” and 5 as “devastating,” firms gave it an average score of 3.3. Forty-two percent rated it a 3: “significant but manageable,” 31 percent rated it a 4: between “significant but manageable” and “devastating,” while almost 9 percent gave it a 5; flat-out “devastating.”

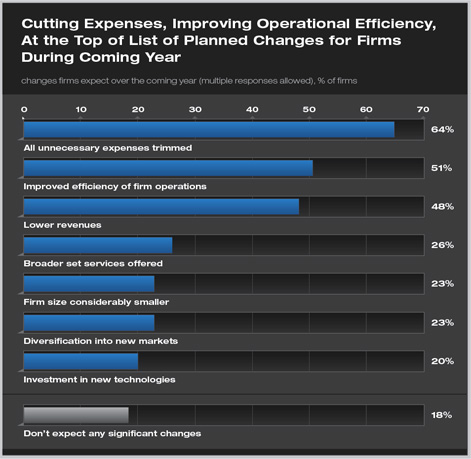

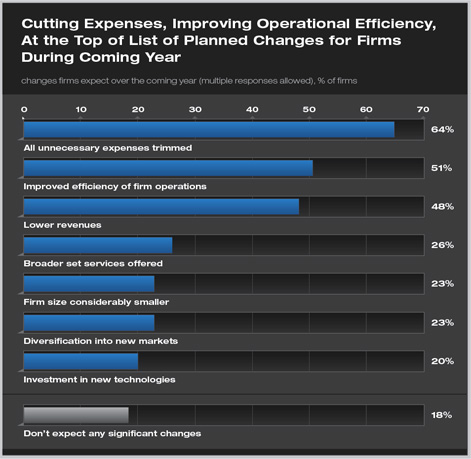

Firms also were asked what specific changes they expect to see in their firm over the next year, some of which they can control, others of which are more dependent on economic conditions. The most common change expected is that firms will work to cut back expenditures by eliminating all unnecessary expenses, mentioned by 64 percent of firms. Improving firm financial performance by operating more efficiently was mentioned by over half of respondents. Almost half of firms expect revenues will be lower next year. Other commonly expected changes are: offering a broader set of services (26 percent), that the firm will be considerably smaller (23 percent), and that the firm will have successfully diversified into new markets (23 percent).

One in five firms expects to invest in new information technologies and communications systems to keep the firm competitive. Focusing on a more limited set of design and related services was mentioned by 6 percent of respondents, while 5 percent expect to have merged with or been acquired by another firm. Ten percent of respondents mentioned other expected changes, such as redirecting their marketing strategy, compensation adjustments, relocating their office, and change in firm leadership. Only 18 percent of respondents don’t expect to see any significant changes in their firm over the next year. |

Summary:

Summary: