| work-on-the-boards Design Slowdown Continues in April Fewer new projects and delays on existing projects contribute to decline in architecture work loads

The downturn in business activity at architecture firms continued in April, as a weakening economy and ongoing problems in credit markets dampened the outlook for nonresidential facilities. The national ABI reading of 45.5 indicates weakness in design activity, though a higher score than in February or March indicates that the slowdown moderated. Inquiries for new projects also showed some improvement, all hopefully suggesting that this current nonresidential downturn may be relatively mild.

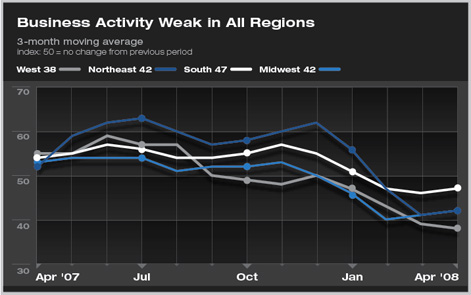

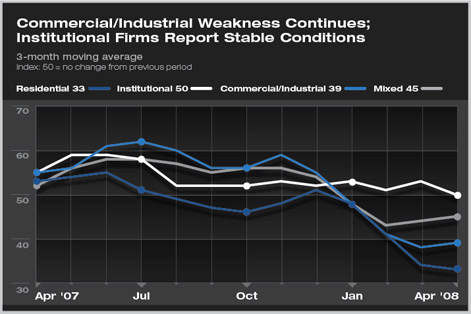

The weakness in nonresidential design activity is so sufficiently pronounced that all regions of the country have been affected. Firms in the West are currently reporting the weakest conditions, although firms in the Northeast and Midwest are also seeing significant downturns. Firms in the South have reported the mildest slowdown to date. Commercial/industrial firms (those with a majority of their billings in this sector) have witnessed a steep drop in activity since the end of last year. In contrast, institutional firms are still seeing steady business conditions. The ABI score for institutional firms stood at 50.4 in April, and has not dipped below the 50 threshold this cycle. Residential firms, which began reporting weakness in early 2006, have seen billings levels plummet even further in recent months. Broader economy remains weak

A slowdown in consumer spending will eventually lead to reduced business investment, particularly for new and renovated facilities. Emerging weakness on the commercial side of the economy is reinforced with the decline in payrolls. Business payrolls nationally have declined each month this year, with the four month loss now totaling 260,000. That’s still a small share of the 138 million payroll positions in the U.S., but with fewer jobs there is less need for new office space, and the reduced spending associated with these job losses results in less need for retail space. Unfortunately, the slowdown in the economy has done little to rein in inflation. Oil prices remain at record levels, and the cost of construction materials continues to spiral up. Construction materials and components used in nonresidential building have increased in the 6–7 percent range over the past year, which creates uncertainty in the design and construction process and means that some projects are no longer feasible at these higher costs.

The overwhelming majority (72 percent) of firms that reported stable billings in April also indicated that they had one or more concerns with their current or prospective project workload. The most common concerns were: “that existing projects may be put on hold” (65 percent of firms with concerns); “possible requests to slow down current projects” or “not be awarded projects that they expect to get” (each at 43 percent). Of firms reporting declining billings, more than half of the respondents indicated that “not enough new project work” and “existing projects put on hold” were factors. Other common reasons were: “that existing or prospective projects were cancelled,” “requests for a slowdown in project schedules,” and “a decreased scope of work on existing projects.” Other less common factors were: “a normal seasonal slowdown,” “delayed negotiations or renegotiations for new work won,” and “projects moving slowly through the approval process.” “Not enough new work” was listed by almost half of the firms with a decline in billings as the principal reason for the decline, while almost a quarter mentioned “existing projects being put on hold” as the principal reason. Smaller firms were most likely to mention “not enough new project work” as the key reason for the slowdown, while larger firms were more likely to mention “projects being put on hold or cancelled” as reasons for declining billings. |

||

Copyright 2008 The American Institute of Architects. All rights reserved. Home Page |

||

news headlines

we the people

business

members connecting

Recent Related

› Billings Hit Lowest Score in 12-Year History

› Billings Take a Tumble in February

› January Drop in Billings Index May Point to More Sustained Downturn

Join the Work-on-the-Boards Panel

This month, Work-on-the-Boards participants are saying:

We have never been busier. So far no projects have slowed or stopped.

—100-person firm in the West, institutional specialization

Business conditions for our firm have become very volatile. Projects that we counted on which were “rush-rush” a few months ago now are being slowed down as the clients evaluate if they want them to go at all. We are trying to be prepared for a very hard landing.

—31-person firm in the Midwest, commercial/industrial specialization

The cost of construction seems to be moderating, which might help some projects move forward. Conversely, the availability of financing has worsened, which may delay (or halt) some new projects from moving forward. This is the most confusing and unpredictable marketplace I’ve ever seen—there is not clarity to the tea leaves at all.

—39-person firm in the South, commercial/industrial specialization

It’s terrible, the worst I have seen in 20 years. No good outlook in sight. Also it is getting harder and harder to collect money. Even public clients are now slow in paying.

—20-person firm in the Northeast, institutional specialization.

Summary:

Summary:

Lack of new work driving billings slowdown

Lack of new work driving billings slowdown