AIA HOME DESIGN TRENDS SURVEY—THIRD QUARTER

Slowdown Sees Established Community Design Trends Giving Way to Infill Locations and Homes with Simpler Features

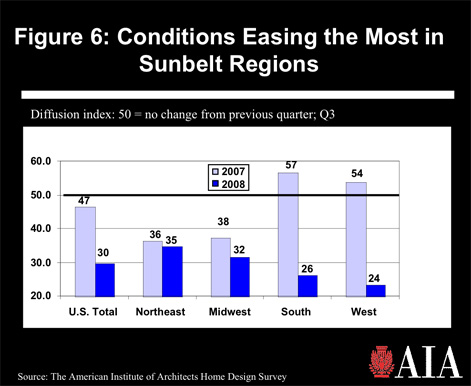

Business activity for residential architects continues to plummet, particularly in Sunbelt regions

by Kermit Baker, PhD, Hon. AIA

Chief Economist

Summary: The housing downturn is reshaping households’ preferences for the design of their neighborhoods and communities. Infill locations are growing in popularity, while exurban subdivisions—even with the opportunities they offer for recreational opportunities, open space, and more fully developed community plans—are losing ground because of their lack of access to public transportation and commercial services. Porches remain a popular feature in home styles, as they often evoke times with greater neighborhood interaction. Households are generally looking for simpler exteriors, with durability a critical concern.

The most recent AIA Home Design Trends Survey focuses on neighborhood and community design issues. In addition to emerging design trends, this survey documents the continued downward spiral of business conditions at residential design firms across the U.S. The Sunbelt regions of the country, where most of the new residential construction occurs, is reporting particularly weak conditions. All of the major residential construction sectors are declining, while remodeling activity has nearly stalled.

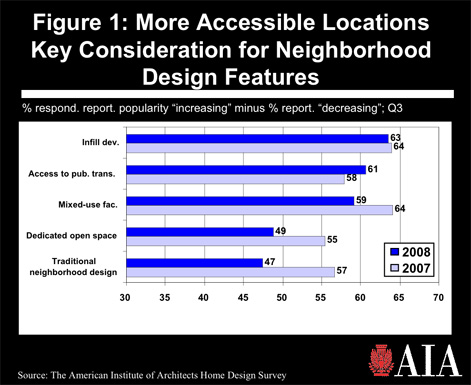

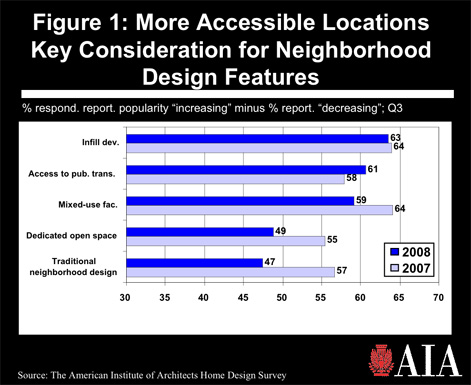

Premium on accessibility in neighborhood design

Much of the home-building activity in recent years has come at the edges of major metropolitan areas. This is where larger land parcels could be assembled to accommodate the volume of homes that were built earlier this decade. However, with the dramatic decline in housing construction, home buyers are rethinking their neighborhood and community preferences.

With weak house prices in most markets, buyers are looking for locations where houses will have the best chance of retaining their value. This often means infill locations, which are more convenient to employment centers, commercial opportunities, and other daily household activities. These locations typically require less driving, which is an additional positive given the spike in oil prices in recent years.

Access to public transportation, which generally is greater in infill development locations, is also a growing priority for households. Public transportation offers alternatives for households when oil prices are volatile. Also, given the weak economy and growing employment declines, enhanced public transportation options give households greater ability for sharing vehicles should the need arise. More mixed-use facilities within developments are still viewed as gaining in popularity, although less so than in recent years given that these other uses may already be present in infill locations.

Residential architects indicate that most other neighborhood design considerations included in this survey are fading in popularity. Dedicated open space within a community, as well as traditional neighborhood design (such as homes closer to the street, sidewalks, and smaller lots) may be less important in an infill context. Likewise, recreational facilities integrated into developments are deemed less important, given current locational preferences.

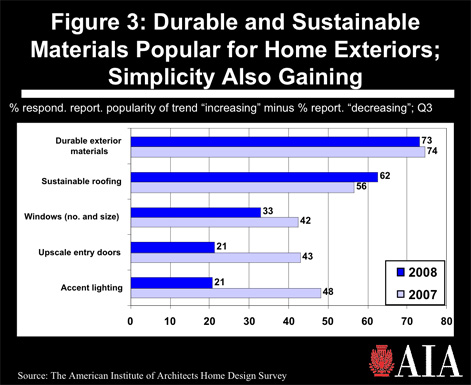

Simplicity gaining in home styles and exteriors

Home styles also are reflecting the changes of a weaker housing market. Front and side porches are the one feature mentioned by residential architects that continues to have strong popularity. Single-story homes, contemporary (as opposed to traditional) styles, simpler exterior detailing, and windows with nontraditional shapes and sizes are all showing limited popularity at present. Unique home features apparently are less desirable in this uncertain market.

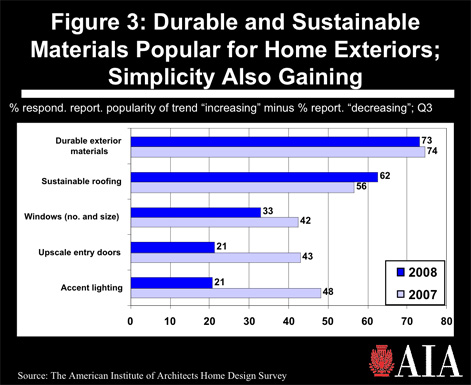

For home exteriors, durability, sustainability, and simplicity are the watchwords. Low-maintenance exterior materials (fiber-cement board, stone, and tile) continue to grow in attractiveness for homeowners, with three-quarters of respondents indicating that these materials are increasing in popularity, and fewer than 2 percent reporting them to be declining. Sustainable roofing materials and green roofs also are growing in popularity.

However, other trends point to growing simplicity for exteriors. Fewer residential architects see the number and size of windows, upscale entry doors, or accent exterior lighting growing in popularity as compared to a year ago, and in most cases the decline has been quite dramatic. With falling prices and greater attention to housing affordability, simpler homes seem to be growing in favor by homeowners.

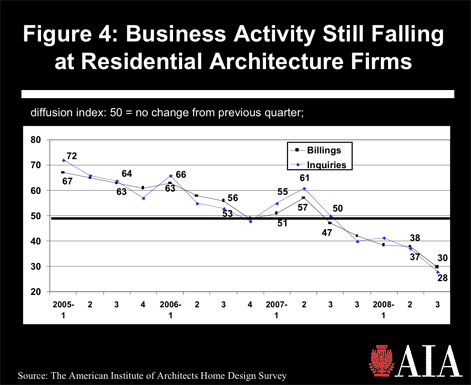

Business conditions move even lower

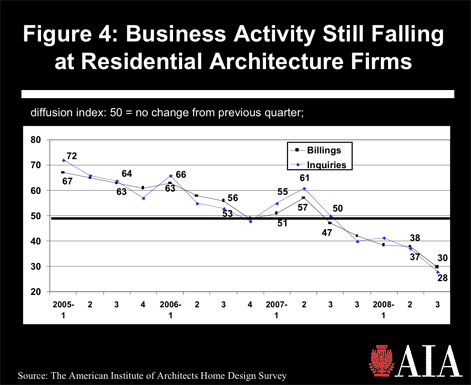

Residential architects have been reporting a steady deterioration in business conditions. Conditions turned from slow growth to decline during the second half of 2007, and the downturn has accelerated throughout 2008. The national billings score was 29.7 in the third quarter (any score below 50 indicates a decline), as more than half of all architecture firms indicated that billings had declined by at least 5 percent from the second quarter. Inquiries for new project activity had an even lower score in the third quarter at 28.0, as 57 percent of firms indicated a significant drop in this indicator. Since inquiries for new work need to pick up before there can be an increase in project billings, there are no signs that conditions have hit bottom yet.

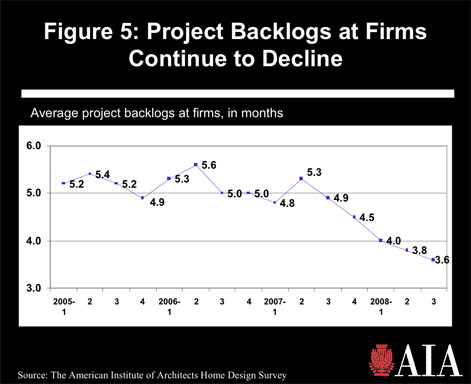

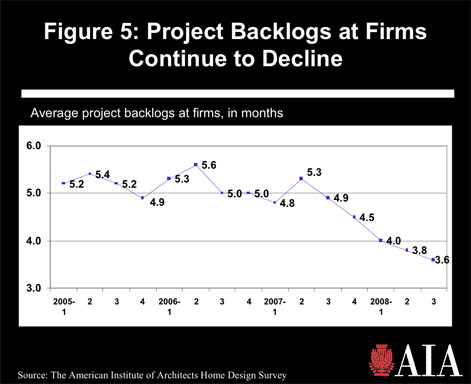

With the decline in new projects, project backlogs are shrinking. Backlogs, which measure the amount of work currently under contract and the length of time that current staff is covered on these projects, have been moving down steadily. Though not adjusted for seasonal fluctuation, they currently are down more than 25 percent from year-ago levels.

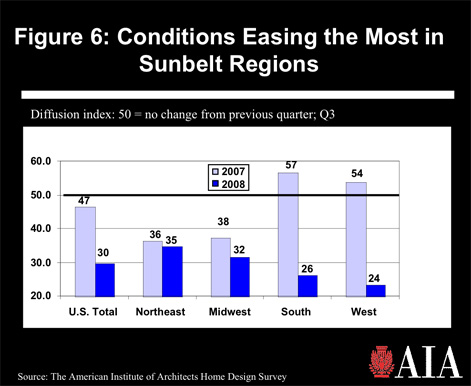

Business conditions for residential architects are weak in all regions of the country. However, over the past year, they have deteriorated the most for firms in the South and West. These regions are where the majority of new residential construction is concentrated, and both were reporting reasonably healthy conditions a year ago. However, the continued decline in new residential construction activity has been felt the most by firms in these two regions. Firms in the Northeast and Midwest regions, which have a higher share of home improvement activity than do the Sunbelt regions, have not reported nearly as much decline in business conditions over the past year.

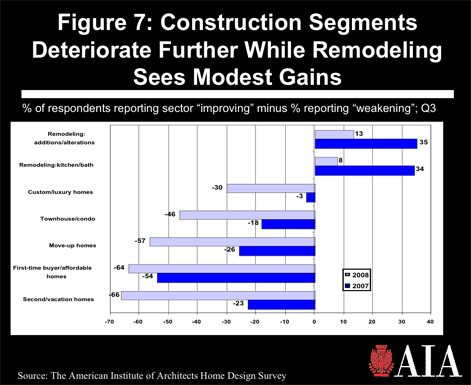

No housing sector spared from downturn

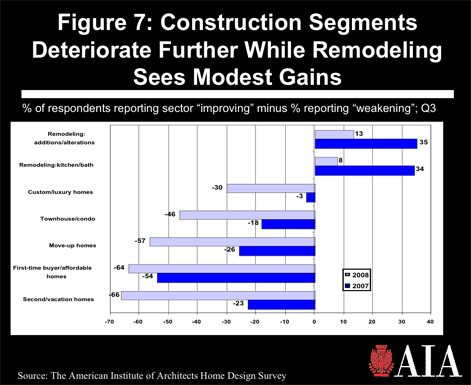

All major construction sectors are reported to be significantly weaker than they were a year ago, according to residential architects surveyed. Second homes and vacations homes are showing the greatest declines, followed closely by first-time buyer/affordable homes, move-up homes, townhouses and condos, and custom and luxury homes. Homes designed for first-time buyers have not deteriorated much from a year ago, indicating that this market segment may finally be reaching bottom. Other construction sectors, however, continue to show steep drops.

Home improvement projects—kitchen and bath projects as well as additions and major alterations—are reported as seeing very weak growth by residential architects. A year ago, they were reporting healthy growth for these projects. However, falling home prices in many markets have cut into homeowner’s equity levels, and therefore their ability to finance home improvement activities.

|