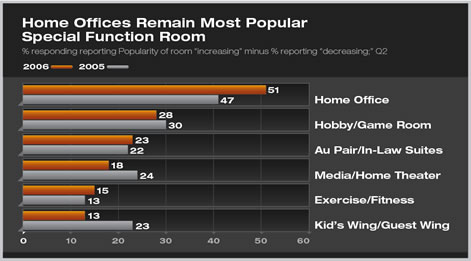

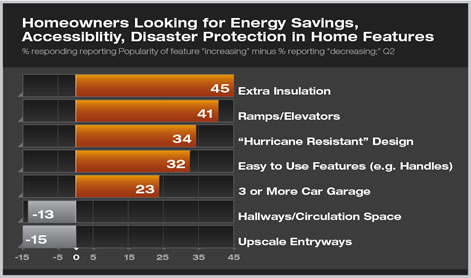

economics Summary: AIA Chief Economist Kermit Baker, PhD, Hon. AIA, reports that as the residential market weakens, remodeling offers opportunities as homeowners look for new ways to increase energy efficiency, accessibility, and flexibility within their existing homes. In fact, the feature most mentioned as most popular by respondents to the AIA Home Trends Survey for the second quarter of 2006 was adding insulation to attics. Even as the housing market continues to ease in most markets nationally, residential architects report that homeowners are looking for additional features, systems, and products in their homes, and often different special function rooms. Motivating the added features in homes typically is a desire for greater energy efficiency, accessibility, and flexibility in use of the space in the home. New one-family homes increased in size by almost 90 square feet in 2005 according to the U.S. Census Bureau. Residential architects report that one of the most popular uses of this additional space was home offices. Over half of residential architects surveyed felt that home offices are increasing in popularity in the markets that they serve, while only about 1 percent feels that they are becoming less popular. Almost half of all residential architects feel that home offices are currently the most popular special-function room. Hobby/game rooms and au pair/in-law suites also are seen as popular special-function rooms. Both of these rooms were rated about the same in popularity as they were in the AIA Home Design Trends survey of a year ago. Media/home theaters and kid’s wing/guest wing have diminished in popularity over the past year according to residential architects.

Higher energy costs affect choices Increasing home accessibility—through the addition of ramps and elevators, as well as including easy-to-use features in the home—also was seen as growing in popularity. Given the recent rise in the frequency of natural disasters, designing homes that are more resistant to hurricanes was seen as rising in popularity.

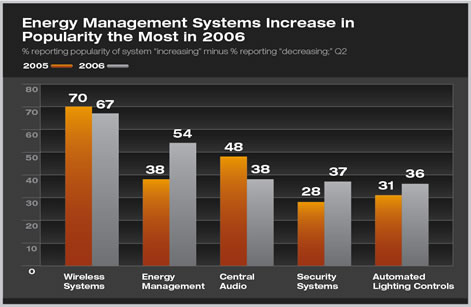

Introducing more consumer entertainment technology in the home was a theme of in-home systems. The popularity of wireless telecommunications and data systems, and central (distributed) audio systems reflects the growing trend toward adding entertainment systems to the home, as well as providing business systems to support home offices. However, concerns over high energy costs are very evident in the home systems that are becoming more common. Energy management systems was the category that increased the most in popularity over the past year, while automated lighting controls, which may help to control energy use, also increased in usage over this period.

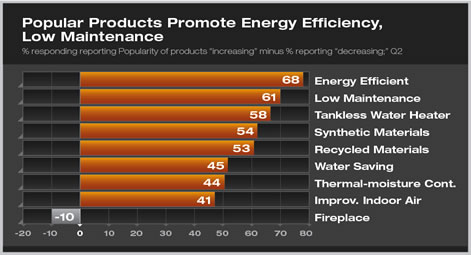

Popular products for the home also reflect homeowner concern with managing energy costs, as well as continued interest with minimizing maintenance. Over two-thirds of residential architects feel that interest in energy-efficient products (e.g. triple-glazed windows) is increasing, while none felt that interest was decreasing. Tankless water heaters and water-saving products are examples of other products that have positive energy-saving characteristics and are growing in popularity.

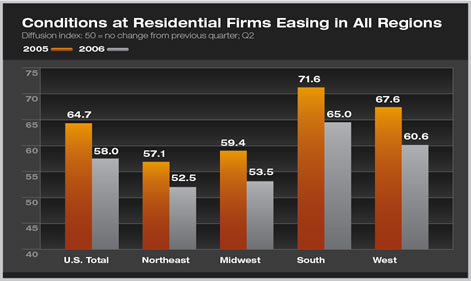

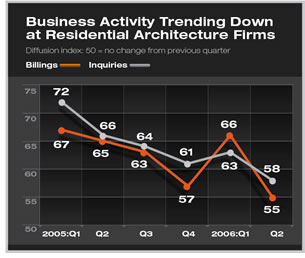

There remains considerable regional variation in business conditions across firms, with firms in the South and West reporting reasonably healthy conditions, and firms in the Northeast and Midwest seeing weaker levels of activity. However, constant across all regions is the slowdown in business conditions over the past year. The firms reporting the healthiest business conditions are also reporting the greatest decline since the second quarter of 2005.

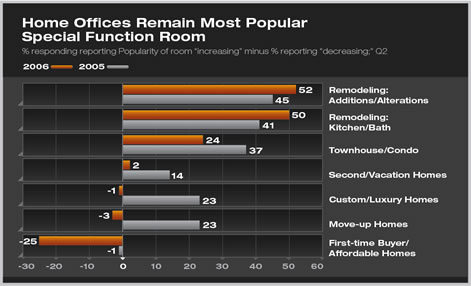

The weakening in the residential market continues to hit some segments more than others. For example, remodeling projects—both additions and alterations to existing homes as well as kitchen and bath remodels—are reported to be stronger now than they were a year ago. However, all types of new construction are significantly weaker now than they were a year ago. A significant portion of residential architects are reporting that projects for homes oriented toward first-time buyers/affordable units are weakening. More are reporting that move-up home and custom/luxury home projects are weakening than are reporting them improving.

Townhouse/condo projects are the only new construction category

where there is any evidence of growth, and even this varies considerably

across markets. Residential architects in the Northeast, for example,

report no increase in townhouse/condo projects. |

||

Copyright 2006 The American Institute of Architects. All rights reserved. Home Page |

||

news headlines

practice

business

design

recent related

› Assessing the Residential Remodeling Market

A

printer-friendly version of “High Energy Costs Inspire New Features

in Homes” is

available.

Download the PDF file

(664 Kb).

Data source: The American Institute of Architects Home Design Survey.

Business trends confirm market slowdown

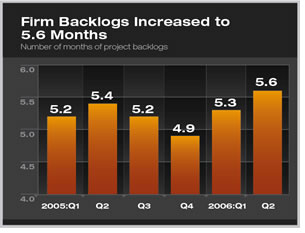

Business trends confirm market slowdown In

spite of the unmistakable easing in business conditions, firms are

reporting strong levels of backlogs. Currently, residential architecture

firms are reporting an average of 5.6 months of work under contract,

its highest level in the six quarters that the survey has been conducted.

One reason that backlogs may be growing as the market is clearly

easing is that a higher share of workloads may be larger or more

complex projects. Larger-scale projects tend to have a longer design

period and therefore typically generate longer backlogs.

In

spite of the unmistakable easing in business conditions, firms are

reporting strong levels of backlogs. Currently, residential architecture

firms are reporting an average of 5.6 months of work under contract,

its highest level in the six quarters that the survey has been conducted.

One reason that backlogs may be growing as the market is clearly

easing is that a higher share of workloads may be larger or more

complex projects. Larger-scale projects tend to have a longer design

period and therefore typically generate longer backlogs.