| AIA HOME TRENDS DESIGN SURVEY: Fourth QUARTER

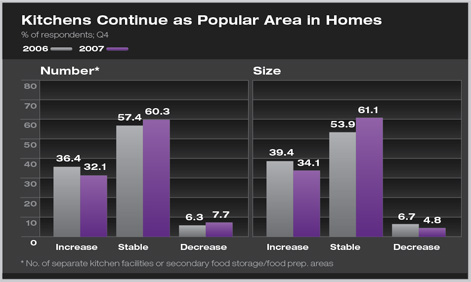

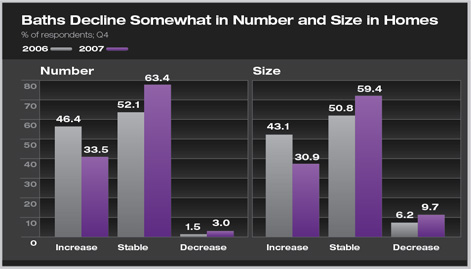

Kitchens and Baths Continue as Focus of Design Activity in Homes, Even as Residential Markets Remain Very Weak Accessibility and sustainable features grow in popularity as upper-end products wane with mounting house price affordability concerns by Kermit Baker, PhD, Hon. AIA Kitchen and bathrooms traditionally have been key design areas within the home. In the Home Design Trends Survey for the fourth quarter of 2007, residential architects report that the number and size of these rooms are still increasing in popularity. However, with the housing market remaining weak and concern growing over affordability of homes, some concessions are being made. Particularly for bathrooms, residential architects report that there is less interest in increasing size and numbers as compared to a year ago. Likewise, architects are reporting declining interest in traditional upper-end features and products in these areas of the home, such as upper-end and duplicate appliances in kitchens, and towel-warming drawers, double-sink vanities, steam showers, and infrared saunas in bathrooms. Instead, there is a growing interest in accessibility and adaptability features in both of these areas to make the home better meet the needs of an aging or less mobile population. Additionally, there is growing interest in environmentally friendly sustainable products, such as renewable material countertops and flooring in kitchens, and water-saving toilets and LED lighting in bathrooms. However, weak business conditions at residential architecture firms provide no evidence that the housing market is poised for a recovery. Billings and inquiries at residential architecture firms are weakening. All of the major residential construction sectors are weaker than a year ago, while home remodeling sectors remain relatively strong. Kitchens remain a focus

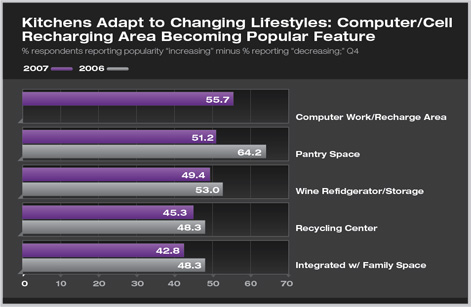

As kitchen areas grow in importance in the home, they are increasing their functions and features. For example, a majority of residential architects report that a computer work area or a recharging area for cell phones or personal digital assistants is becoming more popular in kitchen design. Other popular features for kitchens include more pantry space, a wine refrigeration or storage area, and a recycling center. Integrating the kitchen with family space (e.g., great rooms) and designing kitchens to be adaptable for an aging or less mobile population continue to be popular design options according to residential architects. A smaller share of architects reported a trend toward adding pet feeding or grooming areas in the kitchen.

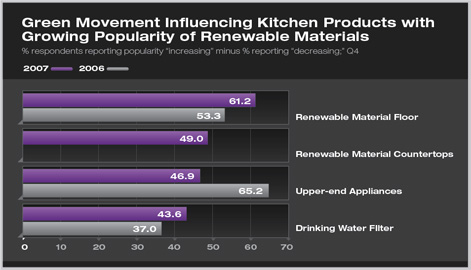

As with other parts of the home, there is growing interest in “green” features in the kitchen. Renewable flooring materials (e.g., bamboo and cork) was seen as growing in popularity by a majority of residential architects, as was renewable material countertops (e.g., concrete and bamboo). A struggling housing market seems to have decreased interest in several upper-end products, although upper-end appliances and duplicate appliances (e.g., dishwashers, refrigerators, and microwaves) were seen to be increasing in popularity, but by a smaller share of architects than a year ago.

Bathrooms decline somewhat in importance

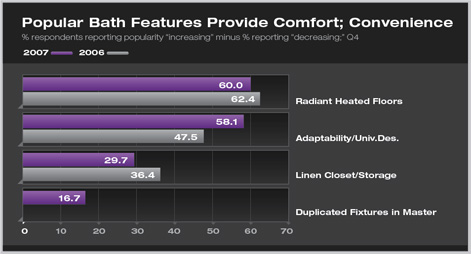

Radiant-heat flooring continued to be a popular feature in bathrooms, as it was in this survey from a year ago. Also, ensuring that bathrooms are accessible to an aging population continues to be a priority in bathroom design, even increasing in popularity from a year ago.

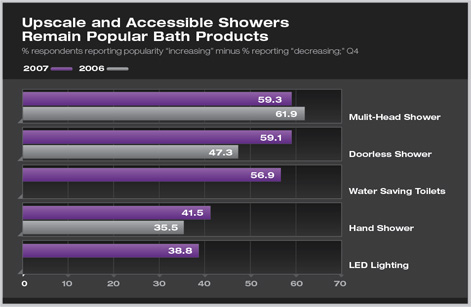

Many bathroom products that are designed for greater accessibility or sustainability are growing in popularity in homes, while other traditional upper-end products seem to be waning somewhat. Doorless/no threshold showers were reported as growing in popularity, and even more so than a year ago, as were hand-held showers, which often are viewed as a product to promote greater accessibility. On the sustainable front, water-saving toilets were reported by a majority of respondents as growing in popularity, as was LED lighting. Multihead showers remain very popular, apparently at the expense of soaking tubs, steam showers, and infrared saunas, each of which is reported to have limited popularity. Other traditional upper-end products, such as towel warming drawers and double-sink vanities, are reported to have limited popularity at present.

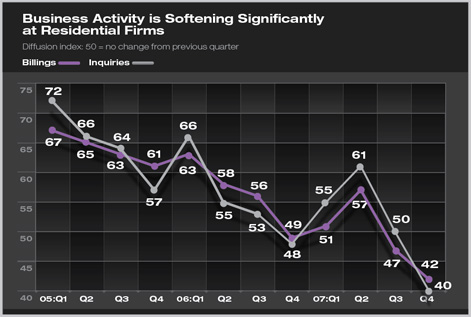

Business conditions continue to deteriorate The index of inquiries for new projects holds out little hope that this weak market will be reversed anytime soon. The index for inquiries stood at 40 in the fourth quarter, down from 48 a year ago, and from 50 in the third quarter of 2007. Again, the fourth quarter score for inquiries was the weakest since the survey began.

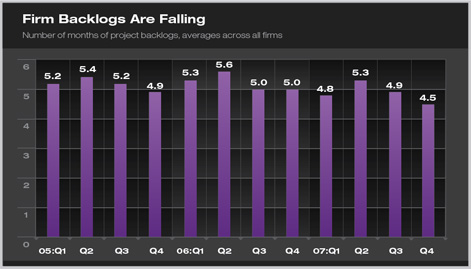

With the weakening in business conditions, project backlog at firms also has suffered. Firms reported an average backlog of 4.5 months of work (the amount of time that the current staff could be fully billable with current project workloads), down from 5.0 months a year ago, and 4.9 months in the third quarter. Prior to this survey, project backlogs at residential architects had never fallen below 4.8 months.

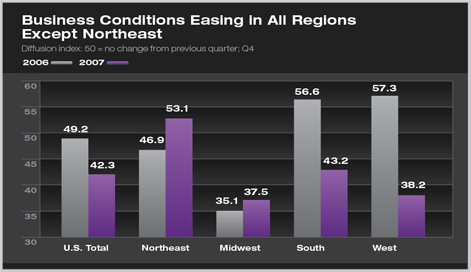

In the face of a sustained residential slowdown, regional business conditions are becoming more erratic. In the fourth quarter, billings scores increased at firms in the Northeast, showed some moderation at firms in the Midwest, and dropped sharply at firms in the South and West. These trends may reflect the continued weakness in new residential construction activity, which is heavily concentrated in the South and West regions, compared to relative strength in improvement activity to existing homes, which tends to be a larger share of activity in the Northeast and Midwest.

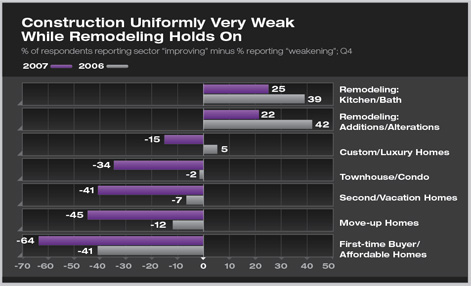

All residential construction sectors soften Homes targeted to first-time buyers, as well as those targeted to younger households trading up to a larger home, have been reported to be the weakest parts of the residential market in recent years. In the fourth quarter, they weakened even further, according to residential architects responding to this survey. Only 5 percent of respondents reported that the first-time buyer market was improving, while 69 percent felt it was weakening in their area, resulting in a composite score of -64. The trade-up housing sector fared only slightly better, with 6 percent of respondents reporting it improving and 51 percent feeling it was weakening, for a composite score of -45. Other major residential construction sectors—second/vacation homes, townhouses and condos, and custom and luxury homes—are all reported to be seeing serious declines. A year ago, all three of these sectors were reasonably stable, with about as many respondents rating them as improving as rated them as weakening. The remodeling sectors, both additions and alterations to existing homes and kitchen and bath remodels, are reported as healthy, although not as strong as they were a year ago. Still, over a third of the residential architects surveyed rated them to be improving, with fewer than 15 percent rating them as weakening.

|

||

Copyright 2008 The American Institute of Architects. All rights reserved. Home Page |

||

news headlines

practice

business

design

recent related

› Households Look for More Activities Integrated into Their Communities

› As Home Energy Costs Remain High, Residential Architects Report That Sustainable Design Motivates Homeowners

› As Housing Markets Correct, Owners Looking for Less Space but Greater Accessibility, More Flexibility in Home Designs

› Homeowners Looking for Greater Accessibility to Services and More Mixed Uses in Communities and Neighborhoods

› High Energy Costs Inspire New Features in Homes

› “Bigger Is Better” No Longer Ruling Home Design

The AIA Home Design Trends Survey is conducted quarterly by the AIA. Because residential architects are design leaders in shaping how homes function, look, and integrate into communities, this survey helps to identify emerging trends in the residential marketplace. It also monitors business conditions at residential architecture firms. For more information on this survey, contact Scott Frank, director of AIA media relations.