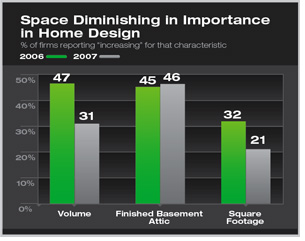

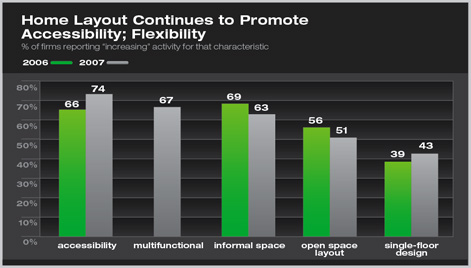

As Housing Markets Correct, Owners Looking for Less Space but Greater Accessibility, More Flexibility in Home Designs How do you . . . gauge trends for new and remodeling residential projects? Summary: Households are putting less focus on the amount of space in their homes and more focus on how that space is being used. Ease of accessibility around the home, with an emphasis on informal areas with multiple functions, is a trend growing in popularity. There also continues to be much greater attention on outdoor living areas as lot sizes shrink. Residential architecture firms report continued cooling of business trends, especially at the lower end of the market. Home improvement activity -additions and alterations to existing homes, and kitchen and bath remodels-remain the bright spots in the housing industry. These are some of the key findings of the AIA’s Home Design Trends Survey for the first quarter of 2007. The overall slowdown in the residential market, growing housing affordability concerns, and high home heating costs that are encouraging greater attention to energy use all continue to reshape residential markets.

Lower rates of home price appreciation coupled with higher short-term interest rates are no doubt a contributing factor in households moderating their expectations. Additionally, rising home energy costs are discouraging larger homes as well as extra interior space that add to heating and cooling expenses. Many households are finding that improved use of existing space in their homes reduces the need for additional square footage. Homeowners are looking to use their homes differently from previous generations and therefore looking for different layouts. At the top of the list is the desire for greater accessibility around the home in terms of wider hallways and fewer steps, as well homes with a single-floor design. Part of this concern stems from an aging baby-boom generation planning for their own retirement years and beginning to think about how best to adapt their homes to their longer-term needs. Another part is a response to more immediate concerns about caring for aging parents or other relatives in their homes, or just making it easier to accommodate visitors who may have mobility issues. Related to accessibility is the desire for space that can serve multiple needs of the household. Increased multifunctional space was seen by residential architects as a trend growing in popularity, as was more open space in the home. As households look to more flexible space, they also are looking for informality in their homes.

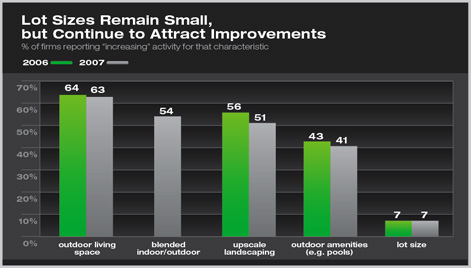

The outdoor focus remains strong With added attention to outdoor space and activities, respondents noted the continued popularity in upscale landscaping and outdoor amenities, such as fireplaces, gazebos, courtyards, swimming pools, and tennis courts. About a quarter of respondents also noted increased popularity in lot boundaries (e.g., fences and walls) and outbuildings on the property (barns, sheds, storage facilities). Greater attention to outdoor space appears to be associated with smaller lot sizes. More than a third (37 percent) of respondents reported that lot sizes are decreasing in size, with only 7 percent reporting them to be increasing.

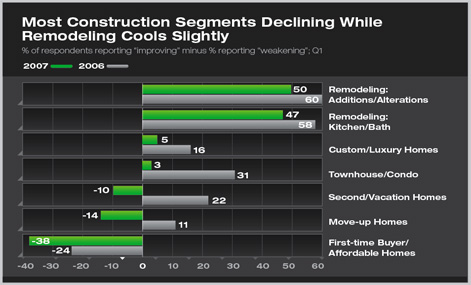

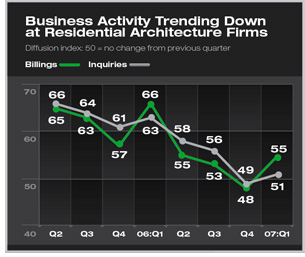

Residential architects reported lower scores for all housing sectors in the first quarter. Within new construction, construction of homes for first-time buyers, move-up homes (for buyers trading up to a nicer home), and second homes and vacation homes were all reported as declining compared to the previous quarter. Townhouses, condos, and custom and luxury homes were reported as seeing only very modest growth. Home improvement projects—both additions and alteration projects, and kitchen and bath remodels—were reported to be seeing healthy growth. However, the pace of growth for both of these categories was slower than was reported a year ago.

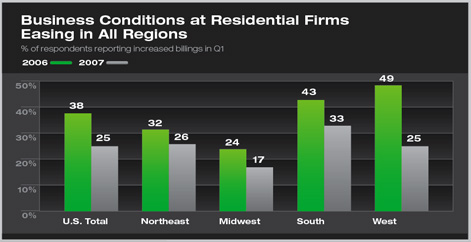

Residential architecture firms in all regions of the country were reporting softening business conditions. In the Midwest in particular, many more firms were reporting declining levels of billings (26 percent) as compared to those reporting increases (17 percent). In the Northeast, the shares were much closer—28 percent reported declines while 26 percent reported increases. Firms in the South and West reported somewhat stronger conditions. In both regions, a higher share of firms were reporting gains (33 percent in the South, 25 percent in the West) than were reporting declines (26 percent in the South, 15 percent in the West).

|

||

Copyright 2007 The American Institute of Architects. All rights reserved. Home Page |

||

home

news headlines

practice

business

design

recent related

› Homeowners Looking for Greater Accessibility to Services and More Mixed Uses in Communities and Neighborhoods

› High Energy Costs Inspire New Features in Homes

› “Bigger Is Better” No Longer Ruling Home Design

› Residential Architects Report Strong Design Focus on Kitchens and Baths

Bigger no longer better

Bigger no longer better

Further slide in business conditions

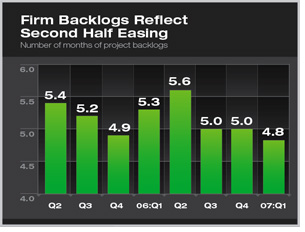

Further slide in business conditions A more telling sign of current conditions may be shrinking project backlogs. Backlogs—the amount of work currently under contract—stood at 4.8 months for the first quarter, down from 5.0 months in the fourth quarter of 2006, and the lowest level since the AIA home design trends survey began in early 2005.

A more telling sign of current conditions may be shrinking project backlogs. Backlogs—the amount of work currently under contract—stood at 4.8 months for the first quarter, down from 5.0 months in the fourth quarter of 2006, and the lowest level since the AIA home design trends survey began in early 2005.