economics

Homeowners Looking for Greater Accessibility to Services and More Mixed Uses in Communities and Neighborhoods

Housing construction slowdown continues according to residential architects, but high equity levels keep home improvement activity strong

by Kermit Baker, PhD, Hon. AIA

AIA Chief Economist

Summary: Community design trends are moving toward greater accessibility to public facilities, such as transportation and commercial activities. Neighborhood design trends favor more mixed-use activities with infill and other higher-density development, and with dedicated areas for recreation and open space. Traditional design of neighborhoods and homes with upscale exteriors, and windows and porches to encourage more street-level interaction, also are gaining popularity according to the AIA’s Home Design Trends Survey focusing on community and neighborhood design issues.

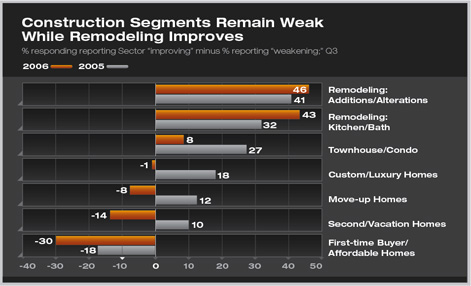

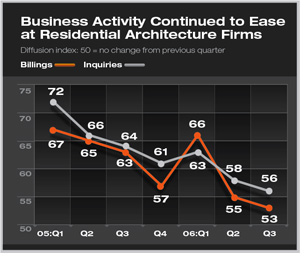

From a business perspective, residential architects are reporting a continued slowing of business conditions, with an even greater easing of inquiries for new work pointing to further slowdown in residential design activity in the quarters ahead. The softening is greater for affordable entry-level homes owing to growing housing affordability concerns, but virtually all new residential construction sectors are reported as weakening. In contrast, homeowners are still investing in their current homes. Kitchen and bath remodeling projects as well as additions and alterations are reported by residential architects as very strong.

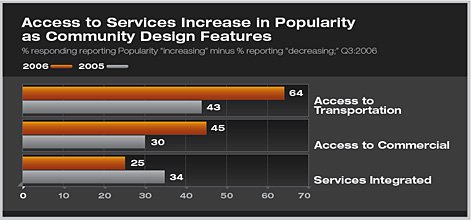

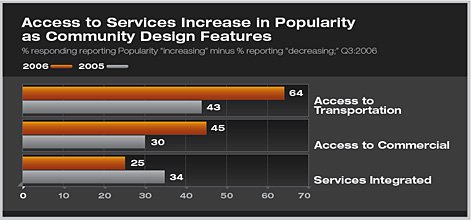

Community design favors accessibility

Access to public transportation, and alternative transportation systems,

such as bikeways and walkways, as well as access to commercial

facilities, were both reported as increasing in popularity as community

design elements by a large share of residential architects. Higher

gasoline prices have made travel for routine activities more expensive,

so preferences for greater accessibility may be partially in response

to resistance to long drives. More services integrated into development—such

as health care and convenience stores—is still seen as increasing

in popularity, although by a smaller margin than a year ago.

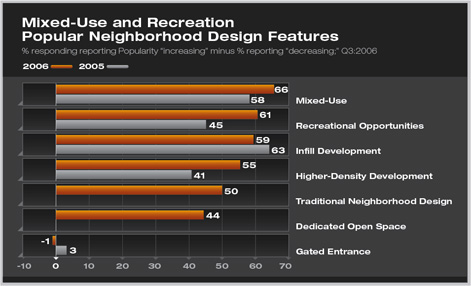

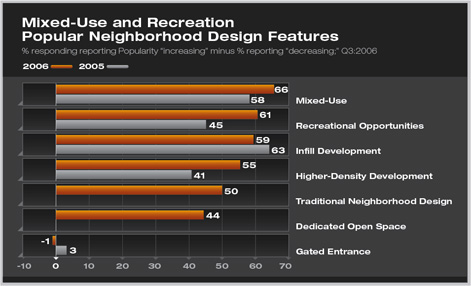

Neighborhood design favors multiple uses and greater densities

In creating greater accessibility to services within their communities,

residential architects also report more integration of uses, growing

densities, and the addition of non-housing activities within neighborhoods.

Almost 70 percent of residential architects report an increase

in mixed-use facilities, often combining residential with retail,

office, or service uses. Infill development and higher-density

development were also seen as generally increasing trends in neighborhoods.

While density is increasing, there is a corresponding growing popularity

for recreational opportunities, such as walking trails or exercise

centers, as well as dedicated open space to help offset some

of the density in development. Traditional neighborhood design—with

homes closer to the street, front porches for more neighborhood

interaction, and smaller lots—also is increasing in popularity.

With greater preferences for interaction, mixed uses, and accessibility,

it’s not surprising that gated entrances are declining in

popularity.

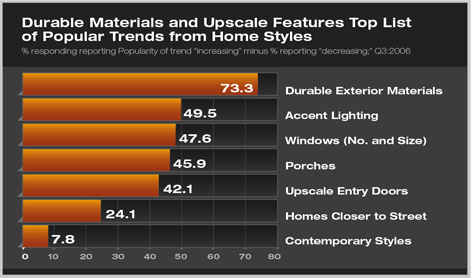

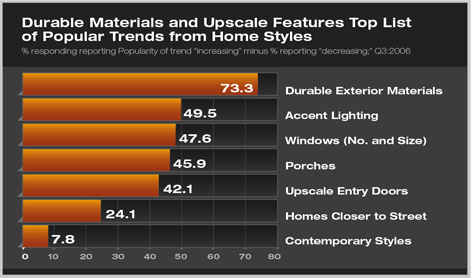

Upscale features popular for home exteriors

More durable and upscale exterior materials such as fiber-cement, stone, and tile are increasing in popularity according to more than three-quarters of residential architects as determined by questions on home styles that were added to this survey. Exterior accent lighting, the number and size of windows, front and side porches, and upscale entry doors were all reported to be increasing in popularity by about half of residential architects. Homes located closer to the street were seen to be increasing in popularity by a much smaller portion. Given the growing interest in traditional neighborhood design, the limited popularity of contemporary styles for home exteriors is not a surprise.

Business conditions continue to ease at firms Business conditions continue to ease at firms

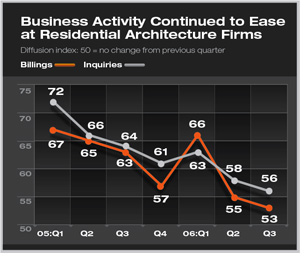

The slowdown in the broader housing market continues to be felt at residential design firms. Billings at firms in the third quarter increased only modestly, as fewer than 30 percent of firms reported an increase over the second quarter, while 17 percent reported a decline. The remaining 54 percent indicated that billings were largely unchanged. Inquiries for new projects are weaker than billings, indicating that the residential design market has likely not hit bottom yet. When it occurs, an increase in inquiries should signal a turnaround in residential design activity. Inquiries were well below the levels of a year ago.

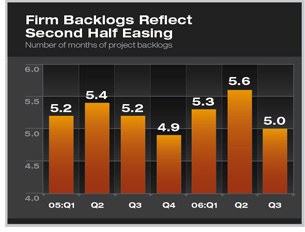

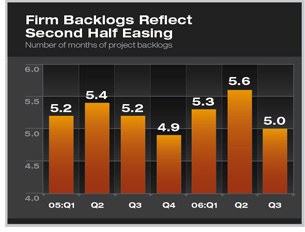

Indicative of the weakness in the residential sector is the decline in project backlogs in the third quarter. Backlog measures the volume of design work under contract in terms of the amount of time current staff is covered by these projects. While backlogs increased during the first and second quarters of this year, it appears that this may have been normal seasonal variation in project activity. Backlogs in the third quarter this year are below the levels of a year ago. Indicative of the weakness in the residential sector is the decline in project backlogs in the third quarter. Backlog measures the volume of design work under contract in terms of the amount of time current staff is covered by these projects. While backlogs increased during the first and second quarters of this year, it appears that this may have been normal seasonal variation in project activity. Backlogs in the third quarter this year are below the levels of a year ago.

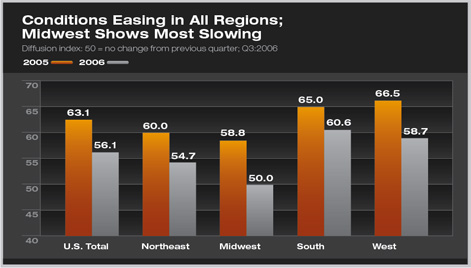

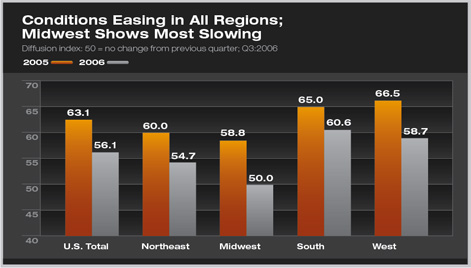

The slowdown in residential design activity is affecting firms in all regions of the country. Billings scores dropped significantly in all regions from a year ago, with the greatest declines in scores occurring at firms in the Midwest and West. Billings at firms in the West were the strongest a year ago, so even with the above-average drop, these firms are reporting reasonably healthy conditions. Firms in the Midwest, however, were reporting the weakest conditions a year ago.

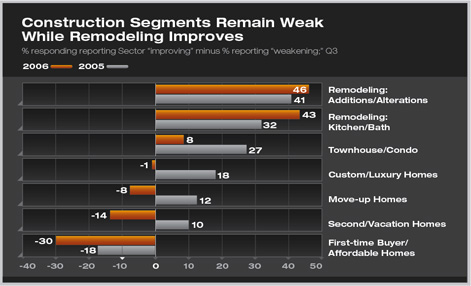

While remodeling remains strong, most new construction sectors still weakening

The residential downturn is expanding. A year ago, only affordable homes designed for first-time home buyers were reported as weakening. Since then the weakness has spread, with widespread softness reported in the construction of second and vacation homes, “move-up” homes (designed for households trading-up out of their current home to a more expensive home), and even custom/luxury homes at the top of the market. The only construction category reporting some overall improvement is the townhouse/condo sector, and the strength of that house type varies considerably from area to area. In fact, given the softness of for-sale homes in many markets, there are increasing reports of units designed as condos being converted to rental units.

Even with the weakness in residential construction, remodeling activity remains strong. About half of residential architects report remodeling to be strengthening in the markets that they serve, while fewer than 10 percent report weakening conditions. These assessments of market strength are up from a year ago.

While remodeling activity typically is less volatile than new construction, a difference with this cycle is that most homeowners have built up a lot of equity in their home that can be used to finance home improvement projects. Even with house prices softening in many markets, the more than 50 percent increase in house prices nationally over the past five years gives owners the ability as well as incentive to reinvest in their homes.

|

Business conditions continue to ease at firms

Business conditions continue to ease at firms Indicative of the weakness in the residential sector is the decline in project backlogs in the third quarter. Backlog measures the volume of design work under contract in terms of the amount of time current staff is covered by these projects. While backlogs increased during the first and second quarters of this year, it appears that this may have been normal seasonal variation in project activity. Backlogs in the third quarter this year are below the levels of a year ago.

Indicative of the weakness in the residential sector is the decline in project backlogs in the third quarter. Backlog measures the volume of design work under contract in terms of the amount of time current staff is covered by these projects. While backlogs increased during the first and second quarters of this year, it appears that this may have been normal seasonal variation in project activity. Backlogs in the third quarter this year are below the levels of a year ago.