|

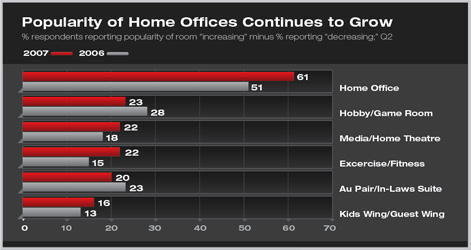

As Home Energy Costs Remain High, Residential Architects Report That Sustainable Design Motivates Homeowners Affordability problems drag down first-time buyer market; home improvement activity remains strong Summary: Energy conservation features top the list of homeowner priorities when selecting housing design features. General interest in sustainable “green” features is on the rise, while home features and products that promote accessibility around the home continue to capture homeowner interest. Home offices remain the most popular special function room. Overall, residential market conditions continue to deteriorate nationally. The greatest declines over the past year are reported by residential architects in the Midwest, while those in the Northeast report some improvement. The steepest market declines have come from more affordable homes targeted for first-time buyers. There has been some firming in market conditions in the custom/luxury market, while home remodeling activity remains relatively strong in spite of the broader weakness in home building. These are some of the key findings from the AIA Home Design Trends Survey for the second quarter of 2007. This survey of residential architects looked at home features growing in popularity among homebuyers including special function rooms, emerging systems and technologies, and types of products that homeowners are looking for in their homes. Home offices continue in popularity

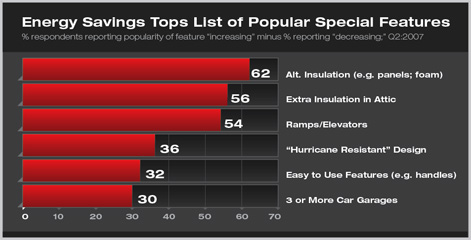

Homeowners respond to higher home energy costs Adding ramps or elevators to homes is also a popular feature, with more than 55 percent of respondents indicating increasing activity, and few noting a decline. Reflecting an aging population, interest in ramps and elevators grew fairly significantly over the past year, while the popularity of easy-to-use features (e.g. handles, faucets) held constant. “Hurricane resistant” designs for homes remained popular in 2007, in spite of a relatively mild hurricane season in 2006.

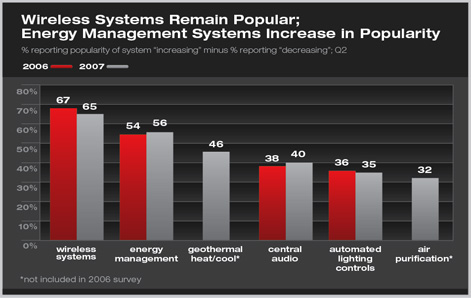

Homeowner interest in managing home energy costs is apparent in the systems they are installing in their homes. Although wireless systems remain the most popular, energy management systems and geothermal heating/cooling systems (e.g., heat pumps) were rated as increasing in popularity by most respondents. Wireless and central audio systems no doubt are growing in popularity in conjunction with home offices and media rooms and home theaters. Automated lighting controls—also a means of managing home energy costs—continue to be a popular option for homeowners.

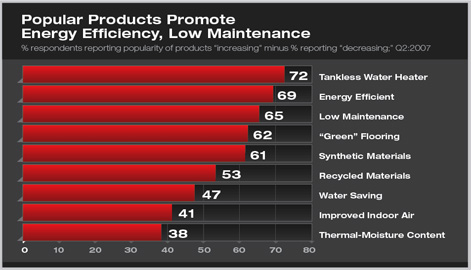

The interest in managing home energy costs also influences popular products that homeowners are selecting for their homes. Tankless hot water heaters topped the list, with almost three-quarters of respondents indicating that these were growing in popularity, up significantly from a year ago. However, other “green” products not related to home energy conservation also are growing in popularity. “Green” flooring products (e.g. bamboo, cork) were reported as increasing in popularity by almost 65 percent of respondents, while fewer than 3 percent reported their popularity to be declining. Likewise, reclaimed and salvaged products were reported as increasing in popularity, as were water saving products. Indoor air quality and mold reduction continue to capture homeowner interest, as products oriented to these concerns had composite scores of around 40.

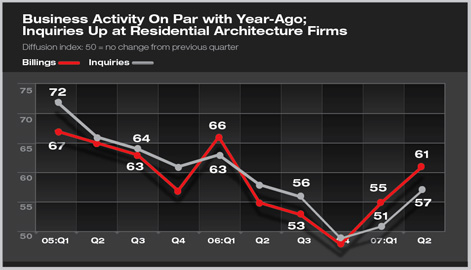

Conditions in the residential market continue to weaken

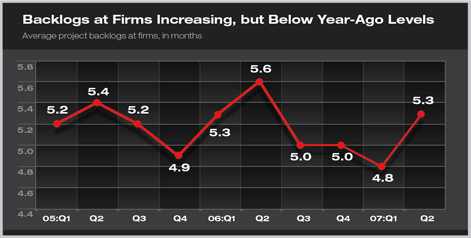

Business backlogs—the amount of work at a firm currently under contract—generally reflect the broader business trends at residential architecture firms. Firms report that on average they have enough work at present to keep their staff fully employed for 5.3 months, which is up from levels of the past three quarters, but down from levels of a year ago. Backlogs generally increase in the second quarter, probably reflecting the general increase in residential construction workloads that quarter, but are not significantly below the second quarter levels of 2005 and 2006.

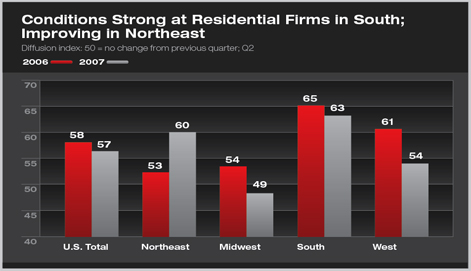

With overall business conditions for residential architects generally comparable to a year ago, there have been some regional changes. Residential architects in the Northeast report healthy conditions that have improved over the past year. Those in the South report healthy conditions that have remained essentially stable, while architects in the West report conditions that have moderated somewhat over the past year. Residential architects in the Midwest have seen conditions weaken recently, and are reporting conditions weaker in the second quarter of this year than they were in the first quarter, a period when conditions normally improve because of seasonal patterns, even if the underlying market is stable.

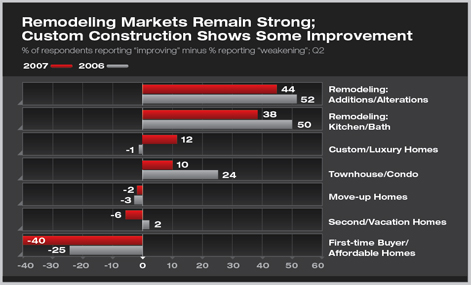

Home improvement activity holds strong, affordable market weakens Custom and luxury homes, in addition to townhouse and condo construction projects are sectors going though the greatest transition at present. Residential architects were reporting a modest decline in custom and luxury home activity a year ago, but the second quarter survey indicates some improvement among these types of homes. Townhouse and condo activity is moving the opposite direction. A year ago, this sector was reported as seeing reasonably strong growth, but the second quarter 2007 numbers show that that growth has slowed significantly.

Finally, the traditional heart of the home-building market—homes targeted for first-time buyers and trade-up buyers—as well as second homes and vacation homes, all are reported as weakening with the second quarter survey. The decline in the move-up and second/vacation home sectors is reported as reasonably modest. However, the traditional entry-level sector continues to weaken significantly. This situation bodes ill for the broader housing market, since these buyers generally eventually propel activity in other sectors as well.

|

||

Copyright 2007 The American Institute of Architects. All rights reserved. Home Page |

||

news headlines

practice

business

design

Recent related

› As Housing Markets Correct, Owners Looking for Less Space but Greater Accessibility, More Flexibility in Home Designs

› Homeowners Looking for Greater Accessibility to Services and More Mixed Uses in Communities and Neighborhoods

› High Energy Costs Inspire New Features in Homes

› “Bigger Is Better” No Longer Ruling Home Design

The AIA Home Design Trends Survey is conducted quarterly by the AIA. Because residential architects are design leaders in shaping how homes function, look, and integrate into communities, this survey helps to identify emerging trends in the residential marketplace. It also monitors business conditions at residential architecture firms. For more information on this survey, contact Scott Frank, director of AIA media relations.