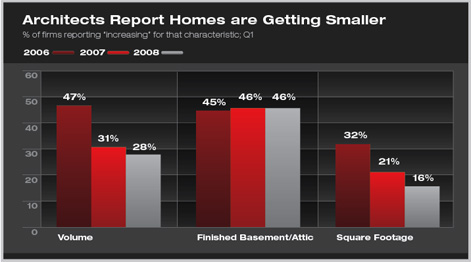

| As Housing Market Weakens, Homes Are Getting Smaller Outdoor living growing in popularity as homeowners improve their properties, even as lot sizes shrink Summary: The downturn in the housing market, coupled with changing lifestyles, has produced a decline in the size of a typical home. Greater accessibility within the home to accommodate an aging population, as well as easier access entering and exiting the home, have become key home design considerations. Households also are increasing their outdoor living options and looking for low-maintenance landscaping as they improve their properties. Finally, business conditions at residential architecture firms remain very depressed, as architects report declining market conditions for all types of new homes. Improvements to existing homes, in contrast, remain much healthier. These are some of the key findings from the AIA’s Home Design Trends Survey for the first quarter of 2008. Key characteristics of the American home continue to evolve, in part because of a dramatic slowdown in the housing industry, in part because emerging weakness in the national economy, in part because of demographic changes in our population, and in part because of the growing awareness of sustainable design principles. One obvious sign of the changing characteristics of homes is their size. According to government figures, the average size of a new home has increased almost 50 percent over the past three decades. As recently as 2006, almost twice as many residential architects participating in the AIA Home Design Trends Survey reported home sizes to be increasing as reported them to be decreasing. By 2007, that trend had reversed, as more residential architects reported home sizes to be decreasing than increasing. With the 2008 survey, more than twice as many respondents reported home size declines as reported increases (33.5 percent vs. 15.5 percent). Trends are similar, although less pronounced, for the volume of homes (e.g., higher ceiling heights, two-story foyers). In our 2005 survey, most (51 percent) residential architects reported that the volume of homes was increasing, where only a small minority (4 percent) reported them to be declining. By 2008, with growing concerns over housing affordability as well as dramatically higher home energy prices that increase the cost of heating these larger spaces, this gap had narrowed significantly: 28 percent of respondents reported the volume of homes to be increasing, while 12 percent reported them to be declining.

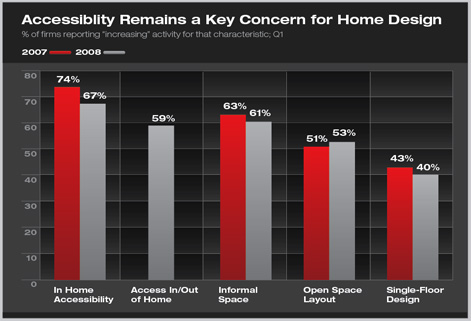

Accessibility and informality remain in the forefront of home design Coupled with the emphasis on accessibility to accommodate an aging population is the continued emphasis on increased informal space in the home and in an open space layout with flexible floor plans. With lifestyles adapting and household compositions changing, households are looking for greater flexibility in the use of space in their homes. As an example, a substantial portion of residential architects (29 percent) note the increased popularity of partial wall divisions (as opposed to floor-to-ceiling walls) to promote greater flexibility in the use of interior space.

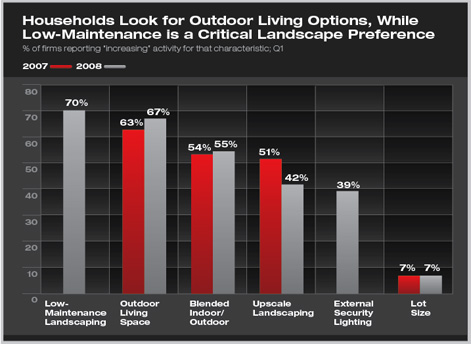

Homeowner improvements move outside Related to outdoor living is the growing interest in blended indoor/outdoor space, as well as outdoor features and amenities (e.g., courtyards, outdoor fireplaces, gazebos, swimming pools). As households place greater emphasis on using their properties, they also are looking for home designs that blur the boundaries between indoor and outdoor features. Investment in upscale landscaping also continues to be a popular option. Increasingly, though, residential architects report growing interest in keeping landscaping as low-maintenance, both due to busy schedules as well as the “green” aspects of reducing water use on landscaping. Exterior lighting, both for aesthetics as well as security considerations, is growing in popularity. Although a significant share (32 percent) of residential architects reports growing interest in exterior decorative water features, an almost equal share (25 percent) reports this to be a decreasing trend, no doubt because of growing concern over water conservation in certain parts of the country.

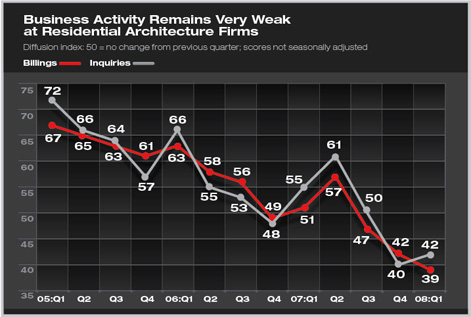

Business conditions deteriorate in the residential market

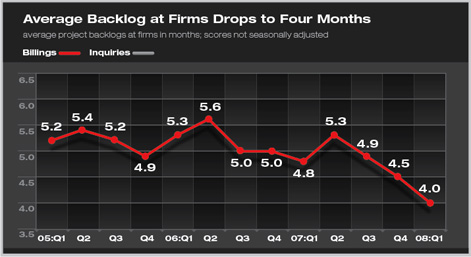

As further evidence of weak market conditions, project backlogs also are declining. Defined as the amount of work currently under contract, backlogs are currently running at 4 months, down from 4.8 months a year ago, and 5.3 months two years ago.

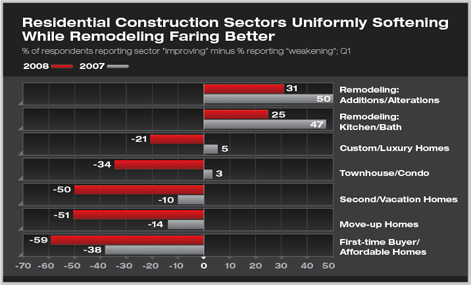

In spite of weakness in the overall residential activity, some sectors are doing better than others. Affordable homes aimed at first-time home buyers continue to be the weakest housing sector. The share of residential architects who indicate that this sector is weakening increased from 24 percent in 2005 to 68 percent with the current survey, as credit restrictions and foreclosures have reduced the number of households looking to purchase homes. Other new residential construction sectors are seeing significant weakness as problems cascade through the housing market. Move-up homes (oriented for households who want to trade up to a nicer home), as well as second homes and vacation homes are reported to be seeing weakening market conditions according to residential architects. Townhouse and condo units, as well as upper-end custom and luxury homes, which were seeing modestly positive conditions a year ago, are both seeing weakening conditions now, according to residential architects. While credit market restrictions have limited home sales, households looking to improve their current homes are still active. Residential architects report that kitchen and bathroom remodeling projects, as well as additions and structural alterations to homes, are still seeing improving levels of activity in many markets, although these activities are not as vibrant as they were a year ago.

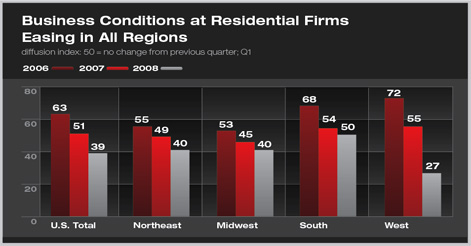

No regions have been spared from the weakness in residential activity. The decline has been the steepest in the West, where residential architects were reporting very strong conditions two years ago, and even reasonably healthy conditions as of the first quarter of 2007. Currently, over half of residential architects in this region are reporting declines, and only 6 percent are reporting gains. Respondents in the Northeast and Midwest have reported similar trends, from reasonably solid conditions two years ago to modest declines last year to steeper declines at present. Firms in the South have seen business conditions hold up the best. Like firms in the West, business conditions in the South were very strong two years ago and quite healthy last year. Currently, conditions are essentially stable, with as many residential architects reporting improvements as are reporting weakening conditions.

|

||

Copyright 2008 The American Institute of Architects. All rights reserved. Home Page |

||

news headlines

practice

business

design

Recent Related

› Kitchens and Baths Continue as Focus of Design Activity in Homes, Even as Residential Markets Remain Very Weak

› Households Look for More Activities Integrated into Their Communities

› As Home Energy Costs Remain High, Residential Architects Report That Sustainable Design Motivates Homeowners

› As Housing Markets Correct, Owners Looking for Less Space but Greater Accessibility, More Flexibility in Home Designs

› Homeowners Looking for Greater Accessibility to Services and More Mixed Uses in Communities and Neighborhoods

› High Energy Costs Inspire New Features in Homes

› “Bigger Is Better” No Longer Ruling Home Design

The AIA Home Design Trends Survey is conducted quarterly by the AIA. Because residential architects are design leaders in shaping how homes function, look, and integrate into communities, this survey helps to identify emerging trends in the residential marketplace. It also monitors business conditions at residential architecture firms. For more information on this survey, contact Scott Frank, director of AIA media relations.