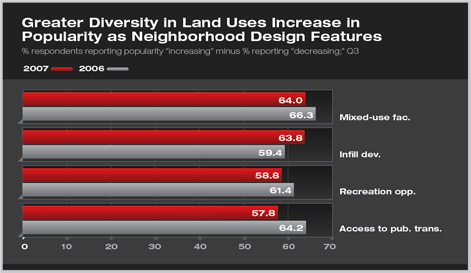

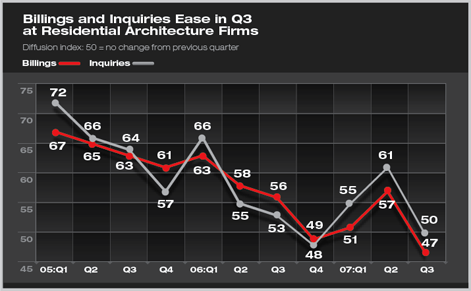

AIA HOME TRENDS DESIGN SURVEY: THIRD QUARTER by Kermit Baker, PhD, Hon. AIA Summary: With rising energy costs and longer commutes, community and neighborhood design trends are favoring greater diversity of land uses and increased accessibility to transportation and commercial opportunities. Homes are being designed to encourage more neighborhood interaction. Households are favoring exterior materials that require less maintenance, as well as those that have sustainable characteristics. These are some of the key findings of a recent AIA survey of home design trends dealing with community and neighborhood design issues. With the overall weakness in the housing industry, residential architects are reporting declining business levels. Particularly hard hit are speculative home building projects, as custom home building has stabilized, while improvements to existing homes are generally showing healthy conditions. Growing popularity of mixed-use facilities and infill projects as owners look for greater access

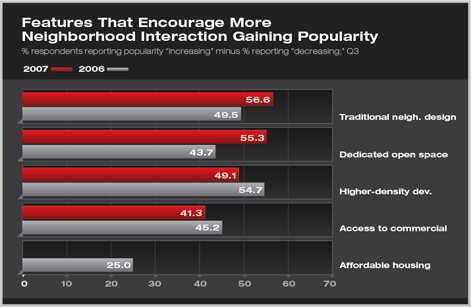

Additionally, households are looking for communities that offer more recreational opportunities integrated into the development, and better access to public transportation opportunities and alternative transportation systems, such as bikeways and walkways. Traditional neighborhood design—with smaller lots where homes are close to the street and typically emphasize porches and sidewalks—is also growing in popularity. With these smaller lots, there is growing interest in having more communal open space available. Providing affordable housing in developments, where costs may be subsidized by the market-rate housing provided, was reported as having mixed popularity.

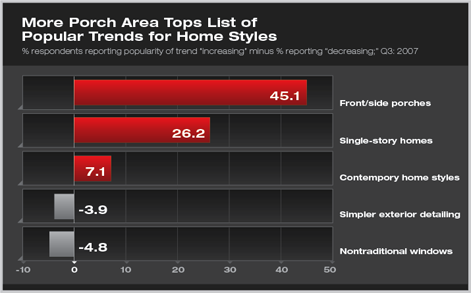

Traditional design with a low maintenance twist

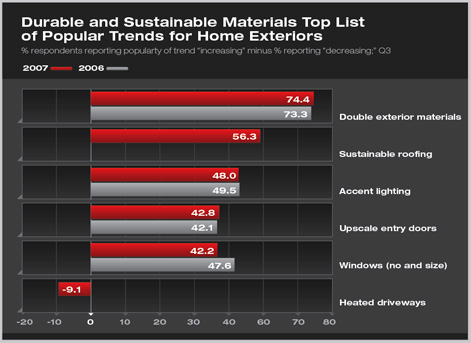

Along with the preference of traditional home designs is the growing popularity of durability and low maintenance in exterior materials. Over three-quarters of residential architects surveyed (78 percent) indicated an increased popularly of low maintenance exterior materials (e.g. fiber-cement, stone, tile, natural earth plasters), while fewer than 4 percent reported a decrease in the use of these materials. Many also noted an increase in the use of sustainable roofing materials.

Despite the downturn in the housing market, there continues to be strong interest in selected upscale exterior products. Both exterior accent lighting and upscale entry doors were seen as increasing in popularity by close to half of residential architects. However, there are limits to homeowners’ interest in upscale features: heated driveways have limited interest, with more residential architects reporting them to be declining in popularly as are reporting their popularity to be growing. Business conditions deteriorate in the residential market

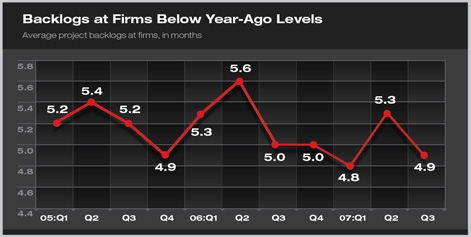

Backlogs at residential architecture firms—defined as the time that current staff can be fully occupied with current projects—have also declined with the housing downturn. Firms are currently reporting backlogs of 4.9 months, down from 5.0 months a year ago, and 5.2 months two years ago. At present, 10 percent of firms have less than one month of project backlogs, while an additional 32 percent have a least a month, but less than three months.

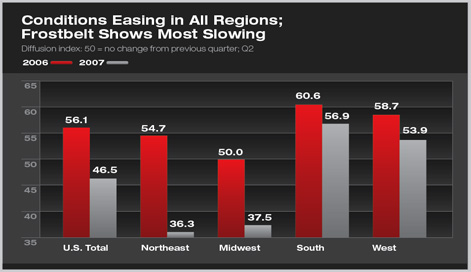

Residential architecture firms in all regions of the country are reporting softer business conditions, but firms in the Northeast and Midwest have reported the greatest declines. Only 10 percent of firms in the Northeast and 13 percent in the Midwest reported increased billings in the third quarter, while about 38 percent in each region reported a decline. As a result, the billings score for firms in the Northeast was 36.3 and 37.5 for firms in the Midwest. Both of these figures are well below year-ago levels. However, firms in the South and West are reporting reasonable healthy conditions. In both regions, more firms are reporting increased billings as are reporting declines. Also, firms in both regions are reporting smaller declines in their billings index than are firms in the Northeast and Midwest.

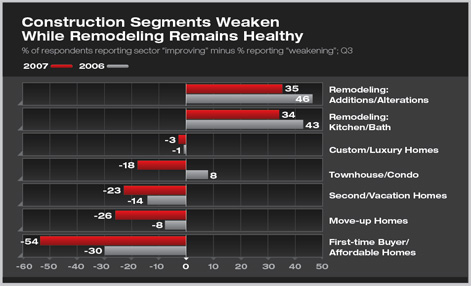

The weakness in business conditions in the residential sector varies considerably by type of project. While residential architects report softer conditions compared to a year ago for all types of projects, some are much weaker than others. For example, about 44 percent of residential architects with projects in the remodeling markets (either additions and major structural alterations, or kitchen and bath remodeling) report improving conditions, while fewer than 10 percent report that conditions are weakening. Those that report improving or weakening conditions are about balanced in the custom/luxury home construction market. For all other types of residential construction, the consensus of residential architects is that market conditions are weakening. For entry-level homes—targeted for first-time buyers—only 4 percent of respondents felt that conditions are improving, while 58 percent felt them to be weakening.

|

||

Copyright 2007 The American Institute of Architects. All rights reserved. Home Page |

||

home

news headlines

practice

business

design

recent related

› As Home Energy Costs Remain High, Residential Architects Report That Sustainable Design Motivates Homeowners

› As Housing Markets Correct, Owners Looking for Less Space but Greater Accessibility, More Flexibility in Home Designs

› Homeowners Looking for Greater Accessibility to Services and More Mixed Uses in Communities and Neighborhoods

› High Energy Costs Inspire New Features in Homes

› “Bigger Is Better” No Longer Ruling Home Design

The AIA Home Design Trends Survey is conducted quarterly by the AIA. Because residential architects are design leaders in shaping how homes function, look, and integrate into communities, this survey helps to identify emerging trends in the residential marketplace. It also monitors business conditions at residential architecture firms. For more information on this survey, contact Scott Frank, director of AIA media relations.