Residential Architects Report that Popular Home Features Focus on Energy Conservation and Accessibility

Business conditions continue to deteriorate at residential architecture firms, with significant downturns in all major construction sectors

by Kermit Baker, PhD, Hon. AIA

Chief Economist

Summary: With the housing market very weak and home energy costs remaining above normal levels, sustainable design features—with a particular focus on energy management and conservation—are the home features growing the most in popularity. Households are looking for new home insulation technologies, while interest in alternative energy generation techniques and energy management systems is growing. Key energy-efficient products are almost universally seen as growing in popularity. With less focus on increasing the size of homes, special function rooms are waning in popularity.

Business conditions are deteriorating at architecture firms, with projects billings, new project inquiries, and project backlogs all showing declines. All major residential construction sectors are reported as weakening, with the townhouse and condo, and custom and luxury markets showing sharp reversals from a year ago. The home improvement market is still showing some gains for many residential architects.

These are some of the key findings from the AIA Home Design Trends Survey for the second quarter of 2008. This survey of residential architects covered home features including special function rooms, special features, systems and technologies in homes, and the types of products that households are looking for in their homes from the perspective of which are gaining in popularity at present, and which are not.

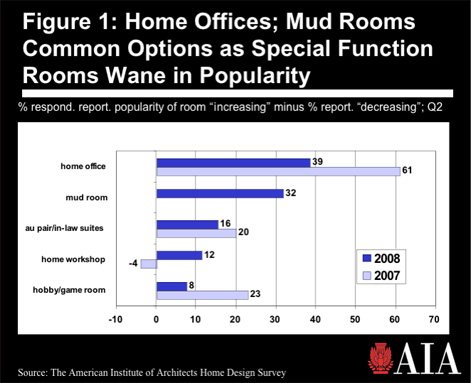

Special function rooms less popular

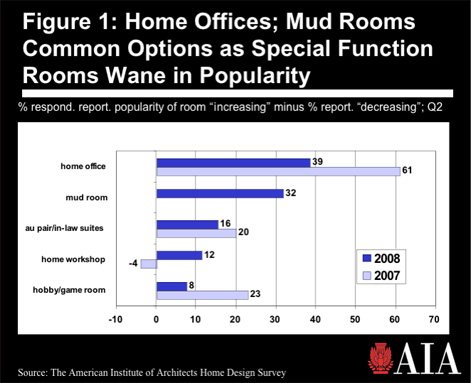

With the recent reported easing of size of homes, residential architects also are seeing less interest in special function rooms in homes. Home offices continue to be the most popular special function room, but they have become decidedly less popular than in recent years. In the AIA’s second quarter 2008 Home Design Trends Survey, 41 percent of respondents indicated that home offices were increasing in popularity, with only 2 percent reporting declining popularity, thereby producing a net score of 39. In the 2007 survey, 61 percent of respondents indicated growing interest in home offices, with none reporting declining interest.

Likewise, interest in other special function rooms seems to be waning. While consumer interest in mud rooms is relatively strong (this room was not included in the 2007 survey), other rooms are seeing only moderate levels of interest. For au pair/in-law suites and hobby/game rooms, consumer interest is below levels of a year ago.

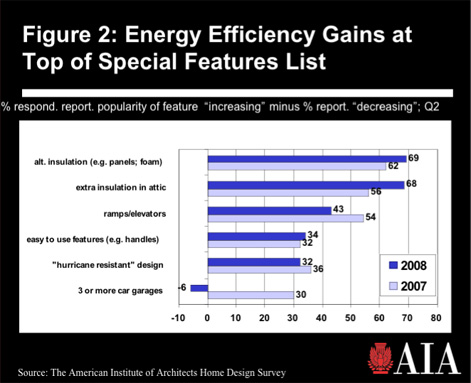

Energy efficiency leads movement toward sustainability

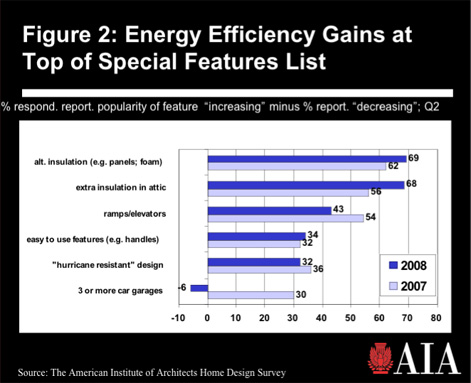

Energy conservation is often the motivation behind popular special features in homes. Alternative home insulation techniques—such as structural insulation panels or sprayed foam insulation—and extra insulation in the attic overwhelmingly are viewed as increasing in popularity. Both features have become more popular over the past year, according to residential architects.

Features promoting greater levels of accessibility around the home also are popular. Ramps and elevators for easier mobility, and easy-to-use features such as handles and faucets also have maintained their popularity. Ongoing threats from hurricanes in coastal regions continue to generate interest in “hurricane resistant” design.

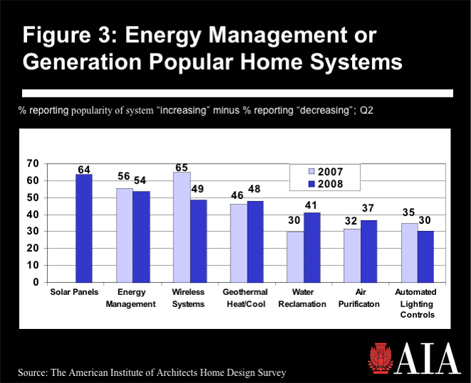

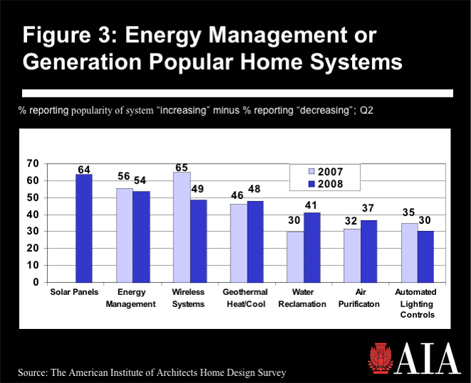

Just as energy conservation is the dominant motivation behind the most popular special features in homes, energy management and other “green” objectives are the dominant motivation behind popular systems and technology in homes. Solar panels/photovoltaics (or other alternative energy generation systems) are the most popular system or technology selected from those listed, followed by energy management systems. Although wireless telecommunications and data systems continue to gain ground, other systems and technologies noted as popular tend to have “green” features, such as geothermal heating or cooling, water reclamation (such as cisterns), or air purification systems.

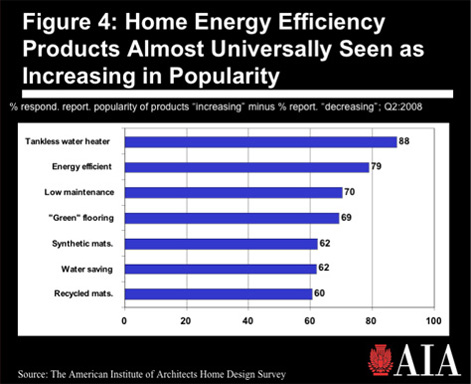

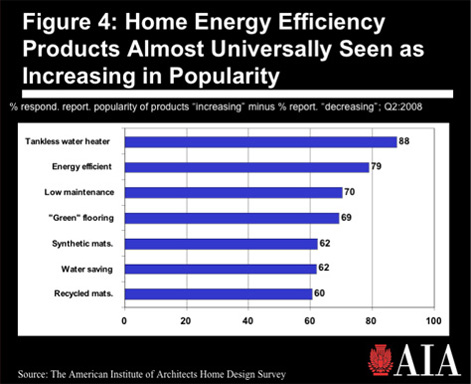

Finally, many of the products growing in popularity for residential use also have energy conservation or other “green” characteristics. Almost all (88 percent) of respondents saw tankless water heaters as growing in popularity, and 79 percent reported that energy-efficient products or materials, such as double- or triple-glazed windows, also were becoming more popular. Low maintenance materials and sustainable flooring products, such as bamboo and cork, were mentioned as gaining traction by more than two-thirds of respondents. Synthetic or engineered materials (for such areas as countertops, flooring, siding, trim, or decking), water- saving or -conserving devices, and the use of reclaimed or salvaged materials also are seen as increasing in popularity by at least 60 percent of respondents.

Business conditions deteriorate for residential architects

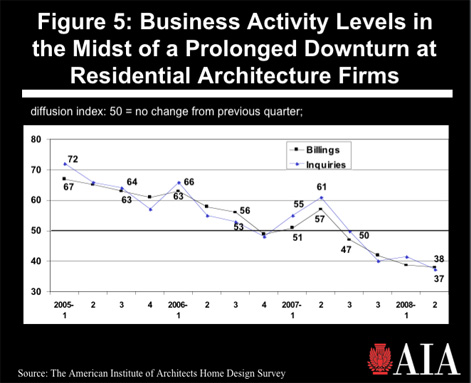

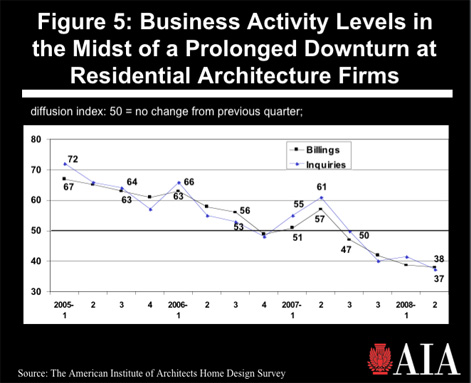

The prolonged slowdown in the housing market is causing weak business conditions at architecture firms nationally. The national billings index was 38 for the second quarter (any score below 50 indicates declining levels of activity), the lowest recorded score in the three and one-half year history of the AIA Home Design Trends Survey. Inquires for new work, with a score of 37, was also at an all-time low for the survey. With project inquiries falling off so dramatically, it is unlikely that billings will recover anytime soon.

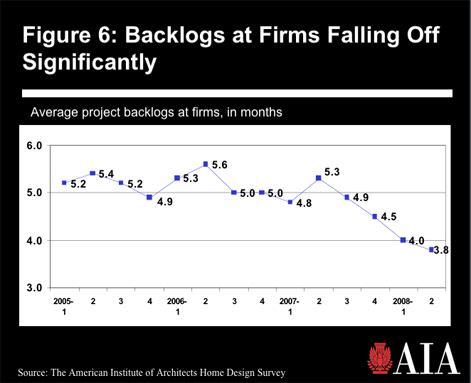

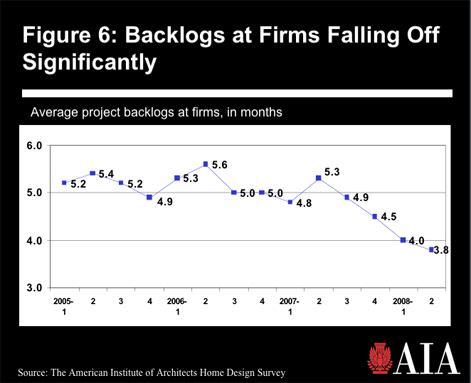

With the decline in billings and inquiries, project backlogs also are falling. Project backlogs—the amount of project work currently under contract—typically have averaged about 5 months for residential architecture firms, meaning that firms could maintain their staff for 5 months at current billings levels on average without new projects. However, firm backlogs have been steadily falling for more than a year, and current backlogs are averaging 3.8 months, down from 5.3 months a year ago.

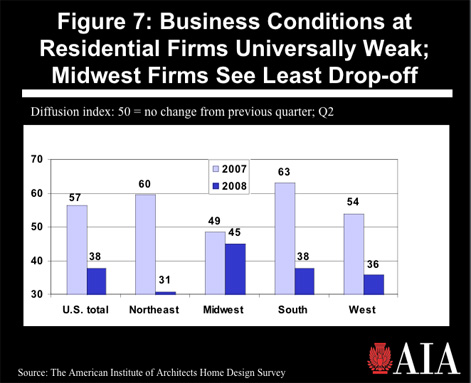

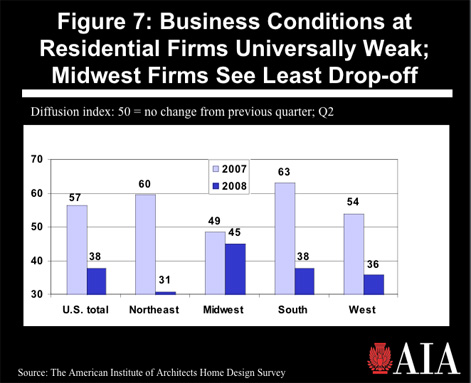

With billings down by such a significant extent nationally, it’s not surprising that firms in all regions are feeling weak business conditions. The greatest declines have come from firms in the Northeast, and firms in the West and South have also reported steep declines in business levels over the past year. Firms in the Midwest, which were reporting the weakest conditions a year ago, seem to be nearing the bottom of their downturn. Business conditions in the second quarter weakened only slightly from first quarter levels. Since firms in the Midwest were the first to see a downturn in residential design activity, it would not be unusual for them to be the first to see a recovery also.

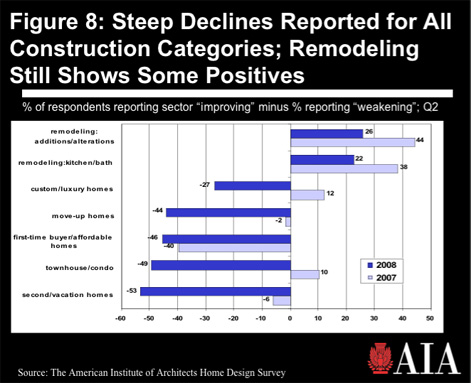

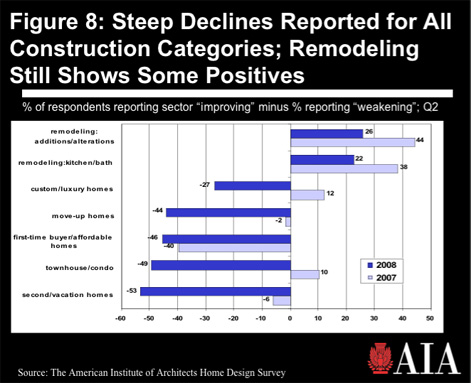

The downturn in residential construction has now hit all construction sectors. As recently as a year ago, residential architects were reporting modest gains in custom and luxury homes as well as in townhouses and condos. Move-up homes and second/vacation homes were seeing only modest declines.

However, current conditions have deteriorated significantly for most residential construction sectors. Second and vacation homes, townhouses and condos, trade-up homes, and custom and luxury homes have all joined entry-level/first-time buyer homes as showing significant declines between the first and second quarters of 2008. The only residential sectors that are deemed to be improving on net—even slightly—are additions and alterations to existing homes, and kitchen and bath remodels.

|