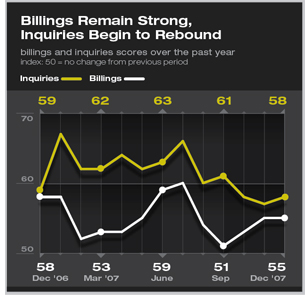

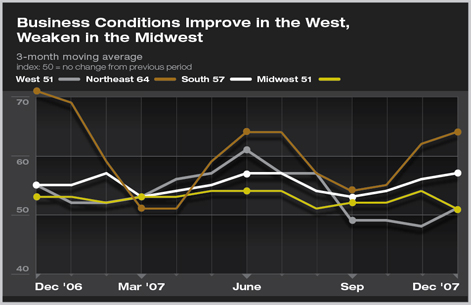

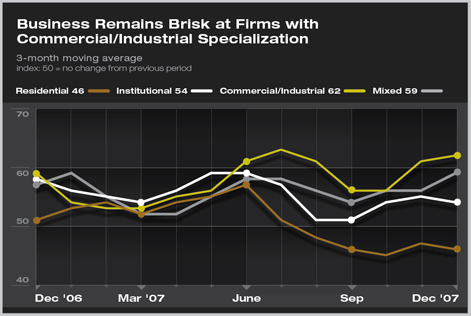

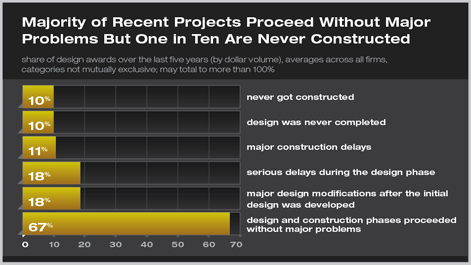

| work-on-the-boards Billings, Inquiries End the Year on an Uptick Most jobs complete design, construction phases without serious problems Summary: Business conditions at architecture firms remained strong in December, and inquiries began to rebound after slowing in the late fall. Billings growth resumed in the West after recent declines, and commercial/industrial firms continued to report the strongest billings by sector. Considering projects that had been worked on over the past five years, firms reported that 67 percent of design awards (by dollar volume) were for projects for which the design and construction phases proceeded without major problems.

Business conditions in the West improved in December, after declining for the three previous months. Billings growth continued to accelerate in the South and Northeast, with scores in the Northeast climbing to their highest point since mid-summer. The pace of growth slowed somewhat in the Midwest after a slight uptick in November, revealing signs of a sustained period of weakness. Firms with a commercial/industrial specialization continue to report the strongest business conditions, with billings climbing to the second highest score of the year (in fact the second highest of all time). Billings growth continued at a moderate pace for firms with an institutional specialization, and firms with a residential practice reported the fifth month in a row of declining billings.

Nonresidential construction leads last-quarter growth On the other hand, December’s employment situation was bleak, with just 18,000 total jobs added. The construction sector alone shed nearly 50,000 jobs. The total number of new jobs added in 2007 was just 1.3 million, down from 2.3 million in 2006. In addition, the unemployment rate in December rose sharply, to 5.0 percent.

Two-thirds of projects have no serious design/construction problems

Firms specializing in residential design reported a smaller share of projects that proceeded with no major problems (60 percent), compared to firms with a commercial/industrial or institutional specialization (70 percent and 68 percent respectively). Residential firms also reported that a much higher share of their projects never got past the design phase—or were never constructed— than other types of firms. Firms with annual billings under $1 million also were more likely to have projects that were never built than larger firms (15 percent versus 8 percent). The largest firms, with annual billings over $5 million, had the lowest share of projects with major construction delays, just 6 percent. |

||

Copyright 2008 The American Institute of Architects. All rights reserved. Home Page |

||

news headlines

practice

business

design

Recent Related

› Billings’ November Upturn Points to Solid Momentum in Nonresidential Construction Sector

› October Billings Show Small Rebound After Declines of Late Summer

› Billings Stall Across the Board in Credit-crunched Economy

› National Credit Market Problems Spill over into Nonresidential Sector

This month, Work-on-the-Boards participants are saying:

Housing market has affected school construction design. Anticipate more slowdown in 2008; looking at other markets.

—18-person firm in the West, institutional specialization

Active opportunities for architecture and engineering work in the public and private sectors, but there is a shortage of construction workers.

—1-person firm in the Midwest, mixed specialization

Commercial is still strong, however, the overall climate is tentative. Investors are looking for product to build but are very selective on location and risk

—41-person firm in the South, commercial/industrial specialization

Conditions have improved due to start-up of projects that have been on hold due to construction cost or financing issues.

—14-person firm in the Northeast, residential specialization.