| work-on-the-boards Billings Stall Across the Board in Credit-crunched Economy Residential firms particularly see credit woes extending to 2008

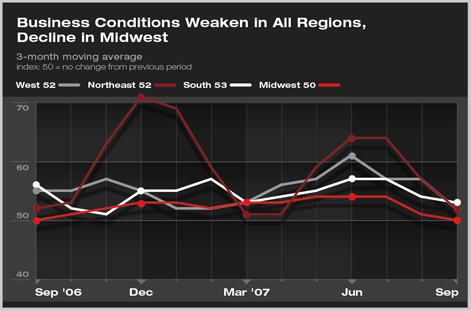

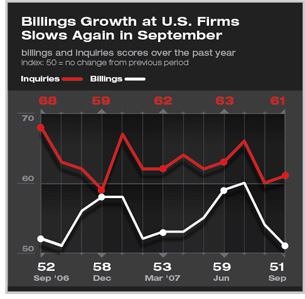

Billings growth at U.S. architecture firms slowed for the second month in a row in September. The Architecture Billings Index (ABI) had a score of 51.1. Because the score is above 50, it does show growth, albeit very slight. This is the slowest pace of growth since June 2006, which indicates that firms and clients are starting to feel the pinch of the current slowdown in the economy. Inquiries, however, remained healthy with a score of 61.4, indicating that there is still an adequate supply of work in the pipeline. Business conditions weakened in all regions of the country in September, with the Midwest reporting its first decline in billings since last September. Continued weakness in the manufacturing sector may be a contributing factor to this. The other three regions reported ongoing growth, but the pace has slowed over the last several months, most notably in the Northeast and West.

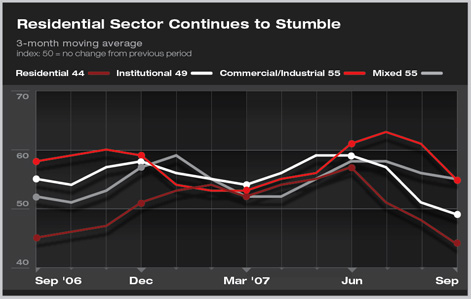

Weakness was also reported for the residential and institutional sectors, as both reported declining billings. For the institutional sector, this is the first month with a score below 50 since December 2004. Business conditions also weakened at firms with a commercial/industrial specialization, but continued to show some degree of growth. Slow employment gains, too

Credit concerns not going away

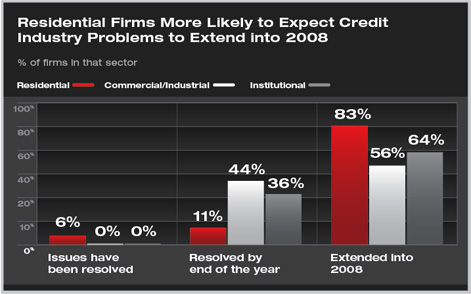

This impact is also being felt more by firms with a residential specialization than those who work primarily in the nonresidential sector. In fact, 83 percent of residential firms anticipate that the impact of credit industry troubles will extend into 2008, compared to just 64 percent of institutional firms and 56 percent of commercial/industrial firms. Problems with the credit industry have had a greater impact on residential firms because clients are no longer able to finance the purchase of a new home. While these same problems can certainly impact the development of nonresidential projects as well, nearly half of firms with a commercial/industrial specialization anticipate that the problems will not affect their projects past the end of the year. |

||

Copyright 2007 The American Institute of Architects. All rights reserved. Home Page |

||

news headlines

practice

business

design

Recent Related

› National Credit Market Problems Spill over into Nonresidential Sector

› July Upturn Adds to Solid Summer Performance at Architecture Firms

› June Brings Strong Growth to All Regions

› Firms Report an Upturn in May

This month, Work-on-the-Boards participants are saying:

The educational design market appears stable; however, we expect substantial growth in that market for 2008 and 2009. Finding quality staff will be our biggest challenge.

—15-person firm in the Midwest, institutional specialization

Overall housing market, as well as job growth, is very steady in Texas. Retail/commercial construction is slowing down a little. However, oil company and health-care construction are keeping very strong.

—59-person firm in the South, commercial/industrial specialization

While our firm does not appear to be directly affected by the “credit crunch,” we have noticed more inquiries from contractors regarding potential projects. This would not have happened 18 months ago.

—17-person firm in the West, institutional specialization

Things are busy now but the longer term seems unpredictable and unstable.

— 3-person firm in the Northeast, institutional specialization.

Summary:

Summary: