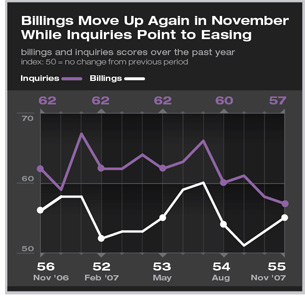

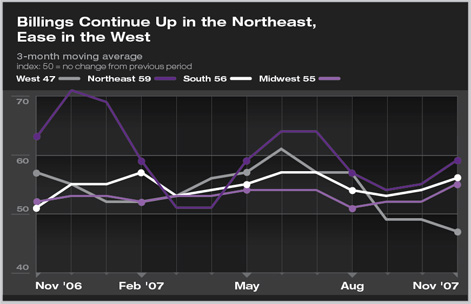

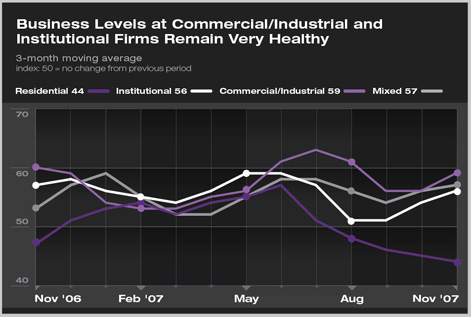

| WORK-ON-THE-BOARDS SURVEY Billings’ November Upturn Points to Solid Momentum in Nonresidential Construction Sector Even with strong workloads, weaker market conditions present key business concern for 2008 Summary: Indicating that the recent weakness in design activity has fully stabilized, billings at architecture firms rose again in November, with the October and November gains totaling over four points in the Architecture Billings Index. The November score stood at 55.3, its fourth highest level for 2007. Inquiries for new work continued to trend down, having dropped almost 10 points since July. The inquiries index is at its lowest level since the summer of 2003. So, although the recent nonresidential slowdown caused principally by problems in credit markets seems to have dissipated, the underlying problem of a weakening economy remains. Easing inquiries for new design projects is indicative of the slower underlying demand for new nonresidential facilities. Firms in the Northeast have reported strong gains in billings in recent months, while those in the West have reported declines. Firms in the Midwest and South have seen business conditions edge up. Firms concentrating in the commercial/industrial sector are reporting slow improvement in conditions in recent months. Institutional firms have seen growth since reporting weaker conditions earlier this summer.

Consumers feeling nervous Rising oil prices have sparked a new round of concern for both producer and consumer prices. Inflation concerns make it difficult for the Federal Reserve Board to continue to lower interest rates to deal with a softening economy. Lower interest rates tend to spur more spending and therefore more inflation, which could discourage the Fed from dealing as aggressively with any downturn.

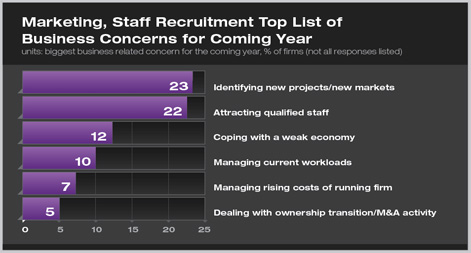

Finding new work is the top concern However, there are other major concerns resulting from strong levels of business. Attracting new qualified staff and managing current project workloads were the second and fourth most commonly listed biggest business-related concern for 2008. Managing rising costs of running a firm, and dealing with ownership transition and merge and acquisition activity were the next most commonly listed concerns.

Dealing with rising construction materials costs, a serious problem in recent years, is a less immediate problem now, with only 3 percent of respondents putting it at the top of their list. Likewise, dealing with national credit market problems was listed by fewer than 2 percent of respondent as their top concern for 2008. Implementing new technologies such as BIM (4 percent), negotiating appropriate fees (4 percent), dealing with growing regulatory barriers (3 percent), and competition from other architecture firms or design professionals (3 percent) were all mentioned by a small percentage of respondents as top concerns for the coming year. |

||

Copyright 2007 The American Institute of Architects. All rights reserved. Home Page |

||

news headlines

practice

business

design

Recent Related

› October Billings Show Small Rebound After Declines of Late Summer

› Billings Stall Across the Board in Credit-crunched Economy

› National Credit Market Problems Spill over into Nonresidential Sector

› July Upturn Adds to Solid Summer Performance at Architecture Firms

This month, Work-on-the-Boards participants are saying:

My recent strategy has been teaming up with contractors and creating projects for hesitant clients by offering design and pricing packages in the pre-design phase. A risky, but efficient process.

—One-person firm in the West, residential specialization

Commercial is steady as we move into the holidays. Good backlog of work well into 2008.

—145-person firm in the West, commercial/industrial specialization

It is increasingly difficult to develop accurate project budgets. Our public projects can take two to three years to develop with feasibility studies, bond elections, and design development. In recent years, project costs have been a moving target.

—10-person firm in the Midwest, institutional specialization

Inquiries are still strong for bigger projects. However, bigger projects take much more time to develop into revenue producing work.

—125-person firm in the South, commercial/industrial specialization.