| work-on-the-boards October Billings Show Small Rebound After Declines of Late Summer Institutional sector shows stronger growth; residential remains weak

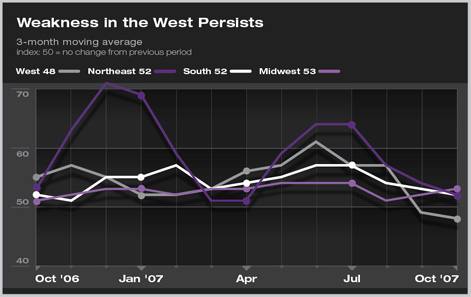

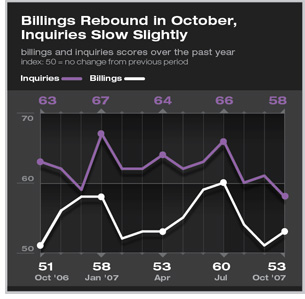

The AIA’s Architecture Billings Index (ABI) showed stronger growth in October, rebounding slightly from a steep downturn in August and September, with a score of 53.2 (where any score above 50 shows growth). Despite the ongoing slowdown in the U.S. economy, ABI panel members continue to report at least modest billings gains each month. Inquiries for new work, however, slowed in October to their lowest rate of growth in a year and a half. They remain healthy overall, though, with a score of 58.1, indicating that new projects are still being planned. Regionally, billings growth slowed once again at firms in the Northeast and South, while business conditions in the West declined for the second month in a row. This is the first time in nearly three years that billings have fallen for two consecutive months in the West. Growth picked up slightly in the Midwest, continuing to rebound from a late summer slowdown.

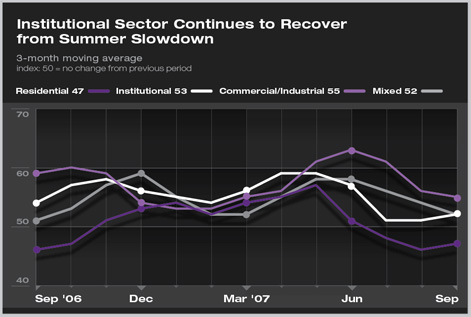

Weakness persists at firms with a residential specialization, as billings in October remained below 50 for the third month in a row. And although business conditions continued to slow at firms with a commercial/industrial specialization, overall they remained fairly healthy. Firms with the majority of their work in the institutional sector were the only ones to show stronger growth in October, as they continue to rebound from a 17-month low in August.

Credit market troubles have mixed effects

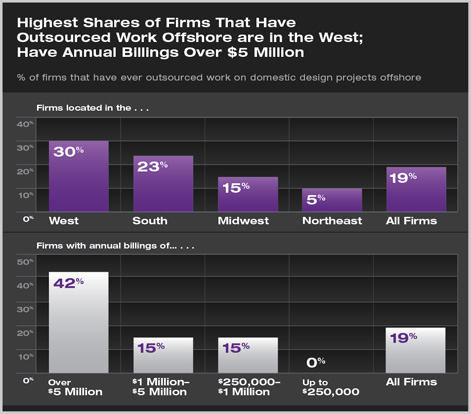

Offshoring is the province of firms in the West, large firms Of those firms that have outsourced offshore, nearly two-thirds do it rarely. For those that do it frequently or occasionally, the most important factor when deciding to outsource offshore is to alleviate workload, i.e., to supplement current staff to cover peak demands. Of the 81 percent of firms that have not outsourced offshore, just 12 percent have even considered it. The most commonly cited reasons for not outsourcing offshore were the difficulty of providing oversight and the availability of better options domestically. |

||

Copyright 2007 The American Institute of Architects. All rights reserved. Home Page |

||

news headlines

practice

business

design

Recent Related

› Billings Stall Across the Board in Credit-crunched Economy

› National Credit Market Problems Spill over into Nonresidential Sector

› July Upturn Adds to Solid Summer Performance at Architecture Firms

› June Brings Strong Growth to All Regions

This month, Work-on-the-Boards participants are saying:

Private sector work remains very slow, while public sector work is steadily

increasing.

—6-person firm in the Midwest, institutional

specialization

Custom residential work is steady. Public school bond projects will

continue to impact institutional work.

—48-person firm in the South, residential

specialization

Our workload, both backlog and inquiries, has been strong. This will

require our expansion in both physical space and staff.

—3-person firm in the West, commercial/industrial

specialization

Stable, but there may be an increase for our firm over the winter with

projects ready for a spring start.

—8-person firm in the Northeast, institutional

specialization.

Summary:

Summary: