| work-on-the-boards Business Conditions Stabilize at Firms in Traditionally Busy Spring Season Compensation levels expected to grow about 4 percent in 2007 for architecture positions

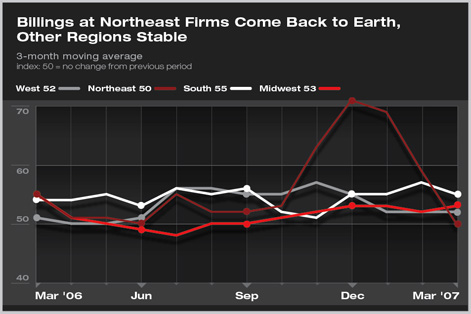

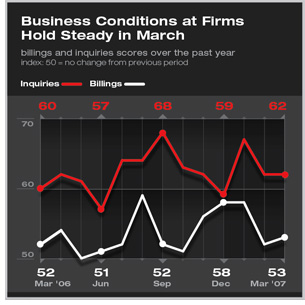

Activity remained virtually unchanged in March from February levels, as the AIA’s Architectural Billings Index (ABI) ticked up a modest 0.1 point to 52.6, while the index for inquiries for new projects dropped 0.1 point to 61.8. Because any reading above 50 indicates growth, both measures point to healthy business conditions at present and for the near future. After spiking from November through January, the ABI has returned to levels seen earlier last fall. Because new project inquiries remain healthy, we can expect to see further gains in the ABI in the months ahead. Northeast most volatile

By sector, commercial/industrial firms are reporting a slowing in billings growth in recent months. They may be pointing to a general easing in commercial/industrial construction activity later this year, or the slower growth may be an indication that many of these firms are at capacity after strong growth over the past 18 months, and are being forced to increase their project backlogs rather than their current production. Likewise, institutional firms are reporting somewhat slower growth, although still above the levels reported at commercial/industrial firms. Residential firms are reporting some modest pickup after slower activity throughout most of 2006. However, there is no evidence of a broader residential rebound. Economy remains basically healthy The recent jump in oil prices, on top of their already high levels, has taken a toll on consumer sentiment readings. The preliminary figures for April from the University of Michigan showed another drop, which is the third decline in four months so far for 2007, and the eighth decline over the past 12 months. However, consumer pessimism has been somewhat offset by business optimism. The Conference Board’s CEO Business Confidence Survey dropped to negative territory in the third quarter of 2006, but has rebounded nicely in the fourth quarter last year and again in the first quarter this year.

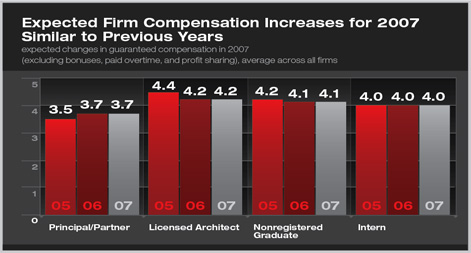

Compensation increases remain steady Additionally, almost 38 percent of firms expect paid overtime for hourly architecture staff to increase this year, while fewer than 10 percent expect it to decline. Almost half (48.5 percent) of firms expect bonuses and profit sharing to increase this year for employees, while only 13 percent expect a decline. |

||

Copyright 2007 The American Institute of Architects. All rights reserved. Home Page |

||

news headlines

practice

business

design

Recent Related

› Return of Cold Weather Dials Billings, Inquiries Down a Notch

› Billings Should Rise in Early 2007

› Year-End Figures Confirm an Upturn in Architecture Firm Business

› November Business Conditions at Architecture Firms Show Considerable Improvement

This month, Work-on-the-Boards participants are saying:

Demand for college and university buildings continues apace. The only thing delaying projects is the source of funding.

—150-person firm in the South, institutional specialization

Staffing, in particular those with 7–10 years of experience and strong computer skills, is almost impossible to find. Up to now we have deployed technology to increase productivity and offset salary increases. At some point we are going to have to start passing these increases along to our clients.

—31-person firm in the Midwest, commercial/industrial specialization

We’ve never been busier in our 20 years of practice! Backlog extends into next year. New project leads are coming every day.

—12-person firm in the Northeast, commercial/industrial specialization

It seems like almost everyone is busier than ever. We are turning away undesirable work, outsourcing drafting to keep up, and clients are willing to wait 4 to 6 months to begin work on their projects.

—14-person firm in the West, residential specialization.

Business conditions at architecture firms remain healthy as we enter a critical time of the year for design activity. March is historically the month where we see the greatest gains in billings, followed closely by February and April. Firms are reporting more stable levels after a year-end spike that mainly affected firms in the Northeast. Compensation levels for architecture positions are expected to increase about 4 percent in 2007, with a significant portion of firms expecting increases in paid overtime as well as in bonuses and profit sharing.

Business conditions at architecture firms remain healthy as we enter a critical time of the year for design activity. March is historically the month where we see the greatest gains in billings, followed closely by February and April. Firms are reporting more stable levels after a year-end spike that mainly affected firms in the Northeast. Compensation levels for architecture positions are expected to increase about 4 percent in 2007, with a significant portion of firms expecting increases in paid overtime as well as in bonuses and profit sharing.