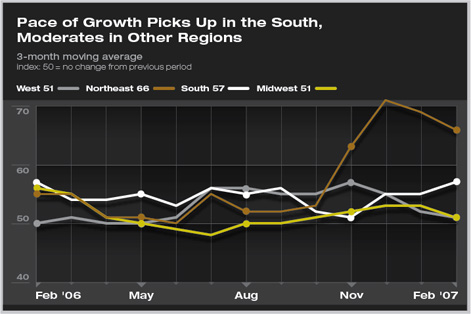

| work-on-the-boards Return of Cold Weather Dials Billings, Inquiries Down a Notch Defined scope, good communications shape profitability Summary: Several atypically warm months to start the winter led to elevated billings, which slowed in February with the arrival of more seasonably cold weather. Declines in billings were reported in nearly every region of the country, although the pace continued to pick up in the South. Residential billings also continued to stabilize after months of decline in 2006.

With the arrival of winter weather after an unseasonably warm December and January, the pace of growth slipped in all regions of the country in February, except the South, where it accelerated slightly. The pace in the Northeast in particular began to decline after having been extremely elevated recently. The slowdown in the West that began in December continued, and the Midwest also eased slightly, but scores for both remain above 50, a good sign that growth will continue into the spring. Housing recovery not imminent

In line with slowing growth, the Bureau of Labor Statistics reported that construction employment declined sharply in February, with a loss of 62,000 jobs after gains in January. February also brought a revision to GDP for the fourth quarter of 2006, as it was revised to an annual growth rate of 2.2 percent (down from a preliminary estimate of 3.5 percent, primarily due to downward revisions to private inventory investment and personal consumption expenditures for goods). In addition, consumer sentiment (as reported by the University of Michigan Consumer Sentiment Index) fell by more than five points in February, although inflation expectations held steady for the month. Defined scope, good communications shape profitability

Respondents working at firms with residential and institutional specializations were more likely to indicate that good communication/trust was the most important characteristic to making a project profitable, while those at firms with a commercial/industrial specialization were more likely to select clearly defined scope. |

||

Copyright 2007 The American Institute of Architects. All rights reserved. Home Page |

||

news headlines

practice

business

design

Recent Related

› Billings Should Rise in Early 2007

› Year-End Figures Confirm an Upturn in Architecture Firm Business

› November Business Conditions at Architecture Firms Show Considerable Improvement

› Firms Report Steady Growth in October

This month, Work-on-the-Boards participants are saying:

We’re still slow in terms of new inquiries and moving projects from preliminary phase to actual construction. Clients still seem reluctant to commit.

—6-person firm in the Midwest, residential specialization

It’s continuing to improve, although contractors report that the current bid market is “bone dry.”

—20-person firm in the Northeast, institutional specialization

Commercial, retail, and office projects continue to get built based on the assumption of pending demand. Residential remains slow due to overbuilding and costs.

—22-person firm in the West, commercial/industrial specialization

Projects that were shelved in 2006 are coming off the shelf in droves.

—13-person firm in the South, mixed specialization.

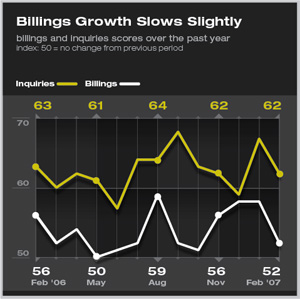

Although the pace of growth for both billings and inquiries slowed somewhat in February, the Architecture Billings Index (ABI) remained above 50 with a score of 53, indicating that growth continues to be solid. As with billings, inquiries also slowed slightly in February after showing a surge at the very beginning of the year, and yet remain strong enough that there presently is no need for concern.

Although the pace of growth for both billings and inquiries slowed somewhat in February, the Architecture Billings Index (ABI) remained above 50 with a score of 53, indicating that growth continues to be solid. As with billings, inquiries also slowed slightly in February after showing a surge at the very beginning of the year, and yet remain strong enough that there presently is no need for concern.