| work-on-the-boards Year-End Figures Confirm an Upturn in Architecture Firm Business Firms report considerable variation in profitability of projects Summary: Billings at architecture firms showed their strongest growth in a year and a half in December after seasonal adjustments, reflecting continued strength in the nonresidential sector, as well as mild weather patterns that may have pushed projects along at a faster pace. The AIA’s Architecture Billings Index rose to 59.5 in December, up from 57.4 in November. Inquiries for new work eased off from the past several months, indicating that billings are likely to slip a bit as we enter 2007.

Economy’s weakness still lingers

The employment picture continues to show modest gains. There were 167,000 net payroll positions added nationally in December, which was above the October or November figures. Still, there were only 1.8 million jobs added in 2006, down from almost 2 million in 2005. The construction employment picture is even weaker currently as December was the fourth straight month that payrolls at construction firms declined.

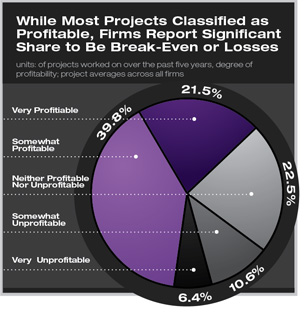

Larger firms report having a higher share of projects that are profitable (70.2 percent reported as very profitable or somewhat profitable) and a lower share unprofitable (13.7 percent somewhat or very unprofitable). Institutional firms report the highest share of very profitable projects (25.2 percent), while commercial/industrial firms report the lowest share of very unprofitable projects (4.6 percent). Factors that make some projects are more profitable than others include:

|

||

Copyright 2007 The American Institute of Architects. All rights reserved. Home Page |

||

news headlines

practice

business

design

This month, Work-on-the-Boards participants are saying:

Everyone is still busy, but a lot of work is for the same speculative developments. It could be that some/many of these projects will never get off the ground.

—9-person firm in the South,

mixed specialization

Recruiting new staff is nearly impossible.

—11-person firm in the Northeast, commercial/industrial specialization

Lots of inquiries, but slow to sign the contract and make the commitment to proceed.

—12-person firm in the West, institutional specialization

Client interest is increasing somewhat, but high construction costs have clients concerned and threaten project cancellations.

—40-person firm in the Midwest, mixed specialization.

A printer-friendly version of this article is available.

Download the PDF file.

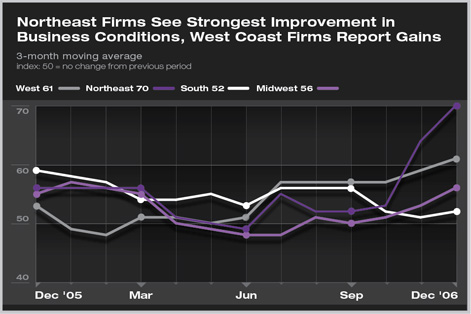

Billings were particularly strong in the Northeast, but also showed a rebound in the Midwest. Both of these regions have had unusually mild weather conditions so far this winter. Firms in the West are reporting very healthy conditions, while those in the South have seen a moderation of growth recently. Firms that concentrate in the commercial/industrial sectors reported the sharpest upturn in December, but institutional practices also indicated improved growth.

Billings were particularly strong in the Northeast, but also showed a rebound in the Midwest. Both of these regions have had unusually mild weather conditions so far this winter. Firms in the West are reporting very healthy conditions, while those in the South have seen a moderation of growth recently. Firms that concentrate in the commercial/industrial sectors reported the sharpest upturn in December, but institutional practices also indicated improved growth.

Profits vary considerably

Profits vary considerably