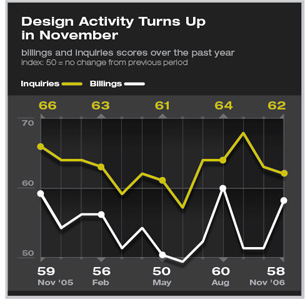

| work-on-the-boards November Business Conditions at Architecture Firms Show Considerable Improvement Attracting new qualified staff tops the list of 2007 business concerns Summary: Approaching year-end, business conditions rebounded at architecture firms, indicating that the nonresidential construction activity will continue to show strength throughout 2007. The commercial/industrial sector in particular showed upward potential, as billings at commercial and industrial architecture firms recorded their best reading of the decade. The AIA’s Architecture Billings Index overall for November jumped to 57.5 in November from 51.2 in October. The November reading was second highest of the year, missing the August high by two points.

Sluggish economy

The employment report for November showed a 132,000 net addition in business payrolls, again better than the October figure, but well below the 185,000 added per month on average in the second quarter. The construction sector has been a key source of weakness in the employment figures recently, as the downturn in homebuilding reduced construction payrolls by 29,000 in November alone, and 37,000 since the beginning of the second quarter of this year. Consumers appear to be getting more nervous about economic prospects. The preliminary December consumer sentiment index from the University of Michigan was down for the second straight month. However, stable energy costs are helping keep inflation in check, which means that the Federal Reserve Board is very unlikely to raise interest rates anytime soon. Increases in consumer prices are currently running about 2% per year overall, and below 3% with food and energy costs netted out. Producer (wholesale) prices are showing even slower gains, which is an encouraging sign for future inflation levels. Finding new staff a challenge

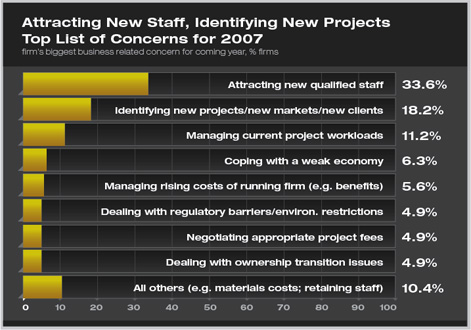

In terms of their single greatest concern for the coming year, attracting new staff easily topped the list, with over a third of firms rating this as their biggest business related concern. Identifying new projects/markets/clients was second with 18 percent rating it as the number one problem, followed by managing current project workloads with 11 percent. Smaller firms (under $1 million in annual billings) put identifying new projects at the top of the list, followed by attracting new staff. Larger firms (over $5 million) put attracting new staff at the top of the list, followed by identifying new projects. Firms in the Northeast, South, and West listed attracting new staff as their principal concern, while firms in the Midwest, where business conditions are softer overall, rated identifying new projects as their biggest concern. |

||

Copyright 2006 The American Institute of Architects. All rights reserved. Home Page |

||

news headlines

practice

business

design

Recent Related

› Firms Report Steady Growth in October

› September’s Billings Up Modestly; Inquiries Much Stronger

› Firms Enjoy a Late Summer Surge

This month, Work-on-the-Boards participants are saying:

Many projects dropped after preliminary design phase, partly due to costs, partly to economic instability.

—6-person firm in the Midwest, residential specialization

We are extremely busy but rampant increases in construction costs are creating major budget issues and canceling projects.

—27-person firm in the West,

mixed specialization

The regulatory environment is out of control at this point in south Florida.

—2-person firm in the South,

mixed specialization

Once again, Houston seems to be counter-cyclical, largely due to the energy market. We are experiencing a lot of growth with not much slowdown in any area.

—9-person firm in the South, institutional specialization.

A

printer-friendly version of this article is available.

Download the PDF file.

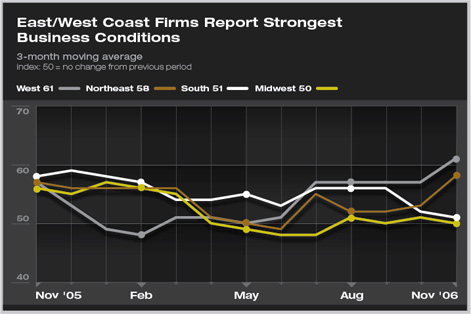

Firms in the Northeast and West reported a sharp upturn in billings in November. Firms in the South continued their trend of slower growth, while firms in the Midwest indicated weaker business conditions. Commercial/industrial firms reported their strongest reading of this design upturn that began in late 2003, following on a trend of accelerating growth that they have been reporting in recent months. Design billings at institutional firms also continue to be at very healthy levels. Even residential firms are reporting some encouraging signs. Though their billings are still weak, the slowdown is moderating, which hopefully means that they are nearing bottom.

Firms in the Northeast and West reported a sharp upturn in billings in November. Firms in the South continued their trend of slower growth, while firms in the Midwest indicated weaker business conditions. Commercial/industrial firms reported their strongest reading of this design upturn that began in late 2003, following on a trend of accelerating growth that they have been reporting in recent months. Design billings at institutional firms also continue to be at very healthy levels. Even residential firms are reporting some encouraging signs. Though their billings are still weak, the slowdown is moderating, which hopefully means that they are nearing bottom.