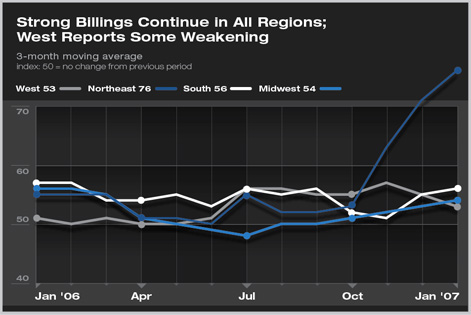

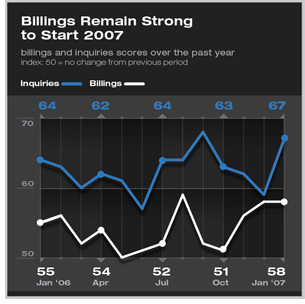

| work-on-the-boards Billings Should Rise in Early 2007 BIM use still scattered; large firms most likely users Summary: Billings at architecture firms remained strong in January with an ABI score of 57.9 (a score above 50 is an increase). This marks the third straight month of increasing strength after a brief period of weakening in the fall of 2006. Inquiries were even stronger this month, in fact, they reversed a three-month decline in strength, indicating that billings should continue to rise in early 2007.

Residential billings continued their slow and steady upward climb, showing a second month of growth after eight straight months of decline. However, commercial/industrial billings showed slower growth for the second month in a row from their 10-year high in November 2006. Meanwhile, the strong growth in institutional billings that began last fall continues. Construction employment up

Large firms most likely to use BIM

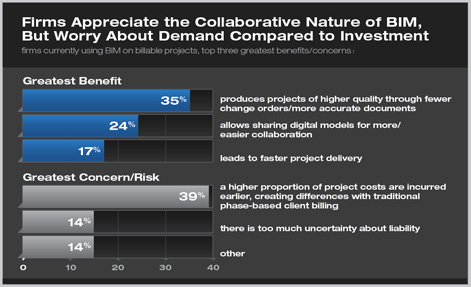

When asked to consider the greatest perceived benefits and concerns/risks of using BIM, firms currently using BIM on billable projects indicated that the ability to produce projects of higher quality through fewer change orders/more accurate documents was considered the greatest benefit. The fact that a higher proportion of project costs are incurred earlier, creating differences with traditional phase-based client billing was seen as the greatest concern/risk. |

||

Copyright 2007 The American Institute of Architects. All rights reserved. Home Page |

||

news headlines

practice

business

design

Recent Related

› Year-End Figures Confirm an Upturn in Architecture Firm Business

› November Business Conditions at Architecture Firms Show Considerable Improvement

› Firms Report Steady Growth in October

This month, Work-on-the-Boards participants are saying:

The market, including residential, remains strong. Access to qualified manpower is getting slightly better but is still an issue.

—10-person firm in the South,

mixed specialization

It looks like the local market is softening.

—22-person firm in the West, institutional specialization

RFPs for health-care and institutional work remain strong. Educational work, especially K–12, is growing.

—14-person firm in the Midwest, institutional specialization

We are still very busy. It is hard to find anyone qualified to work since all offices in the area are busy.

—35-person firm in the Northeast, commercial/industrial specialization.

A

printer-friendly version of this article is available.

Download the PDF file.

Billings show modest gains

Billings show modest gains