| |

Construction Markets Face New Challenges As Broader Economy Weakens

Chief Economist Kermit Baker presents some implications for architects

by Stephanie Stubbs

Managing Editor

Summary: AIA Chief Economist Kermit Baker, PhD, Hon. AIA, says that examining current business trends in design and construction, being aware of the economic outlook for the near future, and addressing key issues facing the profession today can help architects guide their practices through the economic shoals we’re currently riding. Speaking to an audience from AIA chapters in Northern Virginia, Potomac Valley, Md., and Washington, D.C., at the DesignDC annual conference on July 10, Baker offered a session on “Practicing in a Challenging Economy: Construction Outlook for 2008-2009 and Implications for the Design Professions” and explained some of the economics research the AIA makes available to its members.

Baker notes that architects are challenged by working in one of the most cyclical sectors of the economy. Over the last two years, for example, residential architects have been working in a very lean market, while the commercial and institutional markets were very strong and in the midst of a healthy rebound. “But recently as the broader economy has begun to weaken,” Baker says, “both residential and nonresidential construction have seen a new set of challenges.”

These challenges include:

- The housing sector remains in serious recession, and the decline in house prices limits the amount of money consumers have to spend when they do sell their homes

- Business payrolls have declined each month this past year

- Rising oil prices and the weak dollar are stoking inflationary pressures and hurting consumer confidence

- Credit problems are extending the housing downturn and threatening other sectors of the construction industry and every sector of the economy

- Security threats and continuing international tensions, although currently not at the forefront of concerns, can make consumers nervous. “We’re only one international incident away from really tipping the economy,” Baker says. “It is certainly is a background issue for all of us.”

Examining business trends in design and construction

One trends-tracking tool specific to the building industry is the AIA’s own Architectural Billings Index (ABI), which Baker started almost 15 years ago as the Work-on-the-Boards Survey. “When we tracked the monthly trends we were seeing in architecture firms, we confirmed our suspicions that design billings are a very accurate leading indicator of construction activity, with about a 9-12 month lead,” he says.

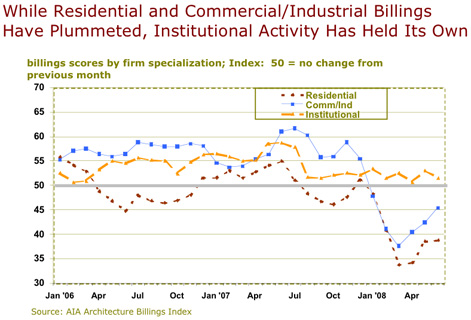

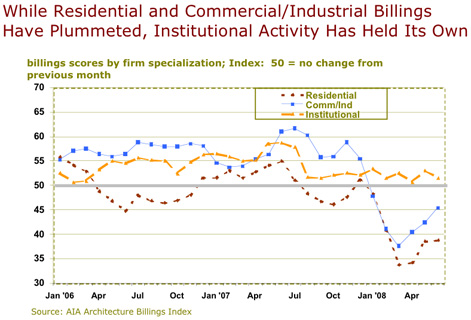

The ABI centers on a base score of 50, which indicates that as many architects are seeing increases in billings activity as are seeing decreases in activity. Any score above 50 indicates general growth in business activity; below 50 indicates a general decline in activity. Every month, the ABI queries some 300 architecture firms representative of national figures in terms of size, focus, and location.

Baker reports that the ABI saw good, solid numbers in 2006 and 2007. “Billings dropped off dramatically when we flipped the calendar to 2008—we had a 15 percent decline in billings from January through March,” he says. “In the 15 years we’ve been running the survey, we’ve never seen anything like a decline of that magnitude. Since then, the declines have been moderating, and we’re moving in the right direction.”

The ABI also tracks billings by the firms’ specializations (residential, commercial/industrial, institutional, and mixed), which can show marked differences. For instance, Baker notes, institutional projects have held up pretty well in the latest downturn, which is fairly typical of the stable market for that project type. Commercial and industrial projects, on the other hand, feel the whiplash of the economy.

The ABI’s regional breakdowns (Northeast, West, South, and Midwest) can offer some idea of what and where business might be heating up. For instance, firms in the Midwest and firms in the South—which went through the downturn first—over the past two months seem to be returning to stability. “We’ll see if they can bring the Northeast, the West and the broader economy back to recovery mode over the near term,” Baker says. (Architects can find the latest ABI every month in AIArchitect. Past surveys are stored on the AIA Economics Web site.)

Tracking the residential outlook

“The residential market started getting weak in mid-2005, and homebuilders weren’t paying attention,” Baker says. “They continued to build homes for at least five quarters after we began to see weakness.”

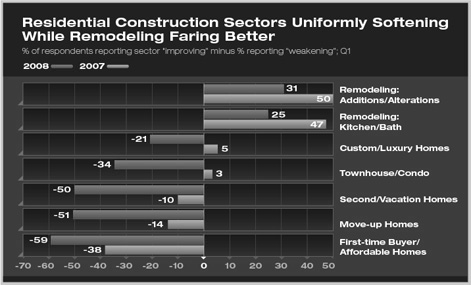

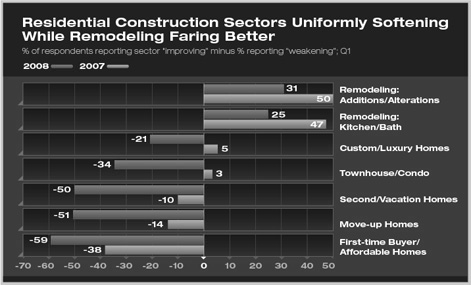

The complex housing market, however, is composed of a number of disparate parts, some of which, such as remodeling, are holding their own even now. Realizing that residential architects have one of the few vantage points that see all of these pieces of the housing market, Baker and the AIA economics and markets research team began three years ago to collect data from these architects and compile a quarterly report, “AIA Home Design Trends Survey.” The survey polls 500 AIA members with a declared specialty in residential design and tracks the percentage of respondents reporting that various sectors of the residential market is improving minus the percentage reporting that it is weakening.

The survey tracks:

- Remodeling/additions/alterations

- Remodeling kitchen/bath

- Custom/luxury homes

- Townhouses/condos

- Second/vacation homes

- First-time buyers/affordable homes.

Harvard University’s Joint Center for Housing Studies (where Baker serves as a senior research fellow and director of the Futures Remodeling Program) measures trends that help round out the picture of residential design and construction for architects. “At the Center, we are trying to track how much we’re building versus how much we need. It’s a moving target, but our best estimate is that we’ve been building more homes than we think we need every year in the last decade,” Baker says.

The Center’s best guess is that a surplus of 1 million housing units needs to be worked off. Demandwise, the U.S. Census indicates we formed 700,000 new households last year, so we have a way to go toward working off the excess. However, ending on a note of optimism, Baker says that the Joint Center does predict that over the next decade, 2 million additional households needing housing will be formed. Another upnote: historically over the last 50 years, when the housing market does snap back, it snaps back quite quickly: the first quarter out of recession typically shows about a 15 percent increase in building; and the second quarter, an additional 5-10 percent gain.

Tracking the outlook for nonresidential

When examining the outlook for the end of 2008 and for 2009, we need to keep our recent economic history in mind. “We’re coming down from a very strong upturn in the late ’90s,” Baker says. “After that, we had a 25 percent aggregate decline in the early part of this decade, followed by three good—not great—years with about a 15 percent gain. The upshot is that we don’t have a huge backlog to work off in the current downturn. That will inform a lot of what we expect to see in 2008 and 2009.”

Of the billion-and-a-half square feet of new construction to be built this year, almost half is projected to be commercial; 20 percent, manufacturing; and 30 percent, institutional. Of these, commercial and institutional are the most important sectors for the AIA to track, as they make up the bulk of architects’ practice. The AIA’s Consensus Forecast, undertaken twice a year, is inflation-adjusted and thus is akin to predicting the amount of square footage—commercial, institutional, industrial, and total—to be built. “The consensus is that construction will be flat this year—maybe a bit of a decline, with the first half of the year a good bit stronger than the second half,” Baker says. “Moving into 2009, the panel sees a pretty significant downturn—a 7 percent decline, with virtually all of it coming out of the commercial sector.” Of the billion-and-a-half square feet of new construction to be built this year, almost half is projected to be commercial; 20 percent, manufacturing; and 30 percent, institutional. Of these, commercial and institutional are the most important sectors for the AIA to track, as they make up the bulk of architects’ practice. The AIA’s Consensus Forecast, undertaken twice a year, is inflation-adjusted and thus is akin to predicting the amount of square footage—commercial, institutional, industrial, and total—to be built. “The consensus is that construction will be flat this year—maybe a bit of a decline, with the first half of the year a good bit stronger than the second half,” Baker says. “Moving into 2009, the panel sees a pretty significant downturn—a 7 percent decline, with virtually all of it coming out of the commercial sector.”

For commercial space—office, retail, and hotel—the overall economy drives demand. Office demand can be predicted by office vacancy rate, such as is measured by C.B. Richard Ellis and other companies. Although there are strong regional variations, vacancy rates in general have been inching up and are likely to trend up a bit—but still are at pretty healthy levels, according to Baker. Retail, which didn’t see much of a downturn in the 2000 recession, has really taken the hit now. And hotels (which as a category includes casinos) also will weaken, showing double-digit declines in 2009.

Institutional construction should fare better. It has a different set of drivers, most of which center on demographic trends, Baker explains, and those numbers don’t change very quickly. For example, the need for schools is driven by population growth and projected enrollments in a particular area. The U.S. Census is predicting strong growth at the elementary school level for the next six or seven years. As for the forecast, education and health care, which make up two-thirds of institutional construction, “are showing small numbers: small increases and small declines. Stability seems to be the overriding feature for institutional markets,” says Baker. “If the markets recover by 2010, as the consensus forecast predicts, we are going to skate through the institutional side with almost no damage done at all.”

Addressing other key issues

The AIA economics and markets research team tracks special-topic issues that flow out of general economic trends. As examples, Baker identified five such issues that bear watching as the current economic scenario unfolds:

- Consolidations and concentrations. “Architecture is still a profession that is dominated by small firms,” Baker says. “Eighty percent of architecture firms employ 10 people or less. But, firms of 50 or more people account for almost 40 percent of employment in the profession and earn almost 50 percent of the revenue.” The Business of Architecture, the AIA’s tri-annual survey of architecture firms, gives data on the size of firms and the increase in firm size within the profession. Upon seeing an uptick in mergers and acquisitions last year, the AIA economics team used the ABI to query firms and found that the trend was driven by desire to diversify in order to ride out booms and busts of the cyclical construction economy. (ABI, August 2007).

- Rising materials costs. Over the last three or four years, the market has weathered tremendous fluctuations in commodities cycles. Baker cites U.S. Labor Department data analyzed by the Associated General Contractors Economics Department, which notes that over the last four years, the price of construction materials has increased 37 percent, while the Consumer Price Index has increased 18 percent. This leap in prices affects project decisions through all phases of design and construction.

- Outsourcing design work offshore. Baker notes that the decision to send work offshore appears to tie directly to the cyclical nature of the construction industry’s economy. The ABI indicates that of firms that have ever outsourced work offshore (about one in five firms), 66 percent indicate that the principal reason was to alleviate workloads through boom and bust cycles. (ABI, October 2007.)

- Technology investments to increase productivity. Again, ABI offers us snapshots: Currently, a third of the firms surveyed indicate that they are using building information modeling (BIM) on billable projects, while 39 percent of those who use it say the main reason is higher quality projects. Where BIM and integrated project delivery will take the profession over the next decade is anyone’s guess; nonetheless, 35 percent of the firms surveyed believe it will be the industry standard within three years, and 51 percent believe it will be standard in more than three years. (ABI, February 2008.)

- Longer-term demand for sustainable design. Although most (almost 80 percent) firms taking part in the ABI index say they work on green projects, the share of projects with green features drops to 35 percent and only a quarter of those projects employ a rating system. Overall, the cost savings over the life of the building was cited by the most respondents (41 percent) as the key motivation for sustainable construction. Baker says that emphasizing the economics of sustainable design can only strengthen its impact on the marketplace. (ABI, May 2007.)

Turn-around in broader economy needed

“The headwind we’re fighting now is issues in the broader economy. We’re not going to see much growth in either residential or nonresidential until we see more fundamental growth in demand,” Baker sums up. “We’re not seeing any signs that the residential market has started to turn. We’ve probably hit bottom, but we’ll be at the bottom for a while. The consensus now for turn-around is early 2010.”

By comparison, Baker notes, nonresidential in comparison looks a lot better. “We’re going into this period of weakness in very good condition, with very little excess stock,” he says. “Again, though, we’re not creating jobs, so we have to get the economy back before we see more growth.” |

|

Of the billion-and-a-half square feet of new construction to be built this year, almost half is projected to be commercial; 20 percent, manufacturing; and 30 percent, institutional. Of these, commercial and institutional are the most important sectors for the AIA to track, as they make up the bulk of architects’ practice. The

Of the billion-and-a-half square feet of new construction to be built this year, almost half is projected to be commercial; 20 percent, manufacturing; and 30 percent, institutional. Of these, commercial and institutional are the most important sectors for the AIA to track, as they make up the bulk of architects’ practice. The