| work-on-the-boards July Upturn Adds to Solid Summer Performance at Architecture Firms Emerging credit market problems form dark cloud over evolving merger and acquisition activity at firms

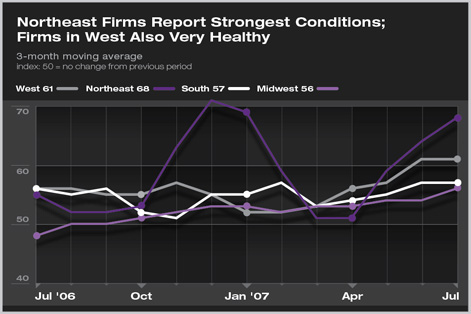

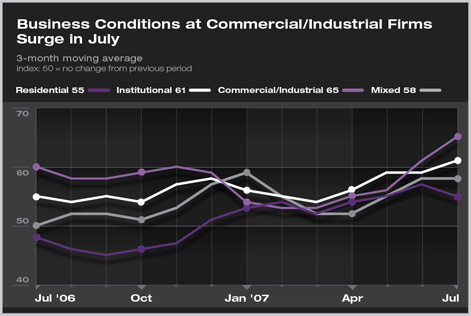

July brought another strong upturn in business conditions at architecture firms. The AIA’s Architecture Billings Index for the month was an even 60; the highest reading since September of 2005, while the index score for inquiries for new work was above 66. Firms in all regions are reporting strong billings, with those in the Northeast and West recording particularly positive conditions. Commercial and industrial firms saw a solid increase in business conditions in July, and institutional firms—which are typically more stable—reported a climb in the billings index score for this sector to above 60 for the first time since late 2005.

Credit concerns loom

Although most analysts feel that problems in the credit markets for nonresidential projects will be resolved favorably given the strong fundamentals in these sectors, it does appear that there may be delays in some projects until these financing jitters are calmed.

Once the credit market picture is clearer, the overall health of the economy will be easier to determine. The strong GDP number for the second quarter (an inflation-adjusted 3.4 percent when seasonally adjusted and annualized) is a source of optimism. The increase in house prices in recent years has supplied homeowners with a lot of equity to supplement their income, but with house prices stabilizing and even declining in some markets, consumers will be spending less. The result is that the economy will continue to feel the effects of a slowdown in the residential sector. Interest in mergers/acquisitions grows

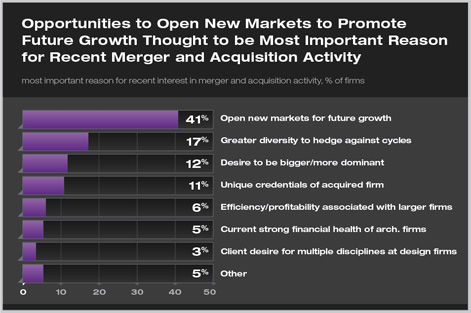

When asked as to the most important reasons for the recent interest in merger and acquisition activity, more than 40 percent of firms put “opportunities to open new markets to promote future growth” at the top of the list. “Greater project diversity to hedge against economic cycles/construction cycles,” “general desire of firm to be bigger and more dominant,” and “acquired firm has unique credentials that are desirable to acquiring firm” also were each listed by at least 10 percent of respondents as the most important reason for this renewed M&A activity. Residential firms were more likely than other types of firms to list “hedge against economic cycles,” and “efficiency and profitability associated with larger firms” as the most important reason. Commercial/industrial firms were more likely to list “desire to be bigger/more dominant” and “client desire for multiple disciplines at design firms.” Institutional firms were more likely to list “unique credentials of acquired firm,” and “current strong financial health of architecture firms.” |

||

Copyright 2007 The American Institute of Architects. All rights reserved. Home Page |

||

news headlines

practice

business

design

Recent Related

› June Brings Strong Growth to All Regions

› Firms Report an Upturn in May

› Business Conditions Hold Steady in April

This month, Work-on-the-Boards participants are saying:

Our new activity is slow right now, but I do not think that there is a general downturn. Seven of our projects have stopped due to the California Coastal Commission and Los Angeles County restrictions.

—3-person firm in the West, residential specialization

Current workload is consistent with last year, but inquiries have slowed down. Payments from clients have slowed considerably to an average of 90 to 120 days.

—9-person firm in the Northeast, commercial/industrial specialization

The Rocky Mountain west is “rockin.” Firms are busy in all market sectors.

—35-person firm in the West, mixed specialization

Firms have to pick and choose projects because of a shortage of experienced workers to take on the incoming work.

—13-person firm in the South, institutional specialization.

Summary:

Summary: