| work-on-the-boards Business Conditions Hold Steady in April Life-cycle cost savings are top green motivators

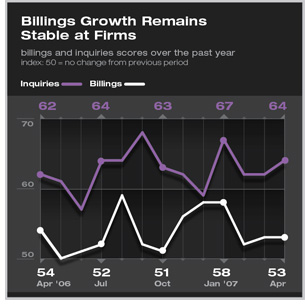

Business conditions at architecture firms remained stable in April, with the AIA Architecture Billings index (ABI) score of 52.7. The ABI has remained relatively unchanged for the last three months, but since any score above 50 indicates revenue growth, there is no cause for concern. In fact, it still seems likely that strong billings will continue for the foreseeable future. Inquiries for new projects have also remained positive for the last several months. Most firms are reporting that they are still very busy, which also bodes well for the summer months ahead.

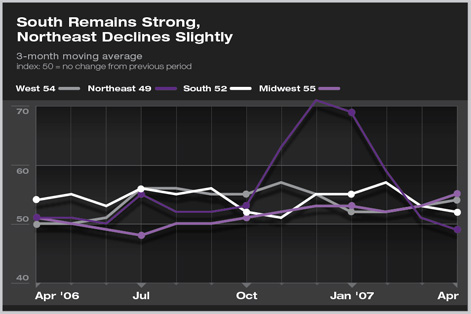

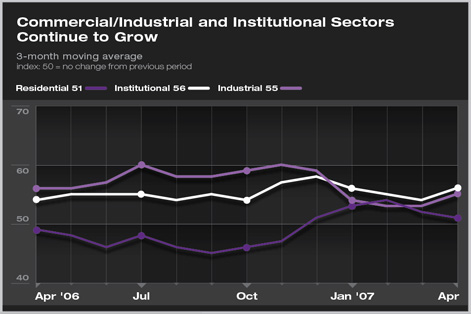

Regionally, conditions in the Northeast continue to moderate after their spike earlier in the year. Firms in the Northeast reported a slight decline in billings in April, the first in more than three years. The late arrival of winter, followed by a delayed start of spring, may be partially to blame for this. The other three regions have all been fairly stable for the first four months of the year, with scores in the low 50s showing steady growth. Growth in the South has been sustained the longest, with no decline in billings reported for nearly five years. Firms that specialize in the commercial/industrial and institutional sectors showed the strongest growth in April. The firms in our panel with a residential focus continue to see some degree of growth after declining for much of the past year, but there is still no definitive sign of a residential rebound on the horizon.

Broader economy still weak Cost savings a top green motivator

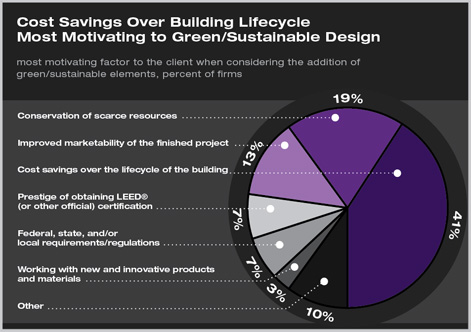

Of that group, nearly half (41 percent) considered costs savings over the lifecycle of the building to be the most motivating factor when considering the addition of green/sustainable elements to a project, followed by one fifth who indicated that conservation of scarce resources was the most important consideration, and 13 percent who indicated the improved marketability of the finished project. |

||

Copyright 2007 The American Institute of Architects. All rights reserved. Home Page |

||

news headlines

practice

business

design

Recent Related

› Business Conditions Stabilize at Firms in Traditionally Busy Spring Season

› Return of Cold Weather Dials Billings, Inquiries Down a Notch

› Billings Should Rise in Early 2007

› Year-End Figures Confirm an Upturn in Architecture Firm Business

This month, Work-on-the-Boards participants are saying:

Requests for architectural design services have been steady since the first of the year. This year has been different from the recent past; business decision makers have more confidence to make the progressive decision to move forward with their projects.

—2-person firm in the Midwest, commercial/industrial specialization

Health care is strong, but large firms are now competing against us for health-care work, which they seemingly used to not bother with.

—8-person firm in the South, institutional specialization

We’re told the residential real-estate market is severely depressed. People can’t sell their homes so they’re not moving up to the next level.

—2-person firm in the Northeast, mixed specialization

Our national market sector continues to grow, but we constantly have to advocate progress on the project. Inflation in energy, raw materials, and labor is still a concern, particularly in the Northwest.

—32-person firm in the West, mixed specialization.

Summary:

Summary: