| work-on-the-boards National Credit Market Problems Spill over into Nonresidential Sector While business conditions at firms remain healthy, over one in five report that recent credit situation has affected current projects

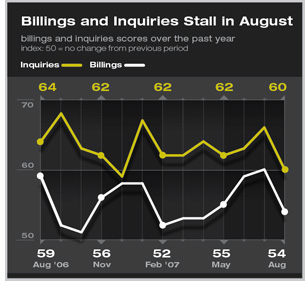

National credit markets grew very volatile in early August as investors became concerned about growing default rates among borrowers in the subprime residential market. Although this problem was concentrated among subprime borrowers (borrowers considered to be higher credit risks), there have been reports of credit becoming more restricted for a much broader range of construction projects. This is occurring while commercial mortgage delinquency rates remain near historic lows, according to commercial broker Marcus and Millichap. Although tightening in lending did slow work on some projects at architecture firms, conditions remained relatively healthy overall, with the AIA Architecture Billings Index recording a 53.9 score in August, down from 60.0 in July. Inquiries for new projects also showed slower growth in August, with the inquiries slowing to 60.5 in August, down from 66.2 in July, and at its lowest level of the year.

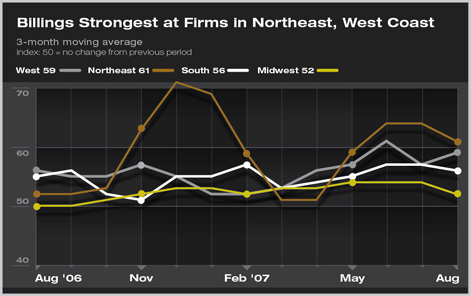

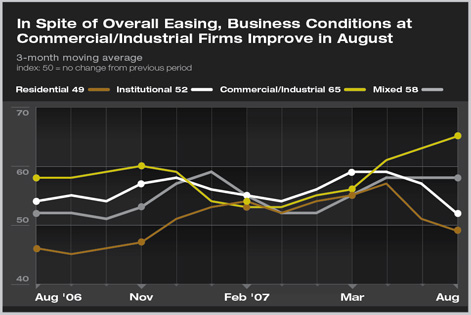

Billings at firms in the Northeast remained very strong, but dipped a bit from July levels. Firms in the West reported some acceleration of business activity during the month. Firms in the Midwest and South reported healthy but easing levels of activity. Commercial/industrial firms reported very strong levels of billings growth, while institutional firms reported easing growth levels. Residential firms noted their first decline in billings since late 2006, no doubt in large part due to the credit restrictions in that sector. Broader economy stumbles

Consumers seem spooked by recent events, as the University of Michigan’s consumer sentiment reading dropped in August, and the preliminary September reading shows no meaningful improvement. Many economic forecasters feel that the possibility of a national economic recession has increased recently. Modest effect on most architecture firms

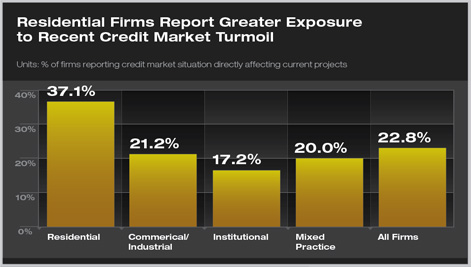

Respondents were also asked whether any projects at their firm had been directly affected by the credit market problems. Between a fifth and a quarter of firms reported that it had affected projects already. Again, residential firms reported the highest share that had faced problems (37 percent), while just one-fifth of commercial/industrial firms and 17 percent of institutional firms had been directly affected. Smaller firms were more likely to report projects being directly affected (31 percent of firms with annual billings under $1 million) than larger firms (17 percent of firms with annual billings over $1 million). |

||

Copyright 2007 The American Institute of Architects. All rights reserved. Home Page |

||

home

news headlines

practice

business

design

Recent Related

› July Upturn Adds to Solid Summer Performance at Architecture Firms

› June Brings Strong Growth to All Regions

› Firms Report an Upturn in May

This month, Work-on-the-Boards participants are saying:

Clients are becoming more cautious because of difficulty in having financing committed. Some projects are being put on hold temporarily following the planning or schematic stage until financing is secured.

—24-person firm in the South, residential specialization

The Seattle metro area is beginning to cool off on the private sector side. Getting public projects (schools, in particular) completed on schedule is difficult when there is a shortage of people to do the work.

—34-person firm in the West, commercial/industrial specialization

The situation in Florida is even worse because the new state tax laws have caused governments at all levels to cancel or shelve projects indefinitely due to lack of capital funding.

—11-person firm in the South, mixed specialization

We have reached a dangerously low availability of tradespeople, and have seen construction prices taking a spike up due to volume of commercial/public construction under contract.

—13-person firm in the Midwest, commercial/industrial specialization.

Summary:

Summary: