| work-on-the-boards Firms Report an Upturn in May As development continues, government expands mechanisms to manage and control growth

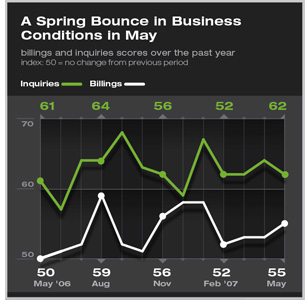

The AIA’s Architectural Billings Index (ABI) jumped to 55.0 in May, after remaining between 52 and 53 for the previous three months. Any score above 50 indicates an increase in design activity. Inquiries for new work scored 62.4, just about on par with readings for the past few months.

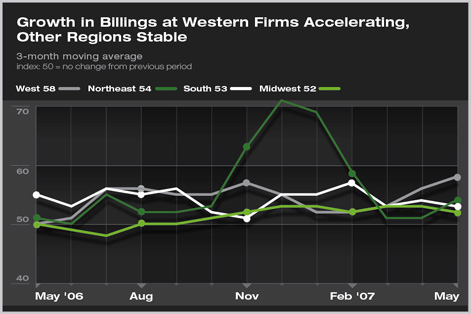

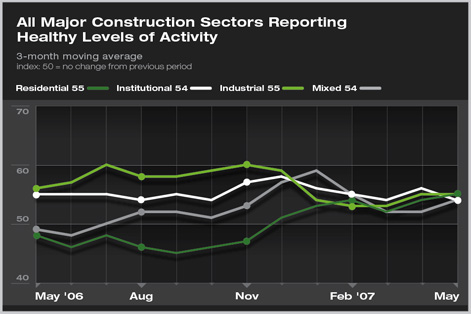

Business conditions in all regions were reported to be improving at a reasonable pace for the month. The one exception to this trend was reported by firms in the West, which indicated that conditions were improving at a much faster pace. Design activity in this region has been accelerating for the past three months. Likewise, design activity in all the major construction sectors was reported to be growing. While the commercial/industrial and institutional markets are in the midst of a major extended upturn, the residential markets remain very weak by most accounts. Architecture firms are recently reporting stabilization in residential design activity, in part because design activity at firms is concentrated in multifamily structures, a sector of the residential market that recently has begun to show signs of firming. General improvement in the economy

In fact, the recent uptick in the economy, higher energy costs, and other inflationary fears have nudged up long-term interest rates. The 10-year Treasury bond rate is currently about 5.25 percent, up 50 basis points from the May average, and at its highest level since early 2002. Higher interest rates will have direct effect on construction activity, increasing financing costs for nonresidential projects and mortgage rates for home buyers. Managing growth by varied means

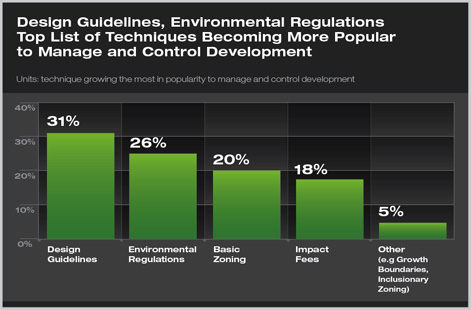

Firms in the Northeast and Midwest were more likely to indicate that basic zoning was increasing the most in popularity by municipal government. Firms in the South and West were most likely to mention design guidelines. Impact fees were more likely to be mentioned by firms in the West, while environmental regulations were mentioned about equally by firms in all regions. |

||

Copyright 2007 The American Institute of Architects. All rights reserved. Home Page |

||

news headlines

practice

business

design

Recent Related

› Business Conditions Hold Steady in April

› Business Conditions Stabilize at Firms in Traditionally Busy Spring Season

› Return of Cold Weather Dials Billings, Inquiries Down a Notch

› Billings Should Rise in Early 2007

This month, Work-on-the-Boards participants are saying:

Business is still good in this area and it is very hard to get qualified people to work in the office.

—60-person firm in the Northeast, commercial/industrial specialization

Projects being put on hold to evaluate additional funding as costs are escalating.

—26-person firm in the Midwest, institutional specialization

Since our community is considering blanketing our town with new historic preservation districts, a moratorium has been declared on building permits affecting any exterior construction. That has shut down half our workload for the past month.

—18-person firm in the South, mixed specialization

The housing sector is down significantly, but most architecture firms doing housing remain busy, retooling housing production to make it more efficient and affordable.

—7-person firm in the West, residential specialization.

Summary:

Summary: