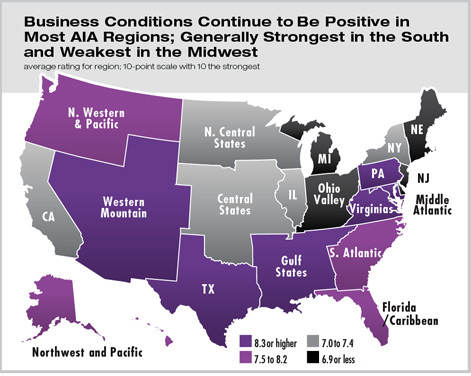

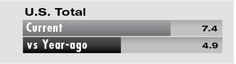

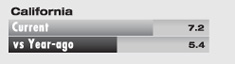

AIA Component Leaders Upbeat on Business Environment Summary: 2006 is winding down as a good year for architecture firms throughout the country. Business conditions are generally very healthy, with leaders in almost every AIA region indicating that they are at least solid, and many rating them as very strong. Leaders in most regions rate conditions as at least as good as a year ago, and in most cases better, with the resurgence of commercial/industrial and institutional design projects. Given favorable business conditions in most regions, architectural positions are generally in high demand, particularly for architects with 3 to 10 years of experience. These are some of the key findings from the AIA 2006 Component Survey of Business Conditions. In the fourth quarter of the year, component leaders and executives from all the AIA regions comment on conditions in their area in an effort to identify those regions with the strongest business conditions, as well as areas where architecture staff positions are in greatest need. Business conditions favorable in most AIA regions On a 10-point scale, with 1 being “terrible” and 10 being “couldn’t be better,” component leaders rated business conditions as a 7.4 on average nationally, with 7 of the 18 regions rated very positive with an 8.0 or higher score. Four regions in the South averaged scores of 8.0 or higher (Texas, Gulf States, the Virginias, and South Atlantic) as did two in the Northeast (Middle Atlantic and Pennsylvania), and one in the West (Western Mountain). In general, AIA regions in the Midwest had ratings below the national average. Business conditions were rated somewhat improved from a year-ago on average. On a 10-point scale, with 1 being “much worse” and 10 being “much better,” component leaders rated this comparison as 5.9 on average. Three regions were rated as significantly improved from a year ago (Middle Atlantic, Gulf States, and Texas), while two were rated as somewhat worse than a year ago (Michigan and New Jersey). Most regions were rated as somewhat better than a year ago.

Architecture staff in demand

Both experienced and moderately experienced architecture positions are generally in high demand in most AIA regions. On average, component leaders rated the need for these positions just between “some need” and “great need.” For each position, areas with the greatest need are concentrated in regions with oil-based economies (Texas, Gulf States, and Western Mountain) and stronger Northeastern regions (Middle Atlantic and Pennsylvania). Michigan was the only region where leaders felt that there was limited need for these positions. Intern positions are generally in less demand than are architect positions, with average scores indicating “some need” from a national perspective. The Gulf States region was the only one indicating a “great need” overall. However, leaders in the Western Mountain region also indicated opportunities for interns in their area. Illinois and Michigan topped the list of regions with limited need for interns, with the Pacific and New England regions also expressing lower levels of need for these positions.

Nonresidential sectors uniformly positive

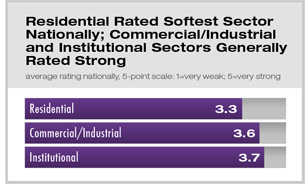

The health of the institutional construction was viewed comparably to commercial/industrial activity: healthy overall and in most AIA regions. Leaders in seven AIA regions rated this sector as at least “strong” (a 4.0 average or above on a 5-point scale), with Pennsylvania, Gulf States, Texas, and Central States rated as 4.3 or higher. Institutional construction tends to be less volatile than commercial/industrial activity, evidenced by the fact that only one region, Michigan, rated this sector below “moderate” on average.

|

||

Copyright 2006 The American Institute of Architects. All rights reserved. Home Page |

||

news headlines

practice

business

design

recent related

› Firms Report Steady Growth in October

› September’s Billings Up Modestly; Inquiries Much Stronger

› Firms Enjoy a Late Summer Surge

This year, components are saying:

Many are complaining that they cannot find enough good people to work for them, and that they cannot keep up with the workload

—Middle Atlantic region

Things are predicted to get worse in Michigan before they get better over the coming few years.

—Michigan region

In the Atlanta area there is a major need for good strong mid-level architects in most firms. Also, quite a few larger firms are practicing nationally and globally and in an expansion mode.

—South Atlantic region

In the Southwest, we are seeing a severe shortage of project architects and the prospects are not good that this will be remedied anytime soon.

—Western Mountain region

How the survey was conducted

The AIA national component has conducted a survey of business conditions in the AIA regions annually for the past nine years. This survey builds on a similar effort previously conducted among AIA components by the Boston Society of Architects for a number of years. This year’s survey was conducted September 28–October 11. Questionnaires were e-mailed to 638 component executives, presidents, and presidents-elect. 166 responses were returned, with multiple responses for each of the AIA regions. Regionally, figures were computed as the average of all responses submitted by respondents from that region.

A printer-friendly version of this article is available.

Download the PDF file.

However, architecture staffing needs vary quite considerably across AIA regions. For managers and senior managers, three AIA regions (Pennsylvania, California, and Illinois) report needs for these positions of 2.5 or greater on a 3-point scale. However, in spite of generally strong workloads, several AIA regions report limited need for managerial level staffing. In 10 regions, the average ranking for these positions was below 2.0 (indicating need somewhere between “no need” and “some need”) with Michigan, Florida/Caribbean, and the Virginias indicating the least need for these positions.

However, architecture staffing needs vary quite considerably across AIA regions. For managers and senior managers, three AIA regions (Pennsylvania, California, and Illinois) report needs for these positions of 2.5 or greater on a 3-point scale. However, in spite of generally strong workloads, several AIA regions report limited need for managerial level staffing. In 10 regions, the average ranking for these positions was below 2.0 (indicating need somewhere between “no need” and “some need”) with Michigan, Florida/Caribbean, and the Virginias indicating the least need for these positions.

Both the commercial/industrial and institutional sectors are generally rated as moderately strong by component leaders. The commercial/industrial sector had an average rating of 4.0 or higher on a 5-point scale in three AIA regions: Western Mountain, Gulf States, and Middle Atlantic. Only two regions had average ratings for this sector below 3.0: Michigan and New Jersey. All other AIA regions rated this sector somewhere between “moderately strong” and “strong” on average.

Both the commercial/industrial and institutional sectors are generally rated as moderately strong by component leaders. The commercial/industrial sector had an average rating of 4.0 or higher on a 5-point scale in three AIA regions: Western Mountain, Gulf States, and Middle Atlantic. Only two regions had average ratings for this sector below 3.0: Michigan and New Jersey. All other AIA regions rated this sector somewhere between “moderately strong” and “strong” on average.