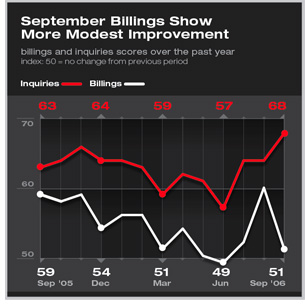

September’s Billings Up Modestly; Inquiries Much Stronger

Summary: Billings at architecture firms remained positive in September, although they slowed considerably from the spike in August. Commercial and industrial activity is strong, while residential remains weak. In the broader economy, although stocks have been soaring to new records and consumer sentiment is running high, business confidence and payrolls are down. And our Work-on-the-Boards survey participants indicate that increased activity means more of principals’ time spent on management and therefore fewer direct billable hours.

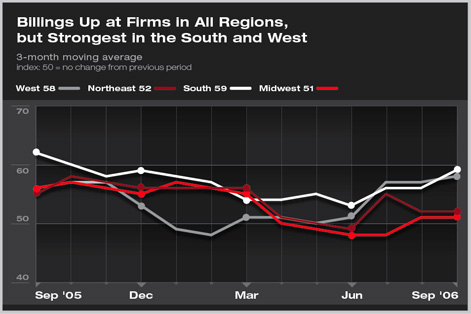

Over the past six months, the trend in the AIA’s Architectural Billings Index has been toward slower growth, compared to the stronger reading of 2005 and early 2006. However, even as the billings figures showed slower growth, inquiries for new projects jumped to one of the strongest readings ever, indicating that this construction expansion is not over yet. Regional design activity readings continue to be erratic. Firms in the South reported a strong upturn in design activity after several months of more moderate growth. Conversely, firms in the Northeast reported a slowing of growth in billings in September after stronger readings in recent months. Firms in the West have reported a steady acceleration in billings. Residential activity remains weak according to reports from residential firms, while commercial and industrial activity remains very strong. Recently, there has been improvement in billings activity at institutional firms, indicating broad strength throughout the nonresidential sector. However, as we get closer to the end of this nonresidential cycle, firms should more closely monitor client plans for future activity as well as commitment to current projects.

Falling oil prices in recent months have slowed the rate of inflation. Consumer prices and producer prices have both shown lower rates of growth recently, with more improvement likely to come as lower oil prices work their way through the economy. With the economy cooling and inflation concerns abating, the Federal Reserve Board is unlikely to raise short term interest rates in the near future. Odds are that the next move will be to lower rates, although that won’t happen until the economy slows even more. Management takes more of principals’ time

These added demands have limited the ability of principals and partners to bill time directly to projects. Overall, only 10 percent of firms report that these positions bill over 75 percent of their time to billable projects, with an additional 47 percent indicating that these positions bill between 50 percent and 75 percent of their time to projects. At firms with billings over $5 million a year, only a third report that principals/partners bill at least 50 percent of their time to projects, a figure that rises to over 70 percent for firms with billings of $1 million or less a year.

|

||

Copyright 2006 The American Institute of Architects. All rights reserved. Home Page |

||

news headlines

practice

business

design

recent related

› Firms Enjoy a Late Summer Surge

› Business Conditions at Architecture Firms Improve in July

› Weakness in Residential Sector Causes Firm Billings to Fall Again in June

› Business Levels Decline in May After Several Months of Softening

This month, Work-on-the-Boards participants are saying:

Projects being suspended because of substantial cost increases in construction.

—12-person firm in the South, residential

specialization

Less than last year’s pace, but steady.

—145-person firm in the West, commercial/industrial

specialization

The rise in interest rates has pushed a change in our housing from condos

to apartments. The institutional work continues apace.

—72-person firm in the South, institutional

specialization

It seems to be picking up in general. Large health-care projects are

underway in the area.

—19-person firm in the Midwest, institutional

specialization.

A

printer-friendly version of this article is available.

Download the PDF file.

Economy sends mixed signals

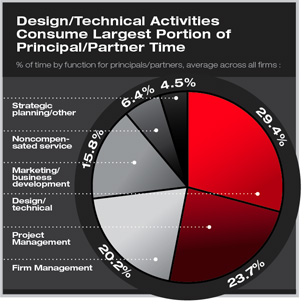

Economy sends mixed signals However, the list is very different when asked which activity has increased the most in terms of demands on their time in recent years. Here, marketing and business development top the list, with over a quarter of respondents indicating that this duty has grown the most in recent years in terms of time demands for principals and partners. Project management and firm management follow close behind, each with 23 percent of respondents indicating that this function has grown the most in terms of time demands in recent years. Design and technical activities is at the bottom of the list, with fewer than 8 percent of respondents selecting this responsibility as increasing the most.

However, the list is very different when asked which activity has increased the most in terms of demands on their time in recent years. Here, marketing and business development top the list, with over a quarter of respondents indicating that this duty has grown the most in recent years in terms of time demands for principals and partners. Project management and firm management follow close behind, each with 23 percent of respondents indicating that this function has grown the most in terms of time demands in recent years. Design and technical activities is at the bottom of the list, with fewer than 8 percent of respondents selecting this responsibility as increasing the most.