work-on-the-boards

Architecture Firm Billings Remain Relatively Weak

Project Backlogs at Firms Shrink to 3.9

Months

by Jennifer Riskus

AIA Economics Research Manager

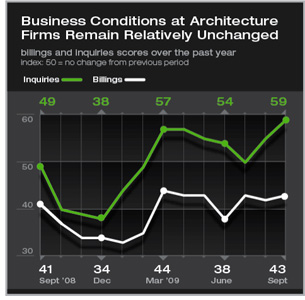

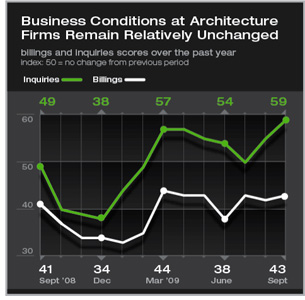

Summary: Despite

recording the highest inquiries score in two years, the Architecture

Billings Index remains mired in the low 40s, with a score of 43.1

reported in September. Architecture firm billings have been in this

vicinity for six of the last seven months, and have not yet shown

any clear signs of approaching 50, and an increase in billings. Business

conditions remain quite poor for many firms, with increasing numbers

indicating nonexistent project backlogs and insufficient billable

hours for current staff. Inquiries scores are still rising, but this

continues to be triggered by the increased competition for projects,

rather than actual increases in project activity. Summary: Despite

recording the highest inquiries score in two years, the Architecture

Billings Index remains mired in the low 40s, with a score of 43.1

reported in September. Architecture firm billings have been in this

vicinity for six of the last seven months, and have not yet shown

any clear signs of approaching 50, and an increase in billings. Business

conditions remain quite poor for many firms, with increasing numbers

indicating nonexistent project backlogs and insufficient billable

hours for current staff. Inquiries scores are still rising, but this

continues to be triggered by the increased competition for projects,

rather than actual increases in project activity.

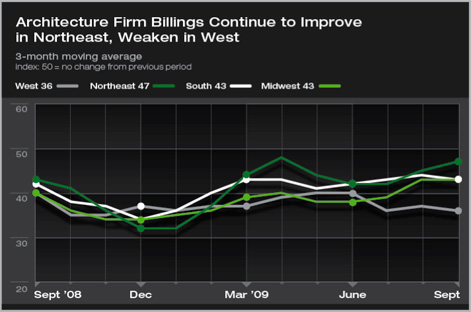

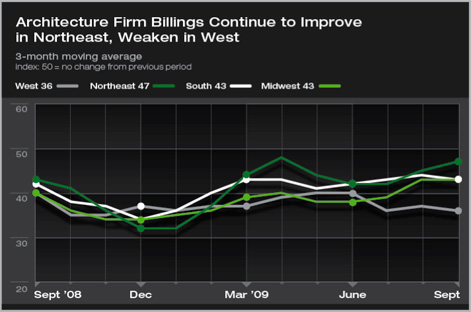

Business conditions remain weak in all regions of the country, with

firms in the West reporting the slowest conditions for the third

month in a row. While a higher share of firms in the Northeast are

reporting improving billings than they did several months ago, the

score remains below 50, indicating that firms with declining billings

still outweigh those reporting improving billings.

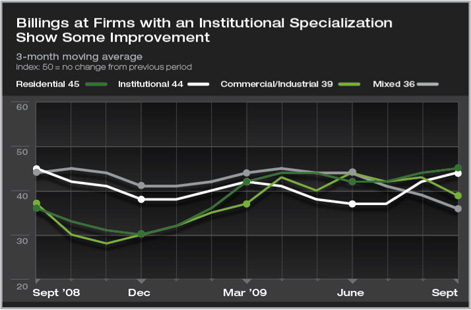

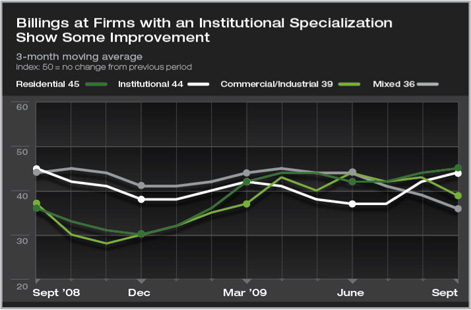

By sector, firms with a commercial/industrial and institutional

specialization continue to report the weakest business conditions.

Firms with a residential specialization reported their highest score

in more than two and a half years in September, as the demand for

housing finally seems to be rebounding.

Despite the fact that payroll employment continues to decline (263,000

jobs were lost in September alone), the pace of the losses is much

slower than it was earlier this year and at the end of 2008, when

nearly three times that many jobs were being shed each month. However,

architecture firm employment continues to decline as a part of this

contraction, and fell to 188,300 in August (the most recent data

available). This is down 16 percent from the most recent peak of

224,500 in July 2008. However, in line with the fact that many believe

the recession has already ended, the Reuters/University of Michigan

Index of Consumer Sentiment rebounded to 73.5 in September, the highest

level it has reached since early 2008. But the nascent recovery continues

to be hampered by weak consumer finances and rising unemployment,

a trend that is not expected to reverse until sometime next year.

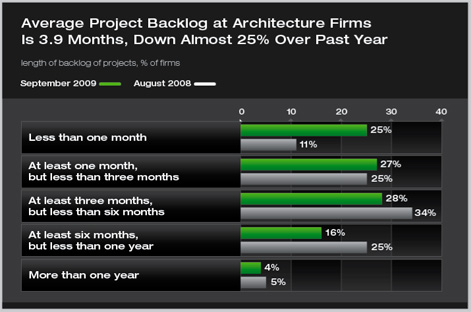

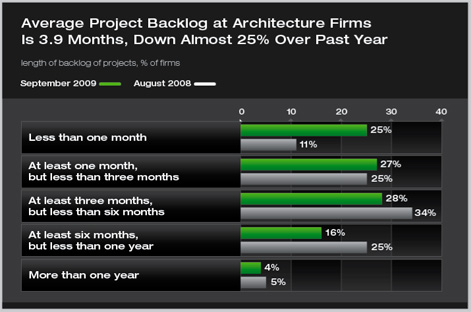

As the economy has faltered, so too has the backlog of projects

at architecture firms declined in the last year. Project backlog,

the amount of work in house and under contract, has fallen from 5.1

months in August 2008 to just 3.9 months in September 2009. More

than half of survey respondents (52 percent) report backlogs of less

than three months with just one-fifth reporting backlogs of six months

or longer. Large firms, with more than $5 million in annual billings,

report the longest current backlogs, 5.7 months, compared to just

over three months for firms with annual billings of less than $1

million. Firms with an institutional specialization also report more

substantial backlogs; at 5.7 months they are averaging double those

found at firms with a residential or commercial/industrial specialization.

In addition, two-thirds of respondents indicated that backlogs at

their firm are lower now than they were at the beginning of the year;

15 percent report that they have been relatively unchanged during

that time while, 18 percent indicate that backlogs are higher now.

However, many firms indicated anecdotally that they have very low

confidence in their current backlogs, and that they could change

at any time, due to the lack of available credit, and projects not

advancing beyond the design phase, among other reasons. |