work-on-the-boards

Increased Inquiries Are Not Yet Translating to More Work

Three quarters of firms impacted by tight credit market

by Jennifer Riskus

Manager, Economic Research

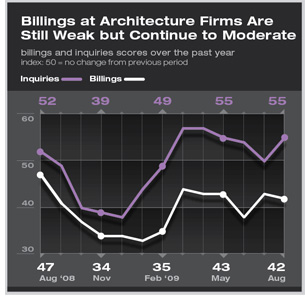

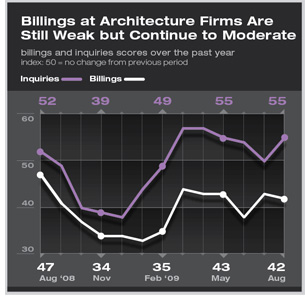

Summary: With a score of 41.7, the AIA’s Architecture Billings Index (ABI) for August was little changed from July. Business conditions at architecture firms remain weak, with the share of firms reporting declining billings still higher than the share of firms that saw billings increase in August. Since the ABI rebounded from all-time low scores earlier this year to scores regularly in the low 40s, it has stalled and not moved any higher. Conditions at firms are better now than they were last winter, but a recovery is not yet imminent. Inquiries, on the other hand, remain relatively strong, with a score over 50 in August for the sixth month in a row. However, architecture firms continue to report that clients are shopping projects around, meaning that firms are seeing many inquiries but few are translating into actual billable work. Summary: With a score of 41.7, the AIA’s Architecture Billings Index (ABI) for August was little changed from July. Business conditions at architecture firms remain weak, with the share of firms reporting declining billings still higher than the share of firms that saw billings increase in August. Since the ABI rebounded from all-time low scores earlier this year to scores regularly in the low 40s, it has stalled and not moved any higher. Conditions at firms are better now than they were last winter, but a recovery is not yet imminent. Inquiries, on the other hand, remain relatively strong, with a score over 50 in August for the sixth month in a row. However, architecture firms continue to report that clients are shopping projects around, meaning that firms are seeing many inquiries but few are translating into actual billable work.

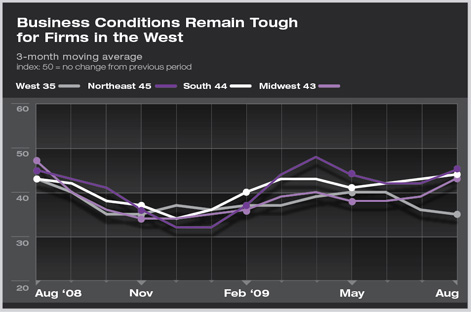

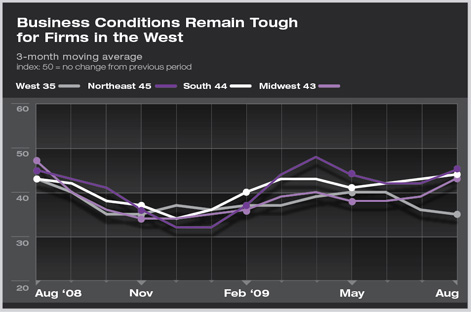

Scores rose in all regions of the country in August with the exception of the West. The other three regions are reporting some of the highest scores in a year, reflecting a degree of emerging optimism. On the other hand, it looks to be a tougher recovery for firms located in the West. The West was the first region to report scores below 50 when the recession began and conditions continue to weaken there even now as other regions begin to improve. Any score below 50 indicates a downturn from the previous month.

Firms with a commercial/industrial specialization have been reporting increasingly higher scores since mid-spring, as have firms with a residential specialization. Fewer firms in both sectors are now reporting declining billings than they did last winter when their all-time lowest scores were recorded. Business conditions remain weakest at firms with an institutional specialization, with little recovery anticipated in the near future.

Recession most likely over

Reports continue to come in indicating that the recession is most likely over. In the Federal Reserve’s most recent Beige Book, 11 of the 12 districts reported that conditions in their district were improving or had stabilized recently. Home prices ceased falling in the Dallas and New York districts and residential construction began to grow again in the Chicago and Dallas districts. However, demand for commercial space remains low and weakness persists in the nonresidential construction sector. On the other hand, public construction has begun to increase in the Chicago, Cleveland, and Minneapolis districts. The Bureau of Labor Statistics reports that nonfarm payroll employment continues to decline and unemployment is still rising, climbing to 9.7 percent in August. Although the monthly declines in both total employment and construction employment have lessened substantially since the beginning of the year, there is still no sign of growth on the horizon.

Despite reports of improving economic conditions, architecture firms continue to be heavily impacted by the recession. Nearly three quarters of ABI panelists (74.4 percent) report that their firms have been impacted by problems in credit markets over the past year. Firms in the Northeast were least likely to report feeling an impact (65.4 percent), as were small firms with annual billings of less than $250,000 (60.6 percent). Firms with a commercial/industrial specialization were far more likely to have been impacted by problems in credit markets (86.0 percent) than firms with a residential (73.4 percent) or institutional (65.6 percent) specialization.

As such, of those firms that have been impacted by problems in credit markets, commercial/industrial projects have been the hardest hit by far. Of respondents, 75 percent indicated that these projects had felt a significant impact from credit market problems, and an additional 23 percent reported feeling a moderate impact. This stands in stark contrast to healthcare projects where only 31 percent reported a significant impact, and education projects, with 28 percent indicating a significant impact. Firms also reported little evidence that problems in credit markets have eased recently. Just one quarter of respondents who have been impacted by problems in credit markets indicated that there has been any degree of easing for commercial/industrial projects, in contrast to more than a third of firms having seen an easing for healthcare projects and 32 percent of firms reporting the same for education projects. |

Summary:

Summary: