work-on-the-boards

Pace of Decline in Billings at Architecture Firms Slows in July

Share of firms reporting work derived from federal stimulus funding grows

by Jennifer Riskus

AIA Economics Research Manager

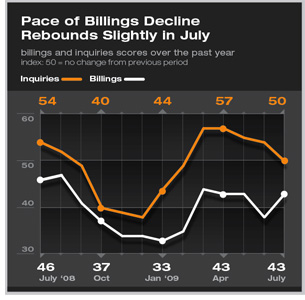

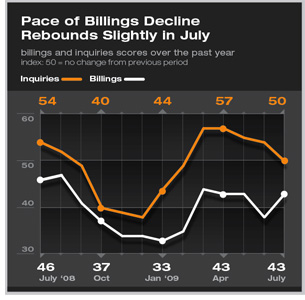

Summary: Following a significant decline of more than five points in June, the AIA’s Architecture Billings Index (ABI) in July returned to a score comparable with what had been reported during the three previous months, 43.1. Although this score continues to indicate that more architecture firms are seeing firm billings decline than are seeing increasing billings, the slowdown moderated in July. The index is likely to continue to fluctuate for the next few months as the economy begins to stabilize from the recession that began in early 2008. In another positive sign, the inquiries index remained above 50 for the fifth month in a row, indicating that there continues to be some interest in new projects. However, the score of 50.3 was the lowest reported since February. Summary: Following a significant decline of more than five points in June, the AIA’s Architecture Billings Index (ABI) in July returned to a score comparable with what had been reported during the three previous months, 43.1. Although this score continues to indicate that more architecture firms are seeing firm billings decline than are seeing increasing billings, the slowdown moderated in July. The index is likely to continue to fluctuate for the next few months as the economy begins to stabilize from the recession that began in early 2008. In another positive sign, the inquiries index remained above 50 for the fifth month in a row, indicating that there continues to be some interest in new projects. However, the score of 50.3 was the lowest reported since February.

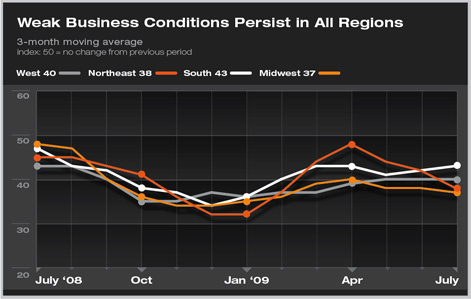

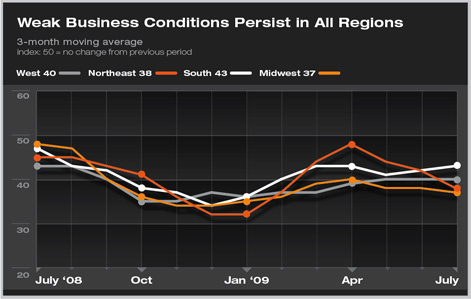

Business conditions remain depressed in all regions of the country. No region has reported a score above 50 in more than a year and it has been since January 2008 that two or more regions indicated improving business conditions in the same month. (An ABI score below 50 indicates a decline in billings or inquiries.) The highest score for July could be found at architecture firms in the South for the second month in a row, while firms located in the Midwest had the lowest score for the third consecutive month.

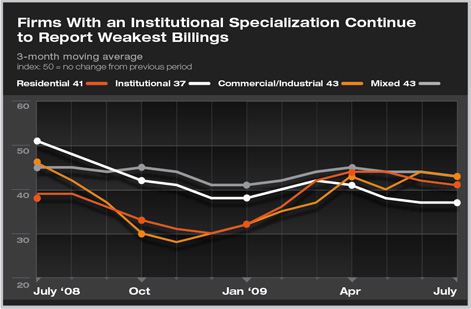

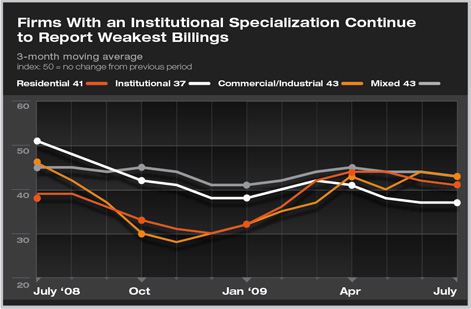

In addition, weakness persists across the board at all types of firms. Billings scores declined in July at both firms with a residential and commercial/industrial specialization and increased by only a fraction at firms with an institutional specialization. Firms with the majority of their billings from institutional projects reported the lowest score for the fourth month in a row, indicative of the pervasive weakness in that sector. Luckily, some residential and commercial/industrial projects are starting to pop back up to help fill the void left by the receding institutional market.

Despite all this, more and more signs are appearing that the broader economy may be starting to emerge from the recession. Payroll employment declined by just under 250,000 in July, much lower than the losses in the previous months. While construction employment also continues to decline, the loss of 76,000 jobs in July was about one third lower than the recent monthly losses. In addition, preliminary data indicate that the GDP declined at an annual rate of 1.0 percent during the second quarter of 2009, a vast improvement over the decline of 6.4 percent in the first quarter. However, consumers are still cautious, with unemployment remaining high (9.4 percent), and retail spending declining by 0.1 percent in July, after reporting gains during the two previous months. There is still a long way to go.

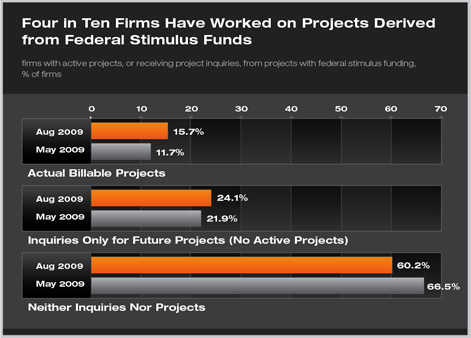

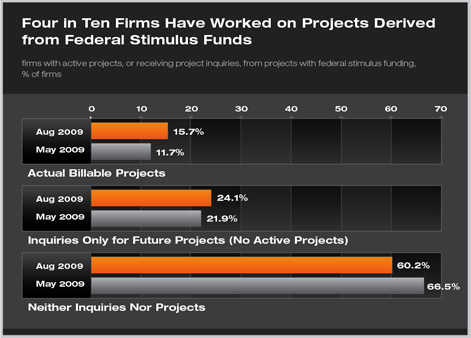

Work resulting from the American Recovery and Reinvestment Act (the federal stimulus plan) is reaching more architects now than earlier this year. In response to this month’s special question, 4 in 10 of the ABI panelists reported having received some degree of interest in projects related to stimulus funding; with more than 15 percent indicating that they have received actual billable work from the stimulus plan. Additionally, just under a quarter (24 percent) having received inquiries for future projects from stimulus funds. This is up by six percentage points from May when 34 percent of respondents indicated they had received some degree of interest. Large firms with annual billings of $5 million or more were more than twice as likely as smaller firms to have already received billable work from the stimulus plan (28 percent of firms versus 12 percent).

Our survey panelists also reported that stimulus projects tend to differ from other projects they have worked on recently in several significant ways. More than half indicated that projects derived from stimulus program funding have more competition from other firms (60 percent), involve more rules and regulations from the client (55 percent), and are more likely to be renovations/rehabilitations of existing facilities than new construction (53 percent). These projects have a longer turn around time from inquiries to billings, report 49 percent of firms, and 46 percent have found that they have more design-build requirements. Projects derived from stimulus program funding also tend to be less profitable (38 percent) and are smaller in terms of cost and size (26 percent). |

Summary:

Summary: