work-on-the-boards

Architecture Firm Billings Decline Sharply in June

by Jennifer Riskus

AIA Economics Research Manager

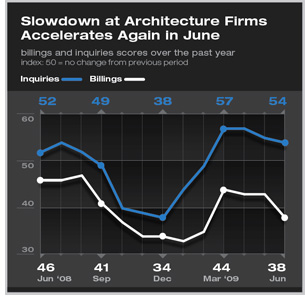

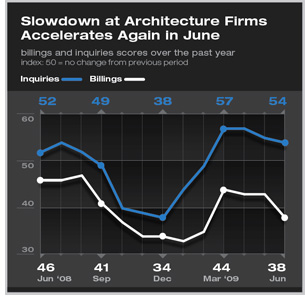

Summary: After three months of holding steady, the ongoing slowdown in business conditions at architecture firms accelerated again in June. The Architecture Billings Index (ABI) score fell to 37.7, its lowest point since February, indicating that the downturn may be more deeply entrenched than anticipated. Summary: After three months of holding steady, the ongoing slowdown in business conditions at architecture firms accelerated again in June. The Architecture Billings Index (ABI) score fell to 37.7, its lowest point since February, indicating that the downturn may be more deeply entrenched than anticipated.

It has now been 18 months since the ABI has reported a score above 50. (ABI scores above 50 indicate growth; a score below 50 indicates decline.) On the other hand, the index of inquiries into new projects had a score of 53.8 this month, marking the fourth consecutive month that growth has been reported. While this is an encouraging sign, business will continue to be tough until these inquiries turn into actual billable work.

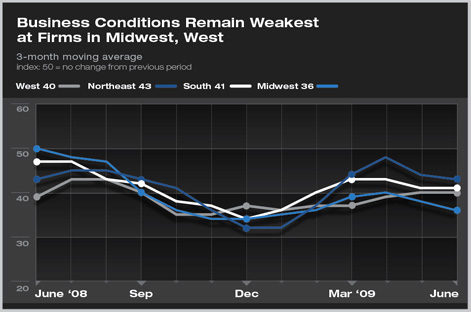

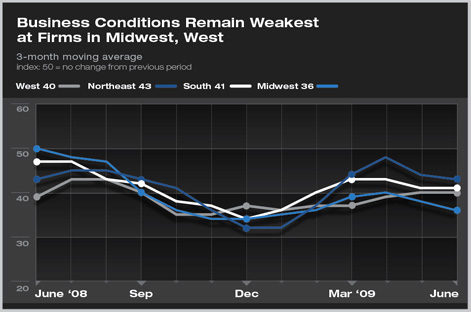

Business conditions remained weak in all regions of the country in June, with firms in the Midwest and West continuing to report the steepest declines. However, businesses located in the West have seen a slightly slower pace of decline for the last three months.

For the third month in a row, billings showed their largest drops at firms with an institutional specialization. Business conditions at residential firms have moderated since the all-time low score recorded last December, but continue to indicate a decline in billings.

Despite some signs of life during the last few months, the overall economy remains weak as well. Employment continues to decline each month, with payrolls declining by 467,000 jobs in June. The construction industry remains particularly soft and shed 79,000 jobs this month. In addition, the unemployment rate remains high at 9.5 percent, although it was relatively unchanged from May. The latest issue of the Federal Reserve’s Beige Book, released in mid-June, continues to show widespread weakness in commercial real estate, accompanied by rising vacancy rates. Major new construction projects have been cancelled in the Atlanta, Chicago, and St. Louis regions, while the number of new projects has declined significantly in the New York, Philadelphia, and Minneapolis regions. But in some more positive news, the Consumer Sentiment Index continued its rebound in June, reaching a score of 70.8, after the most recent cyclical low of 55.3 last November. The economy may be recovering more slowly than they would like, but consumers are starting to feel slightly better.

This month’s special question asked our panelists to provide an update on their firm’s business-related concerns for the remainder of 2009. The two issues that were identified as the biggest concerns—finding new projects/markets/clients and coping with a weak economy—are the same two issues that were mentioned most frequently in December 2008 as the biggest concerns for the coming year. However, now nearly half of the survey respondents (47 percent) indicated that identifying new projects/markets/clients was their biggest concern, compared to 36 percent six months ago. On the other hand, the share of firms most concerned about coping with a weak economy fell from 34 percent in December to 22 percent in June.

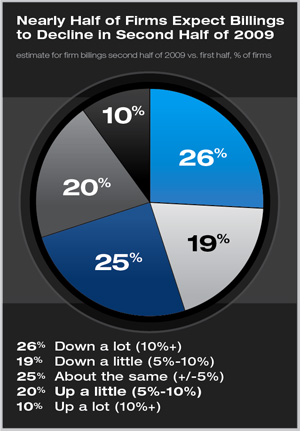

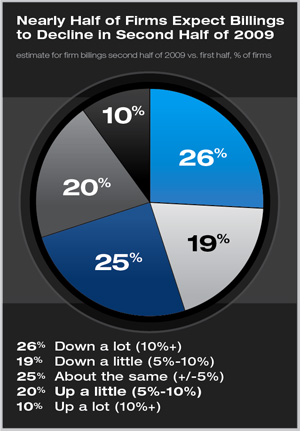

When asked to compare anticipated firm billings for the second half of 2009 to the first six months of the year, the response was overwhelmingly negative, with nearly half of firms (46 percent) indicating that they expect billings to decline. Fewer than one third of firms (30 percent) believe that billings will increase in the second half of the year, and 25 percent anticipate that they will remain at the same level where they are currently. Firms located in the Midwest and the West were most negative, with 53 percent and 49 percent respectively indicating that they expect billings to decline further. Firms with an international focus, which are typically larger, were most optimistic; 43 percent indicated that they expect billings to rise in the next six months, in comparison to the first six months of the year. When asked to compare anticipated firm billings for the second half of 2009 to the first six months of the year, the response was overwhelmingly negative, with nearly half of firms (46 percent) indicating that they expect billings to decline. Fewer than one third of firms (30 percent) believe that billings will increase in the second half of the year, and 25 percent anticipate that they will remain at the same level where they are currently. Firms located in the Midwest and the West were most negative, with 53 percent and 49 percent respectively indicating that they expect billings to decline further. Firms with an international focus, which are typically larger, were most optimistic; 43 percent indicated that they expect billings to rise in the next six months, in comparison to the first six months of the year.

|

When asked to compare anticipated firm billings for the second half of 2009 to the first six months of the year, the response was overwhelmingly negative, with nearly half of firms (46 percent) indicating that they expect billings to decline. Fewer than one third of firms (30 percent) believe that billings will increase in the second half of the year, and 25 percent anticipate that they will remain at the same level where they are currently. Firms located in the Midwest and the West were most negative, with 53 percent and 49 percent respectively indicating that they expect billings to decline further. Firms with an international focus, which are typically larger, were most optimistic; 43 percent indicated that they expect billings to rise in the next six months, in comparison to the first six months of the year.

When asked to compare anticipated firm billings for the second half of 2009 to the first six months of the year, the response was overwhelmingly negative, with nearly half of firms (46 percent) indicating that they expect billings to decline. Fewer than one third of firms (30 percent) believe that billings will increase in the second half of the year, and 25 percent anticipate that they will remain at the same level where they are currently. Firms located in the Midwest and the West were most negative, with 53 percent and 49 percent respectively indicating that they expect billings to decline further. Firms with an international focus, which are typically larger, were most optimistic; 43 percent indicated that they expect billings to rise in the next six months, in comparison to the first six months of the year.