work-on-the-boards

Business Conditions at Architecture Firms Largely Unchanged in May

Architects see stimulus program projects generally promoting emerging design trends

by Kermit Baker, PhD, Hon. AIA

AIA Chief Economist

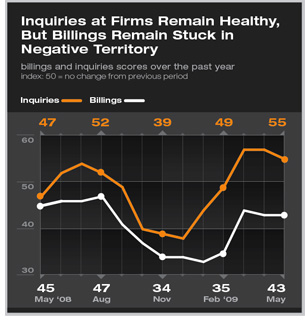

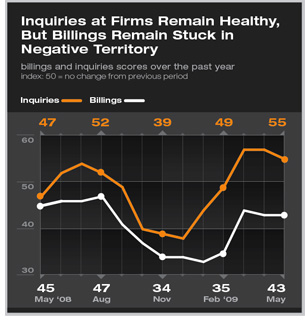

Summary: The path toward recovery in design activity has stalled recently. After a significant moderation in the downturn in design billings in March, the AIA’s Architecture Billings Index (ABI) has failed to show any further hopeful signs in April or May. The ABI score from May was 42.9, barely moving the needle from the 42.8 score in April. Since any score below 50 reflects an overall decline in billings, the May reading indicates that business conditions at architecture firms are still deteriorating, and that there was no significant movement toward recovery during the month. Summary: The path toward recovery in design activity has stalled recently. After a significant moderation in the downturn in design billings in March, the AIA’s Architecture Billings Index (ABI) has failed to show any further hopeful signs in April or May. The ABI score from May was 42.9, barely moving the needle from the 42.8 score in April. Since any score below 50 reflects an overall decline in billings, the May reading indicates that business conditions at architecture firms are still deteriorating, and that there was no significant movement toward recovery during the month.

In contrast, inquiries for new project activity remain very encouraging. The inquiries score for May was just over 55, the third straight month that the inquiries index has been in the mid-50s level. However, the fact that favorable levels of inquiries have not yet generated an increase in billings at firms may point to a change in how clients are searching for design services. Several respondents to this month’s survey noted that they are seeing more competition for projects and feel that many clients are casting a wider net in looking for bidders on design projects, which may generate more inquiries for firms but not necessarily more work.

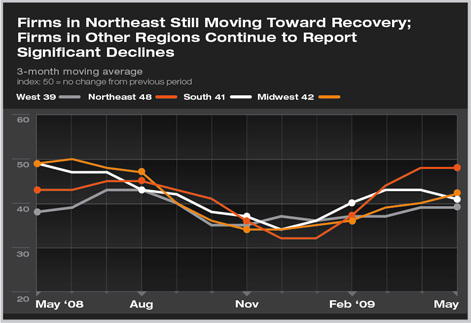

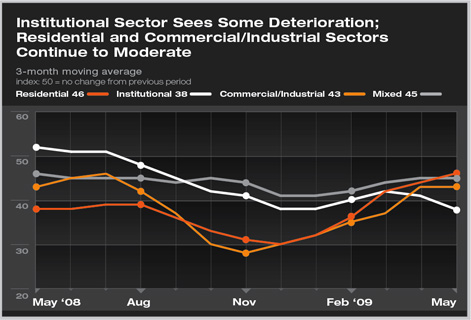

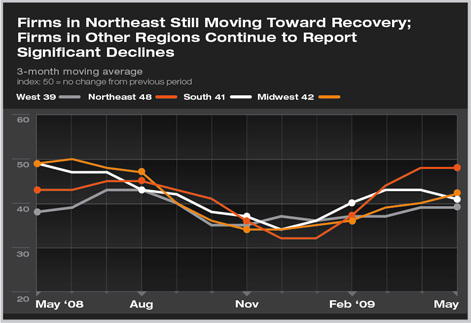

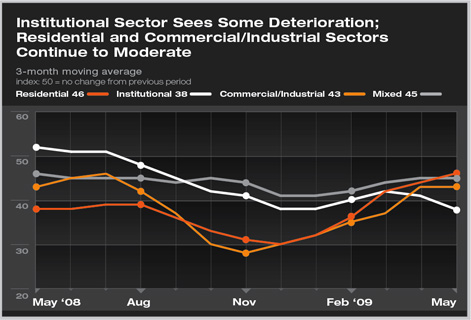

Regionally, firms in the Northeast are reporting the most optimistic signs in business conditions. Firms in this region had the weakest billings scores as recently as January, but have shown steady improvement since then and are poised for modest growth if current trends continue. In contrast, firms in other regions have shown no meaningful positive movement over the past two months. Additionally, residential and commercial/industrial firms have shown recent trends toward a moderation in the downturn. Institutional firms, in contrast are still reporting deteriorating business conditions.

A few positive notes, but economy still weak

There are a few emerging signs of optimism in the economic outlook in spite of the overall generally gloomy current business conditions. Consumer sentiment has risen sharply since hitting a low in February, with the University of Michigan Consumer Sentiment Index up almost 13 points to 69.0 with the preliminary June reading. The housing market apparently is slowly beginning a recovery. Housing starts increased 17 percent in May on a seasonally adjusted basis, although most of the gain was on the more volatile multifamily side. Still, single-family homebuilding has increased every month from its low this past February, and currently is up more than 12 percent (seasonally adjusted) over this period.

While the economy does seem to be improving, there are several indicators pointing to more weakness before the economy finally moves into a recovery mode. Payroll losses totaled 345,000 nationally in May, well below average of the first four months of the year, but significant nonetheless. Construction payrolls declined 59,000 that month. Employment at architecture firms was down 2,000 in April (the most recent month available) bringing losses to almost 22,000 from April 2008, and 31,000 from their high in July 2008. Through April, architecture firms have therefore reduced their payrolls by almost 14 percent. In contrast, throughout the broader economy payrolls have declined only 4.3 percent since the recession began at the end of 2007.

Stimulus projects help revive key design trends

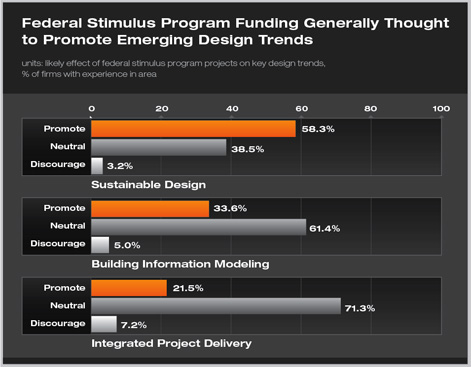

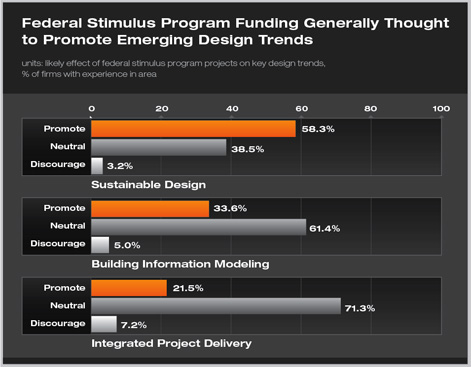

Many key design trends have been slowed by the deep economic recession. A quarter of architecture firms feel that the downturn has reduced interest in building information modeling (BIM), about one in five feel that it has reduced interest in sustainable design, and almost one in six point to less interest in integrated project delivery (IPD).

However, as federal stimulus funded projects slowly begin to cushion the decline in construction and rehabilitation activity, architects are generally optimistic that interest in these trends will be rekindled. Given that one of expressed goals of the federal stimulus program was to help develop a green economy, it’s not surprising that almost 60 percent of architects feel that stimulus projects are likely to promote sustainable design, while only 3 percent feel that it will discourage activity in this area. Residential firms in particular are optimistic that stimulus funding will increase the opportunities for sustainable design.

With the emerging interest of many federal departments in requiring BIM for their projects, a third of firms feel that stimulus projects will encourage the more widespread use of BIM, while only 5 percent expect that these projects will discourage it. Larger firms are somewhat more likely to feel that federal stimulus funding will promote BIM.

There is less consensus on how federal stimulus projects will affect the use of integrated project delivery as a delivery mechanism. Since government projects in general do not require the use of IPD, the impact of these projects on its popularity is viewed as more mixed. Almost 22 percent feel that stimulus projects will promote IPD, while 7 percent feel that they will discourage this approach. More than 70 percent feel that there will be no significant effect. |

Summary:

Summary: