work-on-the-boards

Business Conditions at Architecture Firms Remain Weak but Somewhat Encouraging in April

Project inquiries strengthen as federal stimulus programs begin to kick in

by Kermit Baker, PhD, Hon. AIA

AIA Chief Economist

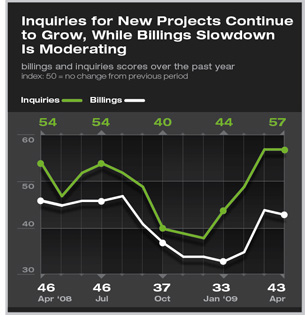

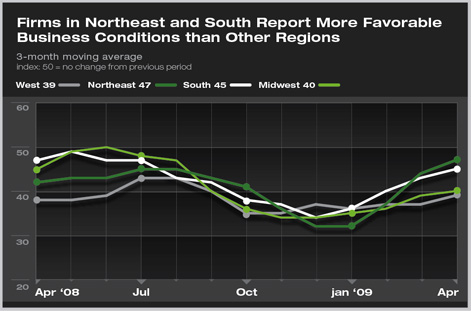

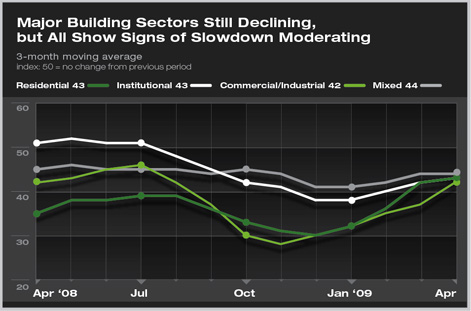

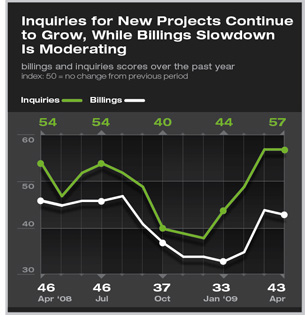

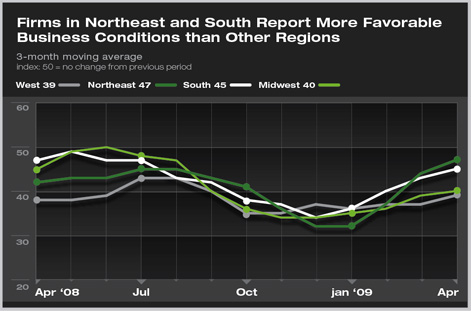

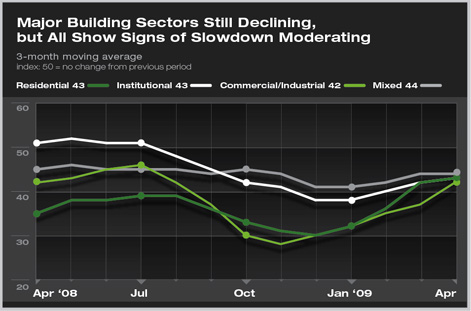

Summary: After steep declines during the fourth quarter of 2008 and the first quarter of this year, architecture firms are reporting that deteriorating business conditions are beginning to moderate. The AIA Architecture Billings Index (ABI) was 42.8 in April, just a tick below the March reading of 43.7. Although still pointing to falling business levels, the steepest part of the downturn appears already to have occurred. Inquiries for new projects remained very healthy, nudging up slightly to 56.8 nationally in April, just above the 56.6 reading in March. Federal stimulus program projects are one source of new project inquiries. Project activity in all major construction sectors is still slowing, but at a moderating pace, while firms in the Northeast and South appear to be closer to recovering than firms in other regions of the country. Summary: After steep declines during the fourth quarter of 2008 and the first quarter of this year, architecture firms are reporting that deteriorating business conditions are beginning to moderate. The AIA Architecture Billings Index (ABI) was 42.8 in April, just a tick below the March reading of 43.7. Although still pointing to falling business levels, the steepest part of the downturn appears already to have occurred. Inquiries for new projects remained very healthy, nudging up slightly to 56.8 nationally in April, just above the 56.6 reading in March. Federal stimulus program projects are one source of new project inquiries. Project activity in all major construction sectors is still slowing, but at a moderating pace, while firms in the Northeast and South appear to be closer to recovering than firms in other regions of the country.

The ABI has remained below 50—and therefore indicating declining business conditions—every month since January 2008. However, inquiries have not been as high as the March and April readings over this five-quarter period, so there is increased likelihood that design billings may see an occasional monthly increase sometime in the near future. Still, overall design market conditions remain very weak, as there is no region of the country or any major construction sector where firms are reporting increases. However, small firms—with annual revenues of $250,000 or less—reported a modest increase in billings in April, possibly pointing to some improvement among smaller design projects.

The broader economy is still in recessionary conditions, but there are a few optimistic signs. Consumer confidence measures jumped sharply in April to their highest levels of the year, indicating that there may be a bit more optimism on their part with the economic outlook. Even the housing market is showing some signs of bottoming out. Sales of both new and existing homes appear to be stabilizing, and sales prices of existing homes have been trending up in recent months. With home prices having fallen significantly in recent years, and given the extremely favorable mortgage rates, first-time homebuyers are finding homeownership costs very affordable; the most affordable of any time of the almost 40 years that the National Association of Realtors has been tracking housing affordability. Tack on an $8,000 federal first-time homebuyer tax credit, and home ownership looks very attractive again to a growing set of potential home buyers.

The national employment picture remains very troublesome. Businesses reduced their payrolls by an additional 539,000 workers in April, bringing the total losses to a staggering 2.67 million through the first four months of the year. These losses helped push up the national unemployment rate to 8.9%, its highest level since 1983. With this growing unemployment, consumers are slowing their spending, as evidenced by the decline in retail sales in April.

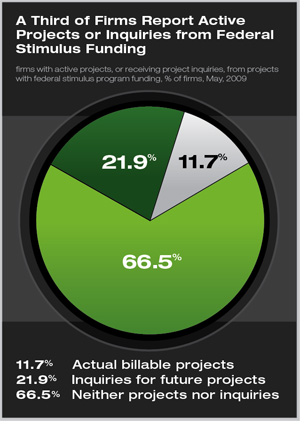

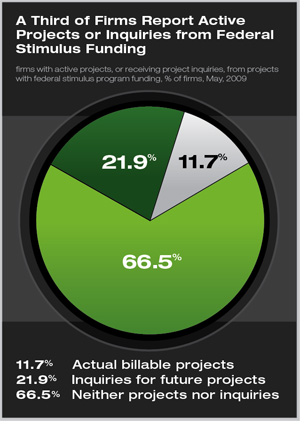

With the weak economy and the continued slowdown in private-sector construction activity, the emerging federal stimulus program funding is turning out to be an important source of new work for many architecture firms. As of early May, almost 12 percent of firms participating in the AIA Work-on-the-Boards monthly business survey reported that they had active design projects funded directly or indirectly by federal stimulus program funds, while an additional 22 percent have received project inquiries from these programs. With the weak economy and the continued slowdown in private-sector construction activity, the emerging federal stimulus program funding is turning out to be an important source of new work for many architecture firms. As of early May, almost 12 percent of firms participating in the AIA Work-on-the-Boards monthly business survey reported that they had active design projects funded directly or indirectly by federal stimulus program funds, while an additional 22 percent have received project inquiries from these programs.

Of those firms with active projects or that have received inquiries, more than 40 percent believe that federal stimulus funded projects will account for at least 5 percent of their firm revenue this year, and a third of this group believes that these projects will account for at least 10 percent of 2009 revenue. Larger firms, particularly those with an institutional focus, more frequently reported projects or inquiries from these funds.

Federal buildings (e.g., the Department of Defense and General Services Administration) were the most common projects that firms have encountered to date, followed by schools and assisted housing modernization projects. Local government buildings (e.g., police and fire), energy upgrades and weatherization, infrastructure (e.g., mass transit and airports), and health-care facilities were also commonly mentioned as stimulus-related projects that firms have encountered to date. |

Summary:

Summary:

With the weak economy and the continued slowdown in private-sector construction activity, the emerging federal stimulus program funding is turning out to be an important source of new work for many architecture firms. As of early May, almost 12 percent of firms participating in the AIA Work-on-the-Boards monthly business survey reported that they had active design projects funded directly or indirectly by federal stimulus program funds, while an additional 22 percent have received project inquiries from these programs.

With the weak economy and the continued slowdown in private-sector construction activity, the emerging federal stimulus program funding is turning out to be an important source of new work for many architecture firms. As of early May, almost 12 percent of firms participating in the AIA Work-on-the-Boards monthly business survey reported that they had active design projects funded directly or indirectly by federal stimulus program funds, while an additional 22 percent have received project inquiries from these programs.