work-on-the-boards

Architecture Firm Billings Show Signs of Spring Thaw

Declining billings nearing a plateau, inquiries slightly up

by Jennifer Riskus

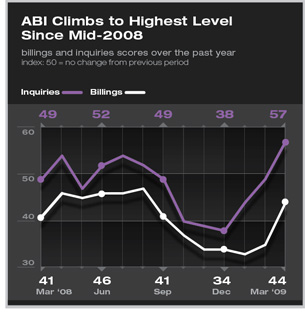

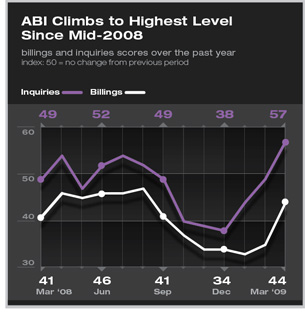

Summary: The AIA’s Architecture Billings Index (ABI) improved significantly in March, easing to its highest level since August 2008 with a score of 43.7. This means that while business conditions at architecture firms still remain weak, the number of firms reporting declining firm billings is fewer than it has been in the last several months. However, conditions are still quite uncertain and while business is improving for some firms, it remains depressed at others. In another positive piece of news, inquiries into new projects continued to rebound this month. For the first time in seven months growth in inquiries was reported as the score reached the highest level in more than a year at 56.6. Summary: The AIA’s Architecture Billings Index (ABI) improved significantly in March, easing to its highest level since August 2008 with a score of 43.7. This means that while business conditions at architecture firms still remain weak, the number of firms reporting declining firm billings is fewer than it has been in the last several months. However, conditions are still quite uncertain and while business is improving for some firms, it remains depressed at others. In another positive piece of news, inquiries into new projects continued to rebound this month. For the first time in seven months growth in inquiries was reported as the score reached the highest level in more than a year at 56.6.

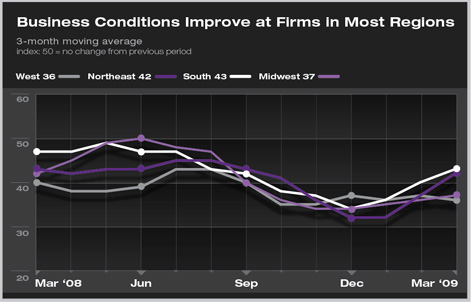

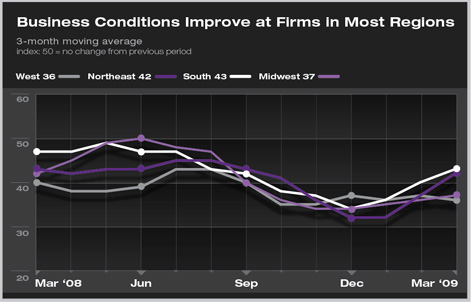

The ongoing slowdown in billings improved at architecture firms in nearly all regions of the country this month, with the exception being those located in the West. Firms in the South reported the highest score for the second month in a row, and March marks the first time in six months that any region has had a score above 40.

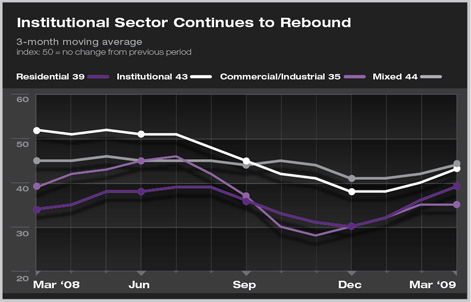

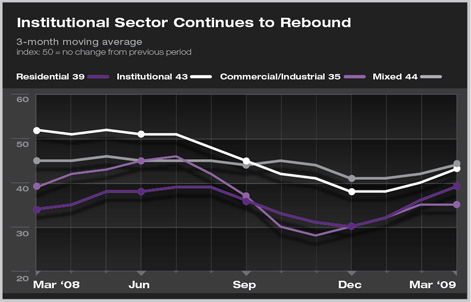

Firms with an institutional specialization also continued to bounce back in March with a score of 42.9 (with declines slowing from an all-time low of 37.6 in January). This was the last sector to report a slowdown, and it is now rebounding the fastest. Business conditions also appear to be improving slightly for firms with a residential focus but are weak and unchanged from last month for firms with a commercial/industrial specialization.

The broader economy remains weak, as payrolls continue to decline dramatically with 663,000 jobs lost in March alone. The construction sector shed 126,000 jobs last month and the industry has now lost more than 1 million jobs since the peak in January 2007, with the majority lost in the last five months. As these losses mount, the national unemployment rate continues to rise. It now stands at 8.5%. In slightly better news, although the Reuters/University of Michigan Index of Consumer Sentiment remains near its all-time low with a score of 57.3 for March, it has stabilized over the last several months. Consumers are still very cautious, and may remain so for the rest of the year, but their fears are no longer worsening each month.

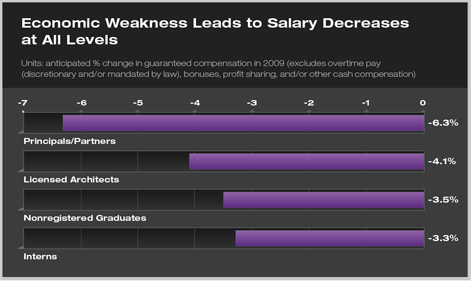

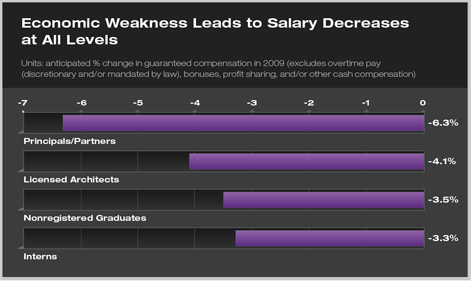

Reflecting the persistent weakness the profession is currently experiencing, our survey panelists reported this month that guaranteed compensation is anticipated to decline across the board in 2009. Senior staff will be the hardest hit, with principal/partner salaries predicted to decline by more than 6 percent. Compensation for licensed architects will fall by 4 percent, and salaries for more junior positions (nonregistered graduates, interns) will be down by more than 3 percent.

For firms where salaries have declined or will decline this year, more than a third (35 percent) indicated that the primary cause would be a reduction in compensation, without reducing hours worked. One quarter attributed the decline to reduced hours worked, while an additional 26 percent will reduce both salary and hours worked. The remaining 14 percent cited other reasons for the decline.

Paid overtime and bonuses and profit sharing are also expected to decrease this year, with nearly two thirds of panelists (65 percent) anticipating a decline in paid overtime and 64 percent reporting that bonuses and profit sharing will be down in 2009. Several firms indicated that the amount of these benefits would remain at the same level as in 2008, but many indicated in their comments that they had already fallen significantly in 2008, and that 2009 would merely reflect a continuation of those reduced levels. |

Summary:

Summary: