work-on-the-boards

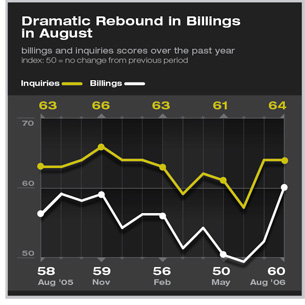

(abi) survey Summary: Billings at architecture firms rebounded sharply in August after several months of sluggish conditions. The AIA Architectural Billings Index (ABI) for August was 59.5, where any reading above 50 signifies growth in business activity. This reversal was led by very strong activity at commercial/industrial firms, which reported their highest reading in the 11-year history of the ABI at 61.4. Institutional firms reported continued favorable conditions, while residential architects reported their fifth straight month of declining billings. And, as construction activity strengthens, change orders to the specifications of projects often increase. Our Work-on-the-Boards panel reported increasing change orders recently, as well over a third (37.5 percent) of firms responded that change orders have become a lot more common or somewhat more common in recent years.

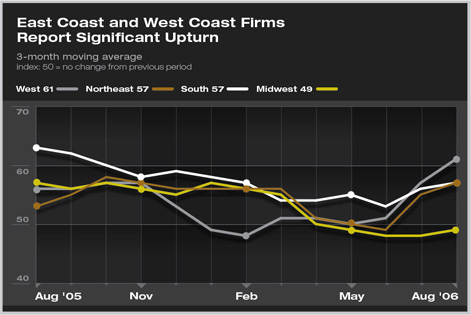

Regionally, firms in the West have reported the greatest improvement in business conditions in recent months. In August, their index reading was well above that of any other region. Firms in the Northeast also report very strong conditions, while firms in the Midwest reported their fifth straight decline in billings. Inquiries for new work continued to be positive in August, showing strong interest for new projects. Broader economy is slowing down

A slower-growing economy has helped ease inflation in consumer prices. Price increases have begun to moderate in recent months, with lower inflation rates likely to continue with the recent drop in gasoline prices. Falling gasoline prices seem to have improved the spirit of consumers. The University of Michigan Consumer Sentiment Index moved up for only the third time this year with the early September reading. Change orders becoming more common

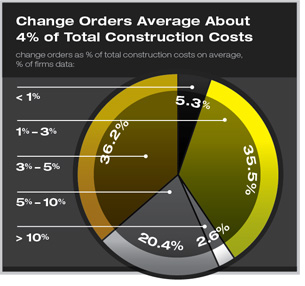

There is also considerable regional difference in the prevalence of change orders. Firms in the Northeast report that change orders average 5.1 percent of construction costs, while firms in the Midwest report much lower averages at 2.9 percent. Change orders result for many reasons. Architecture firms report that owner requests and changes in the scope of a project account for more than half of the average increase in costs on a dollar basis. Unknown or unforeseen circumstances account for about a quarter of the value of change orders. A/E errors and omissions and regulatory-agency-required changes each account for about 10 percent of change orders on a dollar basis.

|

||

Copyright 2006 The American Institute of Architects. All rights reserved. Home Page |

||

news headlines

practice

business

design

recent related

› Ch-ch- changes: Managing Risk in the Change Process

› Business Conditions at Architecture Firms Improve in July

› Weakness in Residential Sector Causes Firm Billings to Fall Again in June

› Business Levels Decline in May After Several Months of Softening

This month, Work-on-the-Boards participants are saying:

Local markets are stable for us. International markets are growing as fast as we can cope.

—73-person firm in the Northeast, commercial/industrial specialization

We currently have a lot of projects lined up, but they are extremely slow in starting. We need to hire more staff, but are having difficulties finding qualified individuals.

—12-person firm in the West, mixed specialization

Homeland Security projects are very active. Anti-Terror/Force Protection projects (provides security planning for defense agencies) are large in scope and technology which translates to high costs per square foot.

—48-person firm in the South, mixed specialization

Commercial requests have had a huge jump, with the leveling off of interest rates and new programs for LEED tax credits.

—17-person firm in the Midwest, commercial/industrial specialization.

A printer-friendly version of this article is available.

Download the PDF file.

Architecture firms report that change orders average about 4 percent of total construction costs, with 23 percent of firms estimating that change orders average 5 percent or more of total costs. Change orders tend to run somewhat higher in the residential sector, as over a third (34.8 percent) of residential architects report that change orders average 5 percent or more of their projects and average 5.2 percent on projects for firms specializing in this sector. Institutional firms report the lowest project change orders (3.8 percent of construction costs on average), just below commercial/industrial firms (4.0 percent).

Architecture firms report that change orders average about 4 percent of total construction costs, with 23 percent of firms estimating that change orders average 5 percent or more of total costs. Change orders tend to run somewhat higher in the residential sector, as over a third (34.8 percent) of residential architects report that change orders average 5 percent or more of their projects and average 5.2 percent on projects for firms specializing in this sector. Institutional firms report the lowest project change orders (3.8 percent of construction costs on average), just below commercial/industrial firms (4.0 percent).