work-on-the-boards

Billings Hit All-time Low, Inquiry Declines Slowing

More than half of ABI panelists have frozen salaries

by Jennifer Riskus

AIA Economics Research Manager

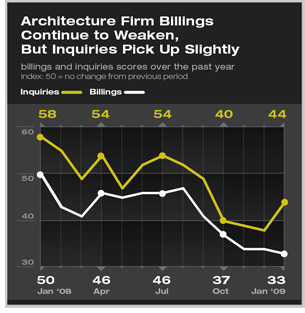

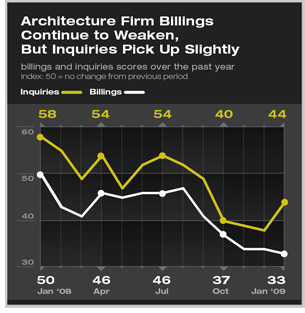

Summary: As the impact of the recession continues to be felt at U.S. architecture firms in 2009, the ABI in January fell to a new all-time low score in the 13 years it has been in existence: 33.3. Inquiries rebounded slightly, indicating that interest in new projects is increasing, but this does not yet indicate a recovery. Business conditions remained weak at firms in all regions of the country and in all practice sectors. Many firms have had been forced to make changes to staff benefits and salaries in light of the recession, with more than half of our panelists indicating that they have instituted salary freezes. Summary: As the impact of the recession continues to be felt at U.S. architecture firms in 2009, the ABI in January fell to a new all-time low score in the 13 years it has been in existence: 33.3. Inquiries rebounded slightly, indicating that interest in new projects is increasing, but this does not yet indicate a recovery. Business conditions remained weak at firms in all regions of the country and in all practice sectors. Many firms have had been forced to make changes to staff benefits and salaries in light of the recession, with more than half of our panelists indicating that they have instituted salary freezes.

Architecture firms continued to report very weak business conditions in January, as the ABI fell to 33.3, a new all-time low score. Any score below 50 indicates a decline from the previous month. The ABI has now been below 50 for the last 12 months, the longest period of sustained weakness in the 13 year history of the index. The decline in inquiries slowed slightly this month with a score of 43.5 (up from 38.5 in December), indicating fewer clients shying away from projects. But overall, business conditions at architecture firms remain depressed.

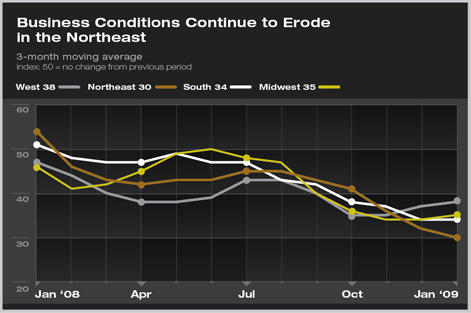

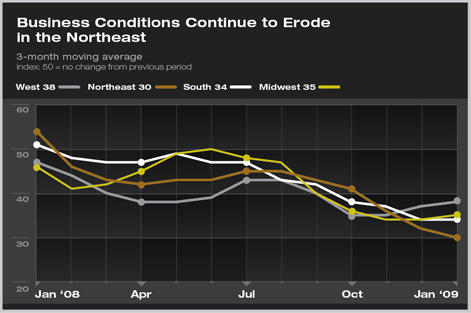

Architecture firm billings are still weak in all regions of the country, with firms in the Northeast reporting the weakest conditions for the second month in a row with a score of 29.8. With the exception of the Midwest, all regions of the country have now reported scores below 50 for at least the last 12 months.

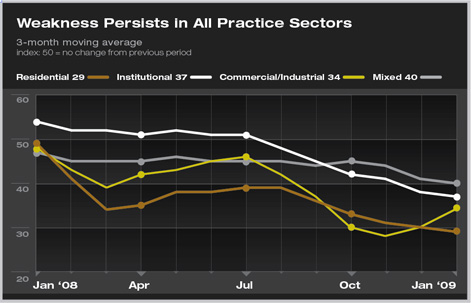

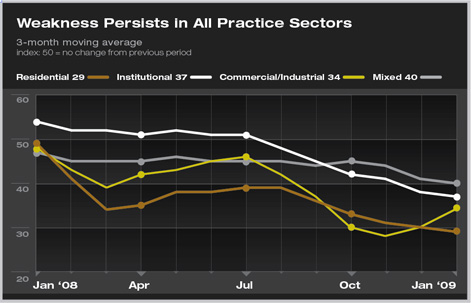

Weak business conditions remained pervasive in all three major practice sectors as well, with firms with a residential specialization continuing to be hardest hit. Those with a commercial/industrial specialization have also seen business conditions weaken significantly over the last 12 months, while the institutional sector, which continued to show growth through July, has now declined for each of the last 6 months.

Weakness pervasive in overall economy

The overall economy continued to weaken further in January as many people awaited the arrival of the Obama Administration and the passage of the new stimulus package. In the meantime, the employment situation worsened further, with unemployment climbing to 7.6 percent from 7.2 percent. Payrolls shed nearly 600,000 jobs, more than a sixth of which were in the construction sector. Preliminary GDP data for the fourth quarter of 2008 was also released in January; it declined by an annual rate of 3.8 percent. Although this was a smaller drop than most economists had predicted, it marks the first time that the GDP has fallen for two consecutive quarters since the fourth quarter of 1990/first quarter of 1991.

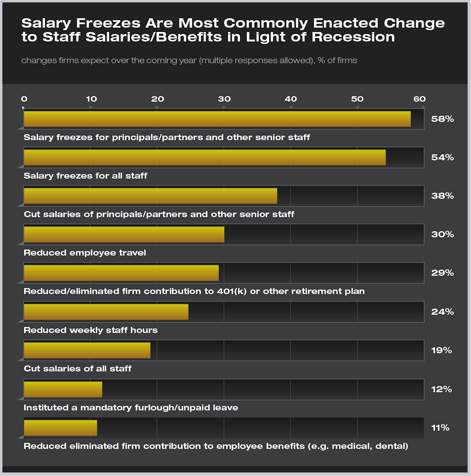

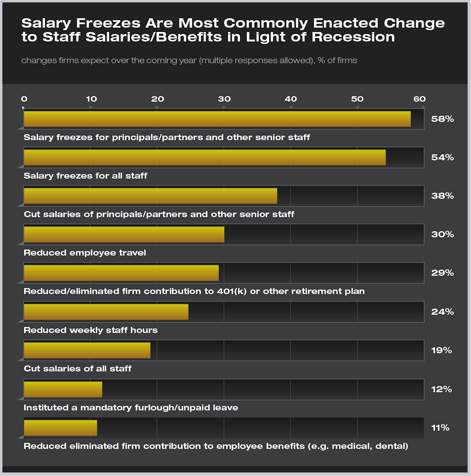

Salary freezes, reductions common

With the recession continuing to deepen, this month we asked our panelists about the types of changes to staff benefits and salaries that they have had to enact this year. Salary freezes were the most frequently cited change, with 58 percent of respondents reporting that they have frozen salaries for firm principals and partners and 54 percent indicating that they have frozen salaries for all staff. Firms have also cut the salaries of principals and partners and instituted reductions in employee travel, firm contributions to 401(k) and other retirement plans, and weekly staff hours.

Small firms, with average annual billings of less than $250,000, were the most likely to reduce employee benefits but the least likely to enact salary freezes. However, they were also more likely to cut salaries than larger firms. Few firms have had to use tactics like instituting a mandatory furlough/period of unpaid leave or reducing firm contribution to employee benefits, but these are also far more likely to occur at smaller firms than at large ones. |

Summary:

Summary: