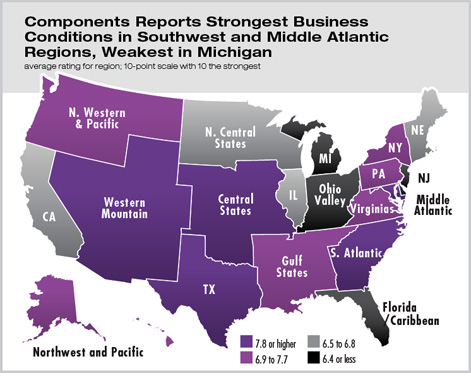

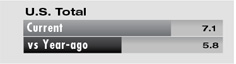

2007 COMPONENT SURVEY OF BUSINESS CONDITIONS by Jennifer Riskus Summary: AIA component leaders report that business conditions remain relatively strong in their regions in 2007, despite some economic upheaval. Many components also rated conditions as similar to last year, which tends to mean that regions that were strong last year remain strong, while those that were weak continue to struggle. Demand for architects of all skill levels remains high, and regions that are prospering have greater need for new hires. Component leaders report a fairly large decline in business conditions in the residential sector, but the commercial/industrial and institutional sectors remain solid. Business conditions in 2007 remain relatively healthy across the country, with business conditions in all regions rated a 7.2 on a 10 point scale (with 1 being “terrible” and 10 being “couldn’t be better”). The best business conditions currently can be found in the southwestern parts of the country (Western Mountain and Texas regions) and in the Middle Atlantic region. The only region where component leaders rated current conditions below a 5 (“so-so”) was Michigan, which is in the midst on an ongoing manufacturing slowdown. Weakness also was reported by component leaders in the Florida/Caribbean and Ohio Valley regions.

Demand for architects remains steady

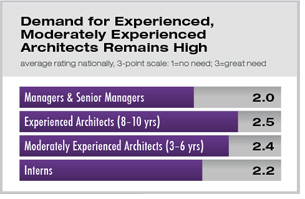

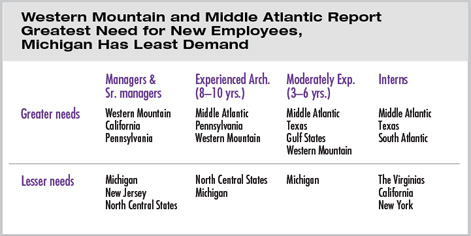

Components report that managers are in highest demand in western regions (Western Mountain and California) and Pennsylvania, but experienced architects remain the position most in demand nationwide, particularly in the Middle Atlantic, Pennsylvania, and Western Mountain regions. Moderately experienced architects are currently needed in nearly all regions of the country, and components report less of a demand for interns at the moment, with most regions indicating only some need.

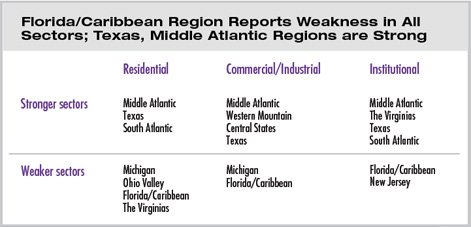

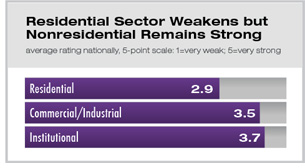

In contrast to the residential slowdown, the nonresidential sector has remained strong, in particular the institutional sector, where four components reported scores of 4 or higher. Regions with strong overall business conditions, such as Central States and Western Mountain, reported the highest commercial/industrial scores this year. Notwithstanding overall business conditions slightly above average, component leaders in the Florida/Caribbean region are seeing widespread weakness in all three sectors, while Texas is reporting strength in all three sectors, to match its overall strong business conditions. |

||

Copyright 2007 The American Institute of Architects. All rights reserved. Home Page |

||

news headlines

practice

business

design

recent related

› AIA Component Leaders Upbeat on Business Environment AIA Component Leaders Upbeat on Business Environment

This year, components are saying:

The market appears to have softened. There are not as many inquiries for new work, and the backlog is smaller.

—New Jersey

The economy is very strong right now. Firms are seeking good qualified employees.

—South Atlantic

Post-Katrina recovery is going strong along the Mississippi coast. Generally, practicing architects in Mississippi are very busy and have a healthy backlog of work. The primary need I hear from practicing architects is the lack of qualified interns.

—Gulf States

Residential was hit hard with significant layoffs. However, other firms are very strong and have picked up a lot of the staff creating a fairly strong market in Orange County.

—California.

How the survey was conducted

The AIA national component has conducted a survey of business conditions in the AIA regions annually for the past 10 years. This survey builds on a similar effort previously conducted among AIA components by the Boston Society of Architects for a number of years. This year’s survey was conducted September 13–September 26. Questionnaires were e-mailed to 653 component executives, presidents, and presidents-elect. A total of 172 responses were returned, with multiple responses for each of the AIA regions. Regionally, figures were computed as the average of all responses submitted by respondents from that region.

Many components report weaker conditions

Many components report weaker conditions

Commercial, institutional stand strong

Commercial, institutional stand strong