8/2006

Staff turnover causing concern as employees use strong market for new opportunities

by Kermit Baker, PhD,

Hon. AIA

Chief Economist

After small declines in May and June, billings

at architecture firms rebounded modestly in July. The overall score

of the AIA’s Architectural

Billings Index was 51.8, where any score above 50 indicates an increase

in billings. Firms in the Northeast and West reported the most improvement,

and firms in the South reported a slight increase, although the gain

at these firms was less than recent months.

After small declines in May and June, billings

at architecture firms rebounded modestly in July. The overall score

of the AIA’s Architectural

Billings Index was 51.8, where any score above 50 indicates an increase

in billings. Firms in the Northeast and West reported the most improvement,

and firms in the South reported a slight increase, although the gain

at these firms was less than recent months.

Even though the overall improvement in business conditions was slight, commercial/industrial firms reported a strong upsurge in billings. The July figures continue a period of strong growth in billings at firms that concentrate in this facility type. Firms focusing on the institutional sector reported only slight increases in billings, while residential firms reported another decline in billings. Residential architects have reported declines for four straight months.

On an optimistic note, inquiries for new projects rebounded sharply to their strongest level since January. Firms in the Northeast reported particularly strong levels of inquiries, but they were also strong for firms in the South and Midwest. Business conditions reported by firms in July probably don’t indicate a reversal of trends, but rather are consistent with a general slowing of growth in design activity.

Broader economy easing

The broader economy continues to show signs of easing. Economic growth

for the second quarter (after seasonal and inflation adjustments) was

2.5 percent, well below the 5.6 percent of the first quarter, but ahead

of the 1.8 percent in the fourth quarter of last year. Rising energy

costs and higher interest rates seem to be generally holding back consumer

spending. Auto sales fell over 5 percent in the second quarter compared

to the same quarter a year ago, and overall retail sales in July were

up less than 5 percent compared to a year ago, in spite of sales increases

of almost 20 percent at gasoline stations due to higher gas prices.

The employment report for July showed no signs of improvement in the economy. Overall nonfarm payrolls increased by 113,000 in July, just about on par with the average growth during the second quarter, but well below the average monthly increase for the first quarter. The national unemployment rate jumped to 4.8 percent in July from 4.6 percent in June. Construction payrolls haven’t fared better, increasing by a mere 6,000 in July after growing by more than twice that rate on average during the first six months of the year.

The Federal Reserve Board decided to leave interest rates unchanged at its August meeting, the first time that it didn’t increase short-term rates in over two years. Their inaction no doubt indicates that they are concerned that another rate hike might do more harm to the economy than the benefit that would come from holding down inflation.

Staff turnover grows

Staff turnover grows

With the strong conditions that we’ve seen at architecture firms

over the past two years, staff turnover is becoming more of a concern.

More than 35 percent of firms that track voluntary staff turnover report

that it has increased over the past year, while only 14 percent report

a decrease. Over half of firms indicate that the rate has stayed relatively

unchanged.

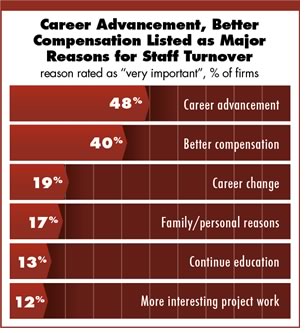

Career advancement/better opportunities, and better compensation are listed as the two most important reasons for voluntary turnover, and were the top of the list for both smaller and larger firms. At smaller firms, seeking more interesting project work was the third highest rated reason for voluntary staff turnover, while seeking a career change was the third highest rated reason at larger firms.

Copyright 2006 The American Institute of Architects.

All rights reserved. Home Page ![]()

![]()

This month, Work-on-the-Boards participants are saying:

• Still busy in Miami—condos, condos, schools, schools.

• Business conditions are very good in St. Louis, as work has picked up.

There appears to be adequate staff out there though.

• Generally slowing. Many larger projects—including large public

schools—have been put on long-term hold due to construction cost escalation

and higher borrowing costs.

• Slowing slightly. Public project bid costs 15 percent or

more above estimates will have a ripple effect in the future.

![]()