work-on-the-boards

November Brings Another Step Back in Business Conditions at Architecture Firms

As design downturn nears two-year

mark, firms anticipate significant changes over the coming year

by Kermit Baker, PhD, Hon. AIA

AIA Chief Economist

Summary: In spite of the generally favorable trends in recent months, business conditions at U.S. architecture firms moved down in November, as the AIA’s Architecture Billings Index (ABI) declined more than three points to a reading of 42.8, indicating that firm revenue continues to decline. Inquiries for new projects remained positive, but steady gains in inquiries for the past nine months still have not produced increases in workloads. Firms in all regions of the country and in all construction sectors are reporting declines, although firms with an institutional specialization are showing the most encouraging signs. Most architecture firms expect significant changes to their structure and operations over the coming year.

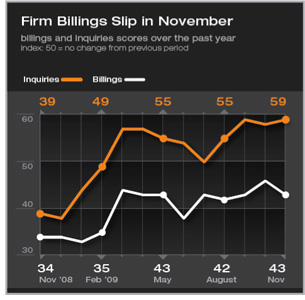

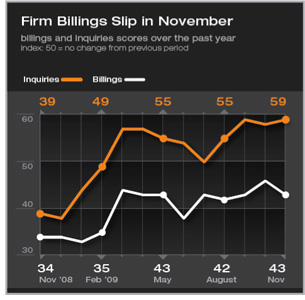

After the steep downturns of last winter and earlier this spring,

the ABI had generally been trending up in recent months. While the

drop in the index in November—the second largest of the year—does

not necessarily point to a longer-term change in direction for business

conditions, it does reinforce the feeling of many that there will

be a slow, erratic recovery in design activity. Firms report steady

gains in inquiries for new work, but they also report that they are

seeing much more competition for these projects; the net result being

that few firms are seeing increases in revenue.

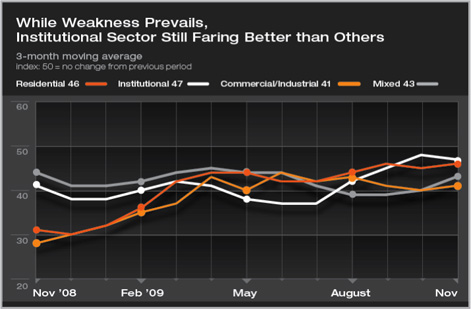

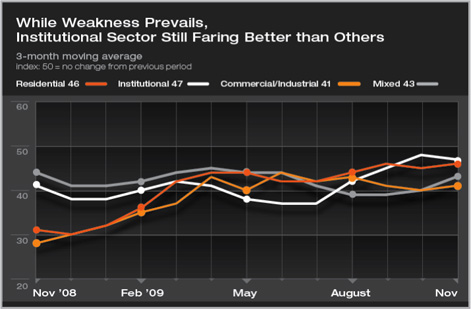

Regional patterns in business conditions remain unusually erratic.

However, regional ABI scores have generally remained in the low-40s

for the past several months and no region is signaling that a recovery

is imminent. Likewise, ABI scores across the major construction sectors

are relatively weak and quite volatile. Institutional firms are reporting

the smallest declines in revenue at present, with residential firms

not far behind.

Brighter signs emerging in the national economy

In general, broader economic trends are improving. The November jobs report was unexpectedly positive. U.S. businesses reported a net decline of only 11,000 jobs during the month, the smallest decline by far since the national recession began. Separately, the government reported that the national unemployment rate declined to 10.0% in November, down from 10.2% in October.

Employment conditions have also moderated in the construction industry, but not nearly to the degree that they have in the broader economy. Construction payrolls declined by 27,000 in November, the smallest decline since the summer of 2008. However, earlier this year construction payroll losses accounted for about 15% to 20% of total job losses, and in recent months they have risen to about a third of all losses. With the November release, our economy excluding construction was adding jobs, so construction remains one of the few sectors with recessionary conditions continuing. Architecture firm payrolls are unfortunately following suit with the construction industry. Architecture firms lost another 700 positions in October (they are released one month after the national numbers) bringing total firm losses to almost 40,000 since their high in July, 2008.

High unemployment rates are depressing consumer confidence. While the University of Michigan’s consumer sentiment index has been trending up for most of the year, it has dropped six points (from an index score of 73.5 to 67.4) over the past two months; months where the national unemployment rate reached the double-digit level.

2010 projected to be a year of change

Given the duration and severity of the current economic downturn in the design professions, most firms expect to see fairly dramatic changes at their firms in 2010. While some of these changes will include cut-backs to deal with anticipated weak business conditions, more firms are plotting strategies that will promote growth and profitability as the construction industry conditions through this economic cycle.

At the top of the list of anticipated changes are planned modifications in firm management and operations to generate greater efficiencies. Most firms feel that they will need to do more with less over the coming year, even if conditions improve. Firm diversification was a close second, with over a third of firms planning to expand into new facility categories, geographical areas, or both. Related to this are plans to offer a broader set of design and/or construction services, as over a quarter of firms see themselves moving in this direction. Many firms are planning on investing in new information technology or communications systems to improve their operational efficiencies and keep their firm competitive, while other hope to move into international markets.

Other firms are planning focusing their practice: downsizing their firm (18.8%) or offering a more limited set of design and related services (7.3%). For some, the situation is more dire: 3.9% anticipate that their firm will close during the year, while 2.7% anticipate that it will have merged with or acquired by another firm. |