Work-on-the-boards

Business Conditions at Architecture Firms Making Progress, But Still Short of Recovering

Most firms see 2010 as another challenging year

by Kermit Baker, PhD, Hon. AIA

AIA Chief Economist

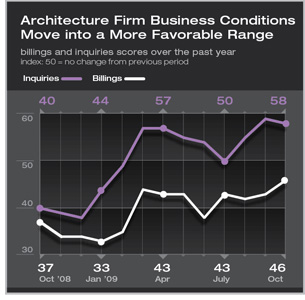

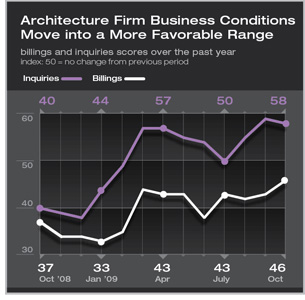

Summary: U.S. architecture firms reported progress toward an eventual recovery in October, as the AIA’s Architecture Billings Index moved up three points to 46.1. This reading is the strongest since the serious problems in the financial sector emerged in late summer 2008 and points to further improvement in our index in the months ahead. Inquiries for new project activity remained strong. Firms report that business conditions in all regions of the country are roughly comparable, while those that specialize in the institutional sector have reported the sharpest gains of the sector-specific billing indexes in recent months.

The ABI has remained remarkably stable for the past seven months, reflecting continued slow deterioration in business conditions at architecture firms. However, the 3 point gain in October coming on top of a 1.4 point gain in September does provide hope that the profession may begin to see an occasional month or two of growing revenue (index scores above 50 indicate growth) over the next three to six months. Growing levels of inquiries for new projects provide more optimism that new project activity is beginning to materialize. The project inquiry index has pointed to gains for the past 8 months, and the past two months have shown inquiries growth generally associated with a healthy design profession. The fact that growing inquiries have not yet translated into increased revenue probably reflects that a larger number of firms are reporting inquiries from the same project. The ABI has remained remarkably stable for the past seven months, reflecting continued slow deterioration in business conditions at architecture firms. However, the 3 point gain in October coming on top of a 1.4 point gain in September does provide hope that the profession may begin to see an occasional month or two of growing revenue (index scores above 50 indicate growth) over the next three to six months. Growing levels of inquiries for new projects provide more optimism that new project activity is beginning to materialize. The project inquiry index has pointed to gains for the past 8 months, and the past two months have shown inquiries growth generally associated with a healthy design profession. The fact that growing inquiries have not yet translated into increased revenue probably reflects that a larger number of firms are reporting inquiries from the same project.

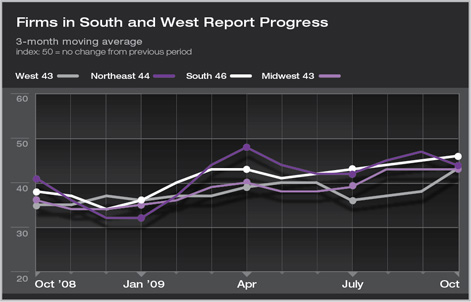

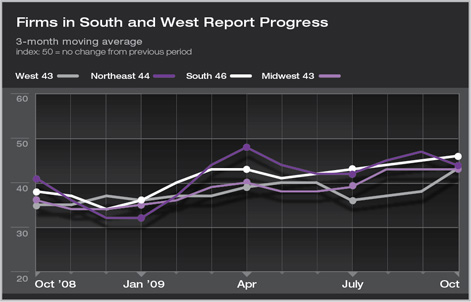

There is at present no region of the country or firm specialization by construction industry sector that has reported growth recently. However, there are a growing number of categories that are showing optimistic signs. Billings activities in all regions have been moving up steadily, according to the ABI regional indices, with firms in the South reporting the most improvement over the past few months.

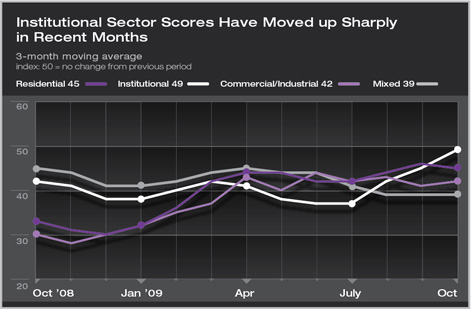

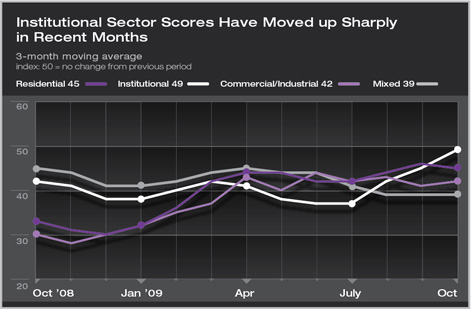

By sector, the firms with an institutional specialization have reported the most improvement recently, with index scores that have increased by more than 10 points over the past three months. Index scores for firms with a commercial/industrial specialization have begun to stall after sharp improvement earlier this year. Scores for residential firms have been slowly improving.

Broader economy has seen significant improvement

Though design activity has not yet begun to recover, there is a growing list of indicators showing improvement in the broader economy. At the top is gross domestic product (GDP), which is the broadest measure of the health of our economy. The Commerce Department recently reported that this indicator increased at a 3.5 percent annual rate during the third quarter, coming on the heels of four straight quarterly declines.

Although the federal stimulus programs no doubt helped generate activity in our economy, there are other sectors that are reporting healthier numbers. For example, U.S. exports increased in the third quarter for the first time in over a year, reflecting some strength in international markets, as well as a weak U.S. dollar, which makes U.S. goods more affordable to foreign buyers. Growing exports have helped turn around our manufacturing sector. Industrial output in the U.S has increased each of the past three months according to the Federal Reserve Board.

Home building activity is also improving after seeing dramatic declines over the past several years. With favorable mortgage rates and emerging stability in home prices, housing starts in the third quarter were up 9 percent over second quarter levels and 12 percent over the first quarter.

Still, the employment picture remains grim. The national unemployment rate jumped past 10 percent in October for the first time since 1983. Business payrolls declined by 190,000 positions in October, with the construction sector still accounting for a large share of the weakness. To date this year, construction job losses have accounted for more than 20 percent of all job losses nationally, even though the construction industry accounts for less than 5 percent of all jobs. In October, with other sectors improving, construction job losses accounted for almost a third of the total.

2010 still projected with some weakness 2010 still projected with some weakness

This past year has produced significant revenue declines for most architecture firms. As of early November, almost 8 of every 10 firms are estimating that their firm saw a decline in revenue in 2009. For over half of these firms, the drop was 25 percent or more off of 2008 levels.

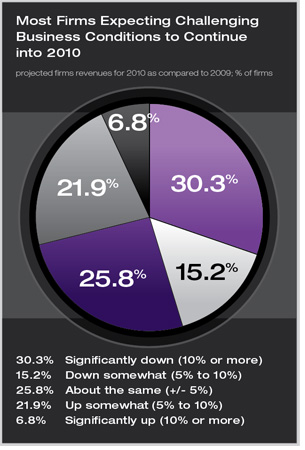

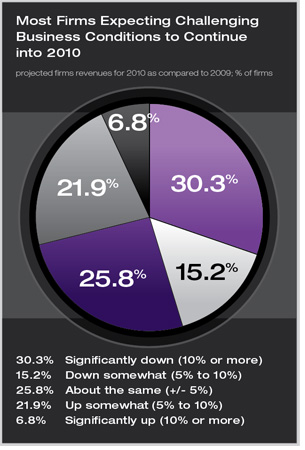

Unfortunately, many firms project that 2010 will produce further declines. Almost half of all firms (46 percent) expect their 2010 revenue will be off at least 5 percent from 2009 levels, while fewer than 30 percent expect revenue growth of at least 5 percent. The remaining quarter expect revenue to be within 5 percent of 2009 levels.

The relative pessimism is across firms of all size and specialization categories. A higher share (32 percent) of larger firms (revenues in excess of $5 million) expects growth of 5 percent or more next year, but a higher than average share (47 percent) of these firms also expects to see decline of 5 percent or more next year. By specialization, residential firms are a bit more optimistic that others, with 30 percent expecting growth in revenue next year and 38 percent expecting declines. Commercial/industrial firms are the least optimistic at present, with 29 percent projecting gains and 51 percent projecting declines. |

2010 still projected with some weakness

2010 still projected with some weakness